Valued at a market cap of $41.8 billion, Fair Isaac Corporation (FICO) is a leading analytics and software company based in Bozeman, Montana. It provides credit scoring, decision-management software, and artificial intelligence solutions to a diverse clientele, including banks, insurers, retailers, and government agencies, helping them make billions of automated, high-volume operational decisions daily.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and FICO fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software - application industry. The company is best known for developing the widely used FICO credit score, which helps lenders evaluate consumer credit risk. With deep expertise in predictive analytics and risk modeling, FICO remains a key player in global credit scoring and decision automation.

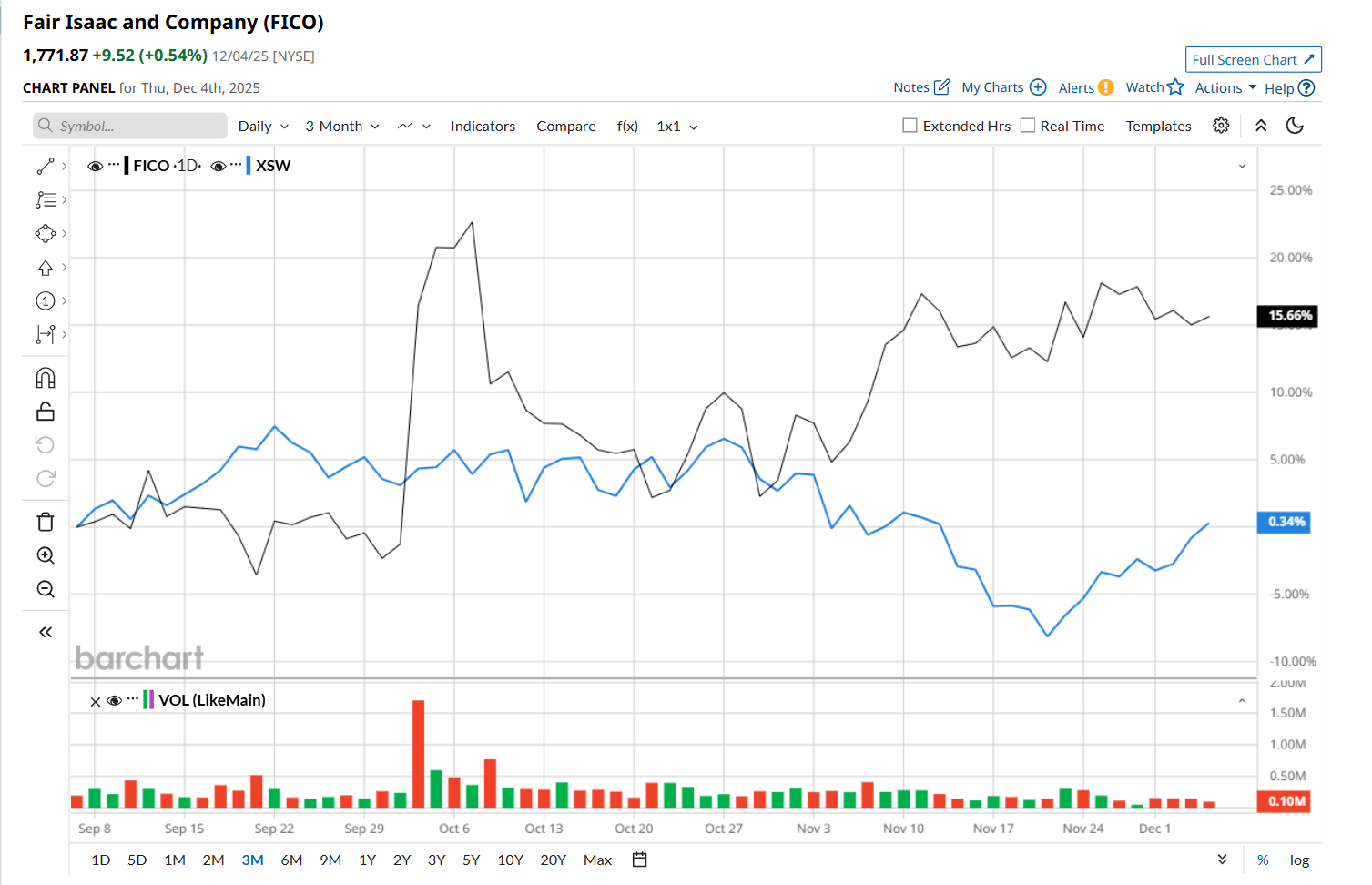

This tech company is currently trading 26.2% below its 52-week high of $2,400, reached on Dec. 6, 2024. Shares of FICO have rallied 16.7% over the past three months, outperforming the SPDR S&P Software & Services ETF’s (XSW) 2.3% rise during the same time frame.

However, on a YTD basis, shares of FICO are down 11%, compared to XSW’s 1.4% return. Moreover, in the longer term, FICO has dropped 25.4% over the past 52 weeks, notably underperforming XSW’s 4.8% downtick over the same time frame.

To confirm its recent bullish trend, FICO has been trading above its 200-day moving average since early November, and has remained above its 50-day moving average since early September.

FICO released better-than-expected Q4 earnings results on Nov. 5, and its shares surged 2.8% in the following trading session. Although the company’s software revenue remained fairly flat year-over-year, strong growth in its scores revenue led to a 13.6% annual rise in its total sales to $515.8 million, which exceeded analyst estimates by a slight margin. Moreover, on the earnings front, its adjusted EPS also increased 18.3% from the year-ago quarter to $7.74, handily beating consensus expectations of $7.34.

FICO has underperformed its rival, Intuit Inc. (INTU), which gained 1.3% over the past 52 weeks and 5.5% on a YTD basis.

Given FICO’s recent outperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 18 analysts covering it, and the mean price target of $2,005 suggests a 13.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart