Palo Alto, California-based HP Inc. (HPQ) provides personal computing and other digital access devices, imaging and printing products, and related technologies, solutions, and services. With a market cap of $24.2 billion, the company offers products including laser and inkjet printers, scanners, copiers and faxes, personal computers, workstations, storage solutions, and computing and printing systems.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and HPQ perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the computer hardware industry. HP is expanding its market presence through a wide range of innovative products targeting both commercial and consumer markets. The company's focus on personal systems, especially in the commercial PC sector, is driving growth in both unit sales and revenue. HP's commitment to innovation is evident in the introduction of AI-powered PCs and hybrid systems designed to meet the changing needs of hybrid work and learning settings.

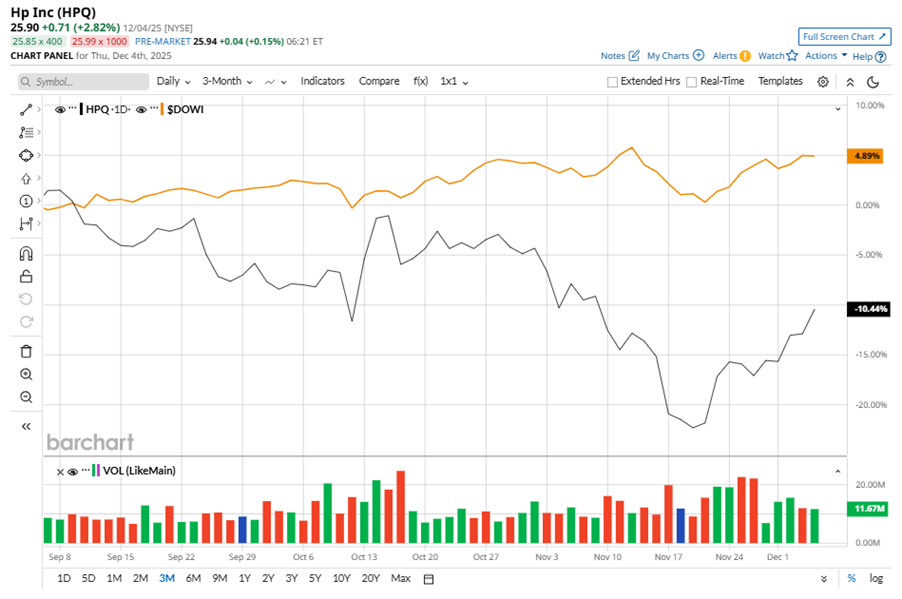

Despite its notable strength, HPQ slipped 29.6% from its 52-week high of $36.81, achieved on Dec. 9, 2024. Over the past three months, HPQ stock has declined 10.4%, underperforming the Dow Jones Industrials Average’s ($DOWI) 4.9% gains during the same time frame.

In the longer term, shares of HPQ rose 2.9% on a six-month basis but dipped 28.8% over the past 52 weeks, underperforming DOWI’s six-month gains of 12.8% and 6.3% returns over the last year.

To confirm the bearish trend, HPQ has been trading below its 50-day moving average since late September, with slight fluctuations. The stock has been trading below its 200-day moving average over the past year, with slight fluctuations.

On Nov. 25, HPQ shares closed down marginally after reporting its Q4 results. Its adjusted EPS of $0.93 topped Wall Street expectations of $0.91. The company’s revenue stood at $14.6 billion, up 4.2% year over year. The company expects full-year adjusted EPS in the range of $2.90 to $3.20.

In the competitive arena of computer hardware, Dell Technologies Inc. (DELL) has taken the lead over HPQ, showing resilience with a 23.3% uptick over the past six months and solid 10.2% gains over the past 52 weeks.

Wall Street analysts are cautious on HPQ’s prospects. The stock has a consensus “Hold” rating from the 14 analysts covering it. While HPQ currently trades above its mean price target of $25.75, the Street-high price target of $30 suggests a 15.8% upside potential.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple Made a Comeback with the iPhone 17, But Will Executive Exits Pull Down AAPL Stock?

- This Former Penny Stock Just Doubled for the Second Time This Week. Should You Chase the Rally Here?

- 3 High-Yield Stocks to Invest in Oracle’s AI Growth with Less Volatility

- iPhone Revenue Just Jumped 40%. Should You Buy AAPL Stock Here?