Artificial intelligence (AI) is reshaping America’s energy use faster than most people realize. AI already accounts for 4.4% of all U.S. electricity consumption, and by 2030, that share is expected to jump to somewhere between 12% and 20% of total demand.

That surge is putting utility companies at the center of AI’s buildout, turning what was once seen as a slow, defensive corner of the market into a key part of the digital economy’s plumbing. Virginia’s Data Center Valley is a clear example: Ashburn alone hosts 133 data centers, and the broader region packs more than 3,500 tech companies into 35 million square feet of facilities.

Dominion Energy (D) sits right in the middle of this shift. The Richmond, Virginia-based utility serves 7.5 million customers across 18 states and carries a market capitalization of $53.6 billion. It posted earnings per share of $1.06 for the third quarter of 2025 and supports an annual dividend yield of 4.25%, offering income that stands out in the utility space.

Behind those numbers, Dominion operates nearly 27,100 megawatts of generating capacity and runs 14,800 miles of natural gas infrastructure, making it a core supplier for data center growth in one of the country’s most important technology corridors.

Can a traditional utility stock delivering above-average income also capture the explosive growth trajectory of artificial intelligence? Let’s find out.

Dominion's Financial Strength

Dominion Energy is a major U.S. utility that provides electricity and natural gas to millions of customers, built around regulated power generation, transmission, and distribution.

Over the past year, its share price has climbed 5.14% on a 52-week basis, and year-to-date (YTD) it is up 16.54%.

From a valuation angle, Dominion’s forward price-to-earnings ratio of 18.40x sits just under the utilities sector average of 19.53x, which suggests a slight discount even as the story improves. The stock also offers an annual dividend yield of 4.25%, above the roughly 3.75% sector average. That income stream rests on a forward payout ratio of 79.09%, with the latest quarterly dividend at $0.668 per share in September 2025. With dividends paid quarterly, the name has delivered a consistent, predictable cash return over time.

On the earnings side, Dominion finished the third quarter of 2025 with GAAP net income of $1.0 billion, or $1.16 per share, up from $934 million, or $1.09 per share, a year earlier. Operating earnings rose as well, to $921 million, or $1.06 per share, versus $836 million, or $0.98 per share, in the prior year, showing steady underlying progress. Full-year sales reached $14.46 billion, with annual net income at $2.124 billion. With 854 million shares outstanding and a market capitalization of about $53.6 billion, Dominion combines scale and stability with income potential that remains attractive for investors focused on yield.

Dominion's Core Strengths and Expansion Catalysts

Dominion Energy Virginia’s plan to install more than 1,700 solar panels on the roof and parking lot of the Richmond Flying Squirrels’ future CarMax Park stadium shows how actively it is using already developed sites to grow capacity. The project, which still needs local and state approval, is expected to deliver about 1 megawatt of carbon-free electricity, enough to power roughly 250 Richmond homes at peak output, and it will rank among the largest solar installations in professional baseball.

At the same time, Dominion is supporting more flexible, on-demand solutions that fit the sharp increases in AI and data center usage. Its three-year collaboration with Power Up Connect produced the MBESS 90 kWh, the first mobile battery energy storage system that meets International Fire Code standards and the only MBESS currently holding a UL 9540 listing.

The unit can deliver up to 30 kW of output, includes 1,100 watts of onboard solar that can be expanded to 15,000 watts, and can be daisy-chained up to ten units for a total of 900 kWh of capacity, all in a package under 5,000 pounds that can be towed by a mid-sized SUV. That combination makes it a practical, emission-free power source for festivals, food trucks, remote work sites, film sets, and emergency response, and a useful complement to fixed grid assets as AI-driven demand puts more pressure on existing systems.

Wall Street's Take and the Road Ahead for Dominion

The company has tightened its 2025 operating earnings guidance to a range of $3.33 to $3.48 per share, keeping the midpoint at $3.40 and counting in estimated RNG 45Z income, and it expects results to come in at or above that midpoint if weather stays normal for the rest of the year. It has also reaffirmed a long-term operating EPS growth target of 5% to 7% a year through 2029.

Analysts are reacting to this setup in different ways, but they are clearly paying attention. J. P. Morgan Chase has kept an “Underweight” rating but raised its price target from $53 to $56, which recognizes better fundamentals even as it remains careful about regulatory and execution risks tied to Dominion’s build-out and AI-focused projects. On the more positive end, Barclays analyst Nicholas Campanella continues to rate the stock a “Buy” with a $63 target, pointing directly to Dominion’s role in supplying power to AI data centers as a key support for future growth in a typically slow-moving industry.

