With a market cap of $47.9 billion, Fastenal Company (FAST) is a global wholesale distributor of industrial and construction supplies, including fasteners, tools, and a wide range of related hardware. It serves diverse markets such as manufacturing, maintenance, construction, transportation, and government.

Companies valued $10 billion or more are generally classified as “large-cap” stocks, and Fastenal fits this criterion perfectly. Its extensive product portfolio supports customers across the United States, Canada, Mexico, and various international regions.

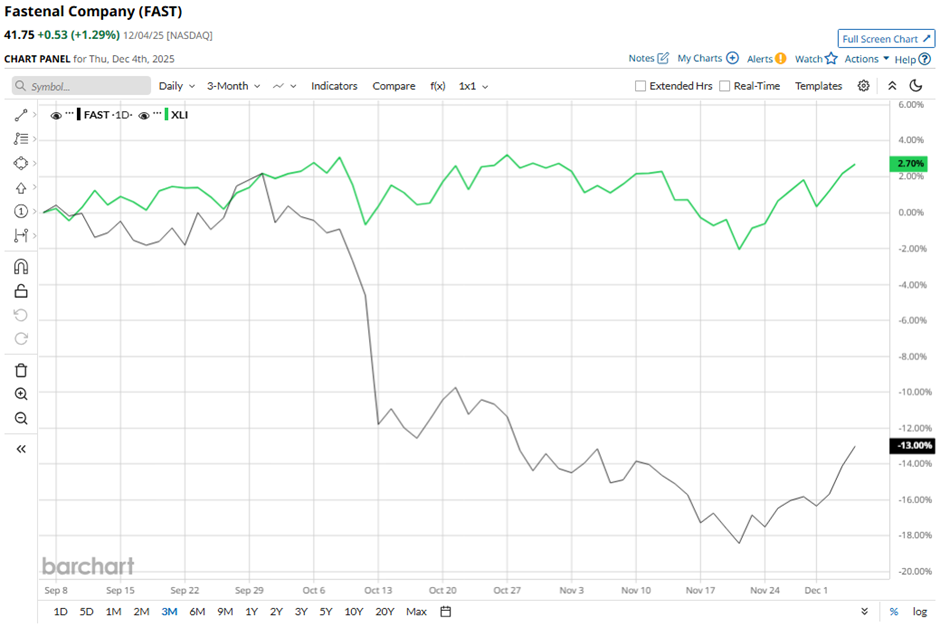

FAST stock has dropped 17.5% from its 52-week high of $50.63. Shares of the company have fallen nearly 17% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) 2.3% gain over the same time frame.

In the longer term, FAST stock is up 16.1% on a YTD basis, slightly lagging behind XLI’s 17.7% increase. Moreover, shares of the maker of industrial and construction fasteners have risen 1.6% over the past 52 weeks, compared to XLI’s 8.7% return over the same time frame.

The stock has been trading below its 50-day average since early October.

Fastenal shares tumbled 7.5% on Oct. 13 as the company posted weaker-than-expected Q3 2025 profit of $0.29 and revenue of $2.13 billion. The company also warned of a slight margin squeeze in Q4 after accelerating inventory deliveries ahead of tariffs and facing rising supply-chain costs.

However, FAST stock has outperformed compared to its rival, W.W. Grainger, Inc. (GWW). Shares of W.W. Grainger have declined 18.8% over the past 52 weeks and 8.1% on a YTD basis.

Despite FAST’s better performance relative to its industry peers, analysts remain cautious about its prospects. The stock has a consensus rating of “Hold” from the 17 analysts covering the stock, and the mean price target of $44.92 is a premium of 7.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart