Apple (AAPL) continues to command global attention as the iPhone 17 cements its position as a runaway hit. The company has turned October into a victory lap, posting a surge in sales that outpaced last year’s iPhone 16 performance by a wide margin.

Bernstein Société Générale Group reports that the iPhone 17 lineup delivered a 20% in unit sales over the iPhone 16 series based on combined sales in September and October, proving that Apple still knows how to engineer consumer excitement. The demand helped Apple seize a record 24.2% market share in October, alongside revenue gains of 14% year-over-year (YOY) and 40% month-over-month (MOM).

In fact, even the International Data Corporation (IDC) is calling the iPhone 17 a “phenomenal success,” noting heavy traction in China, where Apple had previously battled slowing demand. With IDC forecasting 247.4 million iPhone shipments in 2025, up 6% year-over-year (YOY), and Apple CEO Tim Cook projecting a strong holiday quarter, investors now wonder if Apple stock deserves fresh attention.

About Apple Stock

Based in Cupertino, California, Apple remains the crown jewel of the global tech arena. Its hardware lineup, which includes iPhone, Mac, iPad, Apple Watch, and AirPods, works in seamless harmony with services like the App Store, iCloud, Apple Music, and Apple TV+, creating a revenue engine with remarkable staying power.

With a towering market cap of approximately $4.2 trillion, Apple is now pushing aggressively into next-generation hardware, deeper artificial intelligence (AI) capabilities, and a faster-growing subscription ecosystem.

AAPL stock reflects this loyalty and momentum. Over the past 52 weeks, shares climbed 15.51%, while the past six months alone delivered a robust 38.4% rally. For comparison, the Roundhill Magnificent Seven ETF (MAGS) gained 24.94% over the past year and 27.16% in the past six months.

Currently, AAPL trades at 35.08 times forward adjusted earnings and 9.27 times sales. The multiples tower over both the industry norm and AAPL’s own five-year average multiples, highlighting the premium investors willingly pay for the company’s reliability and relentless innovation.

With 12 consecutive years of dividend growth and an annual payout of $1.04, yielding 0.36%, Apple continues to operate as a fortress of consistency in an unpredictable market. The company reinforced that stability with its most recent dividend payment of $0.26 on Nov. 13 to shareholders of record as of Nov. 10.

Apple Surpasses Q4 Earnings

Apple’s fiscal fourth-quarter earnings, reported on Oct. 30, gave investors every reason to stay enthusiastic. Revenue grew 7.9% YOY to $102.5 billion, topping analyst estimates of $101.6 billion. EPS rose 90.7% from the prior year’s period to $1.85, beating analyst expectations of $1.77.

In the September quarter, iPhone revenue hit a record $49 billion, marking a 6% YOY increase. Strong demand for the iPhone 16 and 17 models expanded the active installed base to an all-time high. Apple’s Mac segment also impressed, with revenue rising 13% YOY to $8.7 billion, fueled mainly by the sustained popularity of the MacBook Air.

Moreover, Apple’s Services division continues to operate as a powerful growth engine. The segment delivered a record $28.8 billion, rising 15% YOY with broad-based double-digit gains across global markets.

The momentum appears set to continue, as Apple projects 10% to 12% YOY revenue growth for the December quarter, potentially shaping the strongest quarter in its history. Apple’s product lineup, which includes the iPhone 17 series, AirPods Pro 3, a refreshed Apple Watch family, and M5-powered MacBook Pro and iPad Pro models, further supports this outlook.

Further, analysts expect Q1 fiscal 2026 EPS to rise 10.4% YOY to $2.65, while projecting a 9.4% increase for full-year fiscal 2026 to $8.16. Moreover, they estimate the bottom line will climb 11.3% in fiscal 2027, reaching $9.08 and extending Apple’s growth trajectory.

What Do Analysts Expect for Apple Stock?

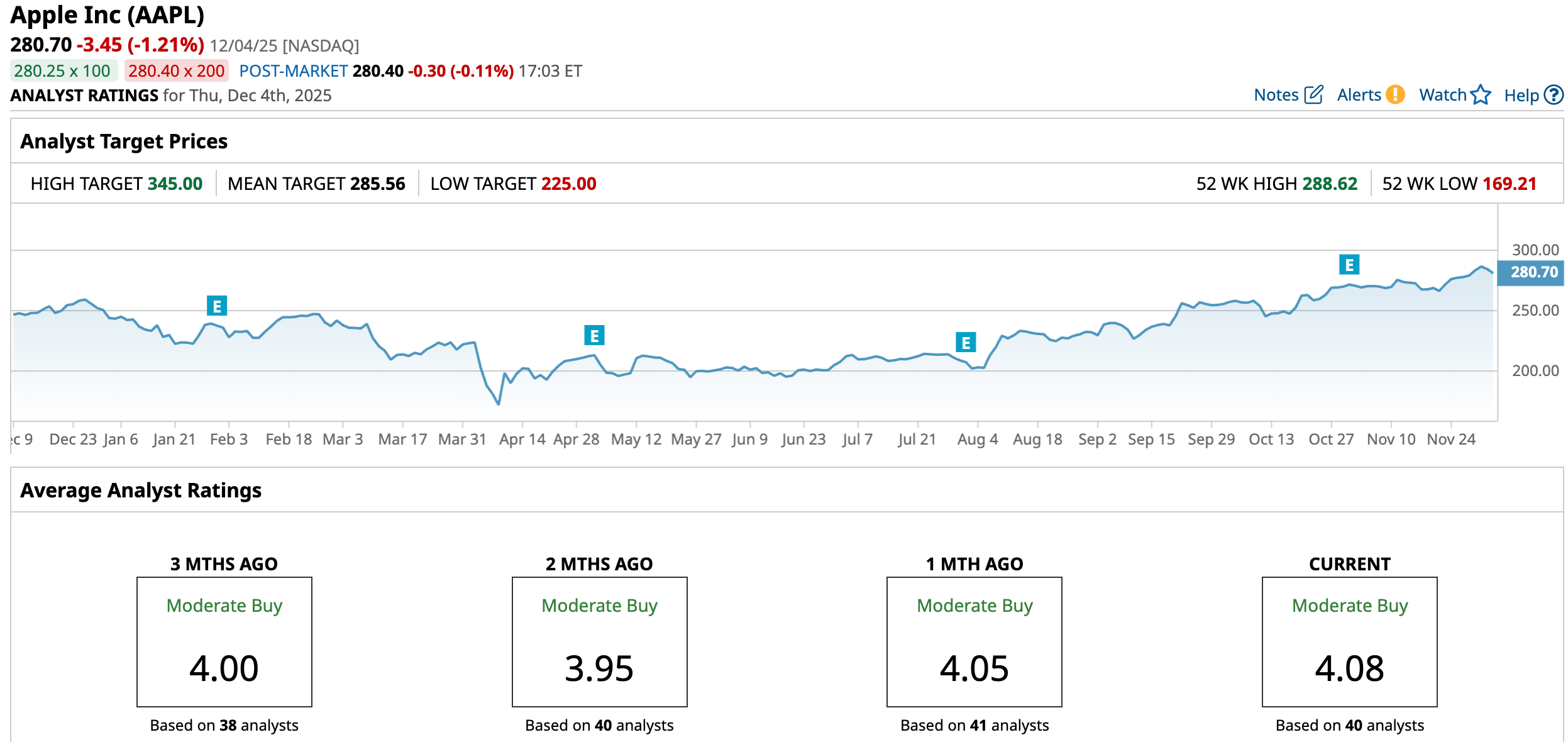

Analysts remain broadly optimistic about AAPL’s trajectory as iPhone 17 momentum strengthens. Loop Capital analyst Gary Mobley recently raised his price target to $325 from $315, maintaining a “Buy” rating based on updated iPhone unit and ASP assumptions based on supply-chain checks.

