CrowdStrike Holdings (CRWD) is a leading cybersecurity company that delivers an AI-native cloud platform to prevent breaches across endpoints, identities, cloud workloads, and data. It unifies endpoint detection and response, threat intelligence, identity protection, and next-gen SIEM to stop sophisticated attacks in real time for enterprises and governments worldwide.

Founded in 2011, CrowdStrike is headquartered in Austin, Texas, with operations across North America, Europe, Asia-Pacific, and other regions through direct sales and partner networks.

About CRWD Stock

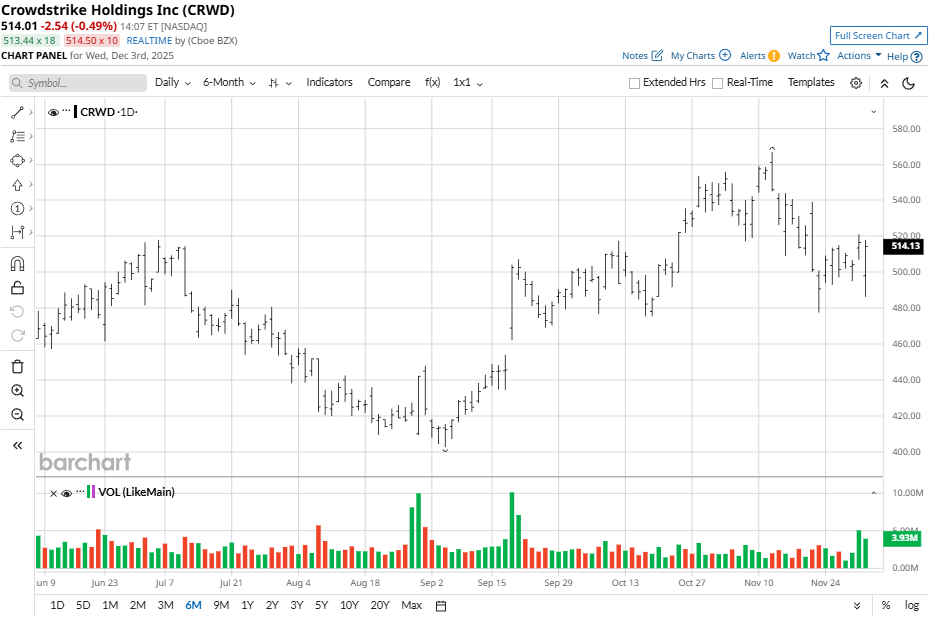

CrowdStrike has shown resilience amid volatility. Over the past five days, shares have experienced minor fluctuations, with an uptick of approximately 2.34%. The 1-month performance reflects a decline of roughly 3.87%, while 3-month gains reached 24.44%. In 6 months, CRWD rose approximately 11.44%, while its 52-week returns stand at nearly 41% with the stock almost 10% below its 52-week high.

Compared to the S&P 500 Index ($SPX), CrowdStrike has significantly outperformed, delivering 45% 1-year returns versus the index's 13%. CRWD's premium valuation reflects strong cybersecurity demand post-earnings momentum.

Crowdstrike Posts Q3 Results

CrowdStrike Holdings reported third-quarter 2026 earnings with an adjusted EPS of $0.96, beating the consensus estimate of $0.94 per share. The company posted revenues of $1.23 billion, exceeding the analyst forecast of $1.21 billion. Despite a GAAP loss of $34 million or $0.14 cents per share, the results showed strong operational performance and market demand.

CrowdStrike’s fiscal Q3 2026 gross margin reached approximately 74%, supported by growth in subscription revenue and improved operating efficiencies. The company generated a strong free cash flow of about $150 million during the quarter, sustaining its robust cash reserves totaling around $1.1 billion. Operating expenses remained elevated to support investments in R&D and sales expansion but showed early signs of leverage.

CrowdStrike expanded its customer base to over 22,000 subscription customers, reflecting continued adoption across endpoints, cloud workloads, and identity security. The platform usage metrics demonstrated increased engagement, with an average of 40% of customers adopting multiple modules, contributing to strong recurring revenue growth and improving unit economics.

For fiscal Q4 2026, CrowdStrike projects revenue between $1.29 billion and $1.3 billion and adjusted EPS of $1.09 to $1.11 per share. The management anticipates continued strength in AI-powered cybersecurity demand, with further platform expansions expected to drive revenue growth and margin improvement into 2026.

Crowdstrike Impresses Wall Street

Wall Street analysts hailed CrowdStrike's Q3 results and guidance as a "major validation moment" for the cybersecurity leader, highlighting accelerated net-new annual recurring revenue (ARR) driven by demand for its Cloud, Identity, SIEM, and Charlotte AI solutions.

Wedbush Securities analyst Dan Ives had an “Outperform” rating on the stock with a price target of $600, reflecting an upside potential of 14.5% from the market rate. The analyst called CrowdStrike the "gold standard" in cybersecurity, noting it's in the early innings of a multi-year growth story fueled by platform consolidation and the AI revolution market opportunity.