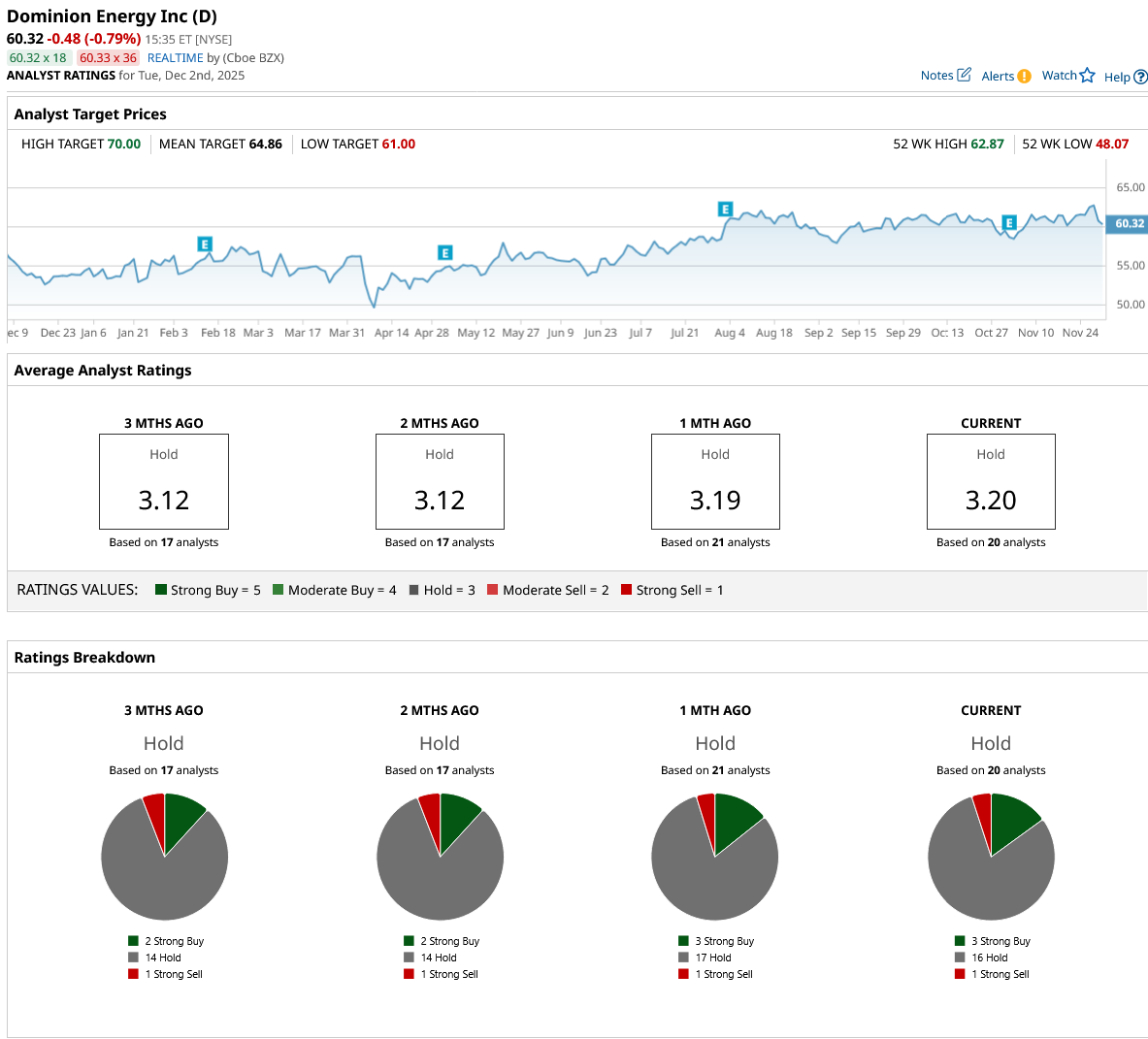

Stepping back, the wider analyst group is still guarded, with all 20 surveyed analysts assigning a consensus “Hold” rating. Even so, their average price target of $64.86 implies about 7.5% upside from the current share price.

Conclusion

Dominion Energy looks like the kind of name you buy more for the journey than the drama. With AI-related demand ramping, a tightened 2025 earnings range that still points to mid-single-digit growth, and a dividend yield north of 4% doing a lot of the heavy lifting, the setup leans toward a slow grind higher rather than a moonshot. Shares are most likely to track modestly upward over the next year as data center projects, grid investments, and offshore wind progress move from story to numbers, giving investors a steadier total-return profile than the typical high-beta AI trade.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Utility Stock Is a Top AI Buy

- Microsoft May Be an AI Tech Giant, But It Is Also One of the Safest Stocks to Own Now, According to Wall Street

- Small-Cap Investment Firm Slumps to 52-Week Low: Opportunity or Red Flag?

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?