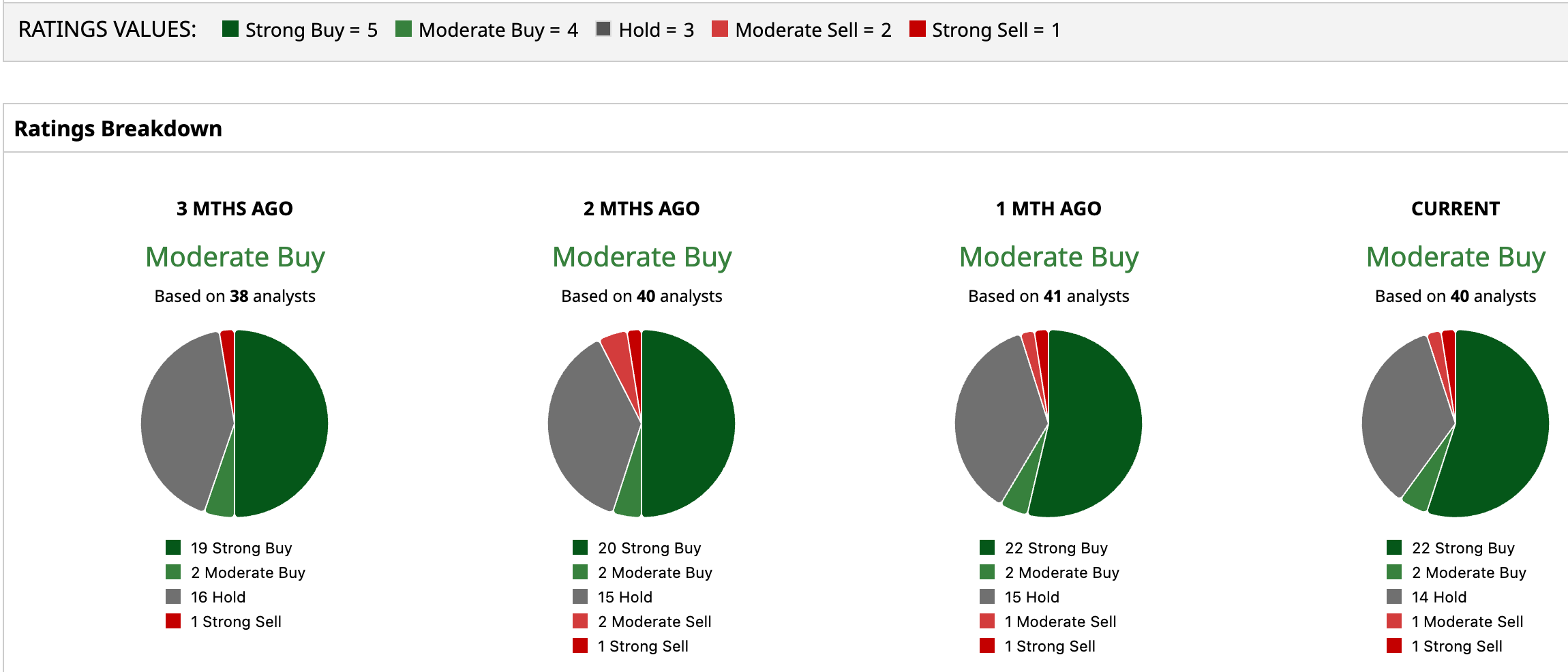

Across Wall Street, sentiment skews positive, with AAPL carrying a “Moderate Buy” consensus rating. Out of 40 analysts, 22 issue a “Strong Buy,” two recommend a “Moderate Buy,” 14 prefer “Hold,” one assigns a “Moderate Sell,” and one delivers a rare “Strong Sell.”

AAPL’s average price target of $285.56 represents marginal 2% potential upside. Meanwhile, the Street-High target of $345 suggests that the stock can climb as much as 23% from the current price level.

With strong demand trends, expanding services revenue, and fresh product cycles in motion, analysts appear comfortable betting that Apple’s latest momentum remains solid.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple Made a Comeback with the iPhone 17, But Will Executive Exits Pull Down AAPL Stock?

- This Former Penny Stock Just Doubled for the Second Time This Week. Should You Chase the Rally Here?

- 3 High-Yield Stocks to Invest in Oracle’s AI Growth with Less Volatility

- iPhone Revenue Just Jumped 40%. Should You Buy AAPL Stock Here?