Morgan Stanley analyst Meta Marshall weighed in with an “Equal-Weight” rating and a price target of $515, on par with the stock’s market price. Marshall pointed to platform strength, with 49%, 34%, and 24% of subscription customers adopting 6, 7, and 8 modules, respectively, though she cautioned that lack of upward revisions on out-year numbers may limit near-term stock upside.

Jefferies analyst Joseph Gallo had a “Buy” rating with a $600 price target, a 14.5% potential raise, while praising the 22.5% ARR growth despite partner headwinds, calling it an impressive quarter with acceleration in Endpoint, SIEM, Identity, and Cloud, boosting confidence in 23%+ year-over-year (YOY) ARR growth for FY27.

Investment firms Susquehanna and BMO also raised price targets to $600 (from $520) and $555 (from $500), respectively, underscoring broad optimism.

Should You Buy CRWD?

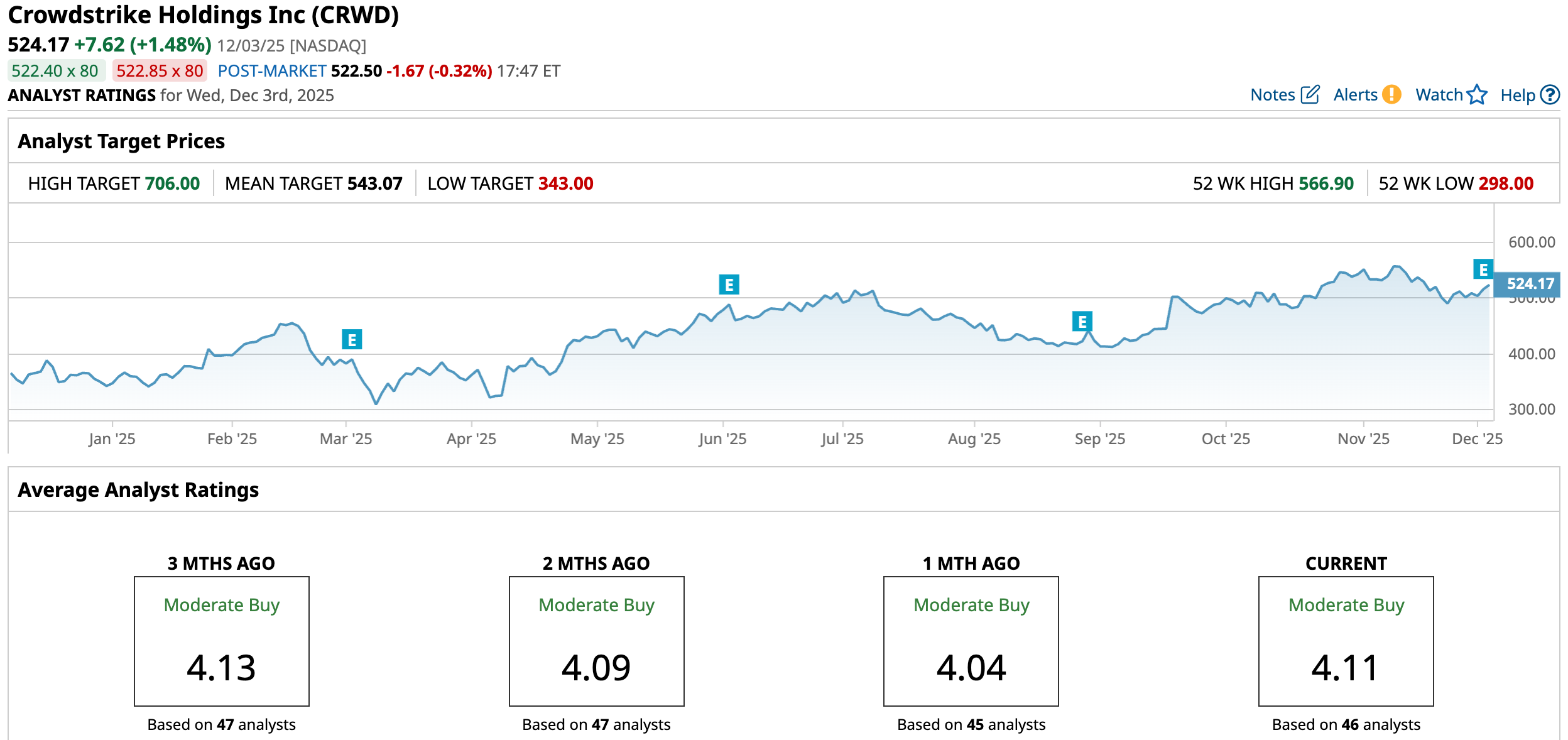

Crowdstrike has received considerable market support, with a consensus “Moderate Buy” rating and a mean price target of $543.07, indicating a 3.06% upside from current levels. The stock has been rated by 46 analysts, receiving 26 “Strong Buy” ratings, three “Moderate Buy” ratings, 15 “Hold” ratings, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 3 Robotics Stocks to Buy Now Ahead of a White House Game-Changer

- China’s EV Growth Is Stagnating. Is That Another Nail in the Coffin for Tesla Stock?

- 3 Ways to Play Celsius Holdings’ 2 Unusually Active Call Options

- Michael Burry Is Betting Big on Fannie Mae. What Is the Bull Case for FNMA Stock Here?