With a market cap of $31.6 billion, Old Dominion Freight Line, Inc. (ODFL) is a leading less-than-truckload (LTL) motor carrier serving customers across the United States and North America. The company provides regional, inter-regional, and national LTL services, along with expedited transportation options.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Old Dominion Freight Line fits this criterion perfectly. It also offers value-added solutions such as container drayage, truckload brokerage, supply chain consulting, and operates extensive service and fleet maintenance centers.

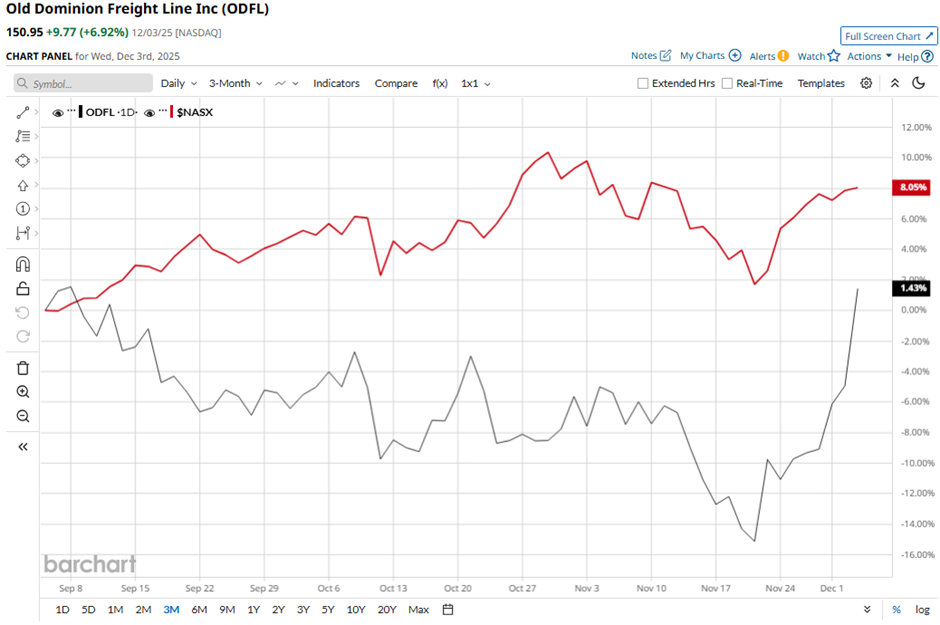

Despite this, shares of the Thomasville, North Carolina-based company have declined 30.8% from its 52-week high of $218.01. ODFL stock has risen 1.9% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 9.1% increase over the same time frame.

In the longer term, the stock is down 14.4% on a YTD basis, lagging behind NASX’s 21.5% gain. Moreover, shares of the trucking company have decreased nearly 31% over the past 52 weeks, compared to NASX’s 20.4% return over the same time frame.

Despite a few fluctuations, ODFL stock has been trading mostly below its 50-day and 200-day moving averages since last year.

Shares of ODFL recovered marginally on Oct. 29 after the company reported Q3 2025 EPS of $1.28 and revenue of $1.41 billion, surpassing forecasts. Despite year-over-year declines, investors responded positively to the company’s ability to maintain strong operating metrics, such as 99% on-time service, and solid cash generation of $437.5 million.

In contrast, rival XPO, Inc. (XPO) has outpaced ODFL stock. Shares of XPO have risen 6.6% on a YTD basis and declined 8.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Old Dominion. The stock has a consensus rating of “Moderate Buy” from 24 analysts in coverage, and the mean price target of $155.23 is a premium of 2.8% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart