With a market cap of $43.9 billion, The Kroger Co. (KR) is a leading food and drug retailer in the United States. The company operates a variety of store formats, including combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses, offering groceries, pharmacy services, general merchandise, and specialty products.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Kroger fits this criterion perfectly. In addition to retail, Kroger manufactures and processes food products and sells fuel through its fuel centers, serving customers both in-store and online.

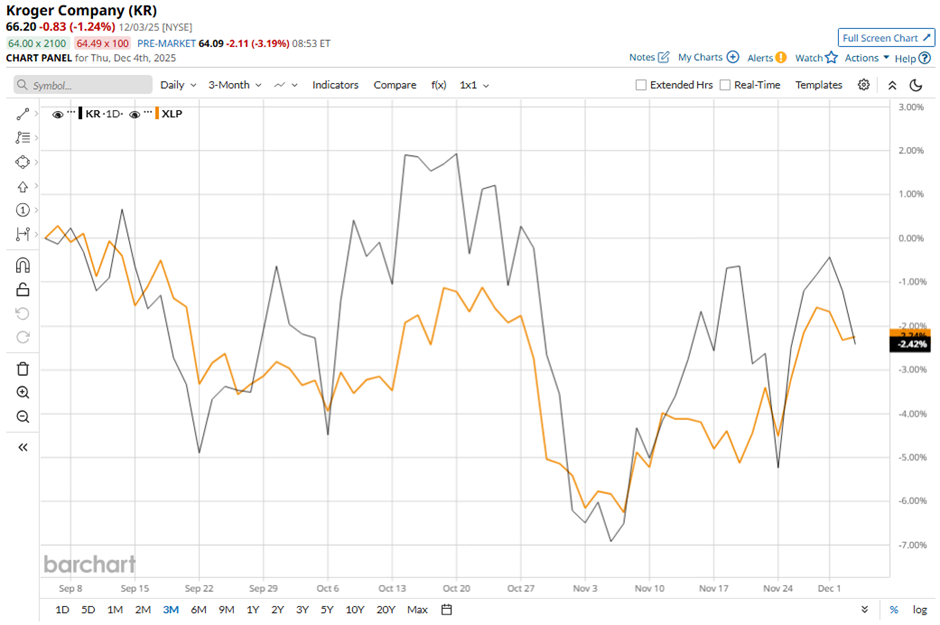

Shares of the Cincinnati, Ohio-based company have pulled back 14.6% from its 52-week high of $74.90. Shares of Kroger have declined 5.7% over the past three months, lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% decrease over the same time frame.

Longer term, KR stock is up 4.6% on a YTD basis, outperforming XLP’s marginal rise. Moreover, shares of the company have increased 6.8% over the past 52 weeks, compared to XLP’s 4.4% decrease over the same time frame.

Despite a few fluctuations, the stock has fallen below its 200-day moving average since mid-September.

Kroger reported strong Q3 2025 results on Dec. 4, including a 2.6% increase in identical sales without fuel and 17% growth in eCommerce sales. Investors also reacted positively to Kroger raising the lower end of its full-year adjusted EPS guidance to a new range of $4.75 to $4.80, supported by adjusted FIFO operating profit of $1.09 billion. Confidence was further boosted by management’s expectation that the eCommerce business will become profitable in 2026 and by continued share repurchases under the remaining $2.5 billion authorization.

In comparison, rival The Procter & Gamble Company (PG) has lagged behind Kroger stock. Shares of Procter & Gamble have decreased 16.1% over the past 52 weeks and 12.4% on a YTD basis.

Despite the stock’s better performance relative to the sector over the past year, analysts are cautiously optimistic about its prospects. KR stock holds a consensus rating of “Moderate Buy” from the 21 analysts covering it, and the mean price target of $77.50 is a premium of 17.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart