With a market cap of $31.6 billion, Ingersoll Rand Inc. (IR) provides mission-critical air, fluid, energy, and medical technology solutions worldwide. The company operates through two segments: Industrial Technologies and Services, offering air and gas compression, fluid transfer, and power tool solutions; and Precision and Science Technologies, delivering pumps, gas boosters, automated liquid handling, and related systems for diverse industries.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Ingersoll Rand fits this criterion perfectly. The company sells its products globally through direct sales representatives and independent distributors.

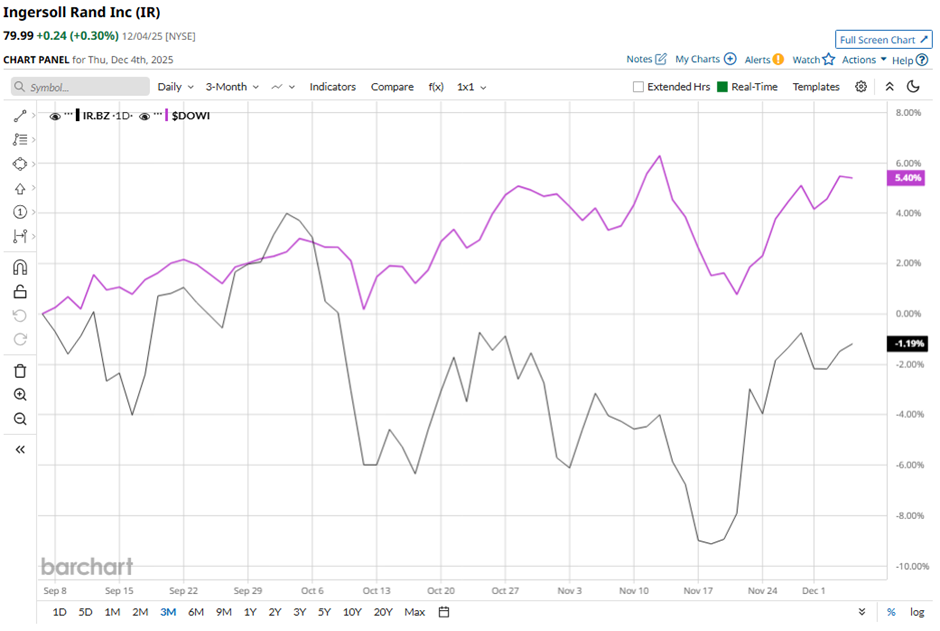

Shares of the Davidson, North Carolina-based company have declined 23.2% from its 52-week high of $104.18. Over the past three months, its shares have gained 1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 4.9% rise during the same period.

Longer term, IR stock is down 11.6% on a YTD basis, lagging behind DOWI's 12.5% return. Moreover, shares of the company have dipped 23.1% over the past 52 weeks, compared to DOWI’s 6.3% increase over the same time frame.

The stock has been in a bearish trend, consistently trading below its 200-day moving average since late December last year.

Ingersoll Rand reported strong Q3 2025 on Oct. 30, including orders of $1.94 billion, revenues of $1.96 billion, and adjusted net income of $346 million, or $0.86 per share. Both segments contributed to growth, with Industrial Technologies & Services posting $1.52 billion in orders and Precision & Science Technologies delivering $420 million in orders alongside improved adjusted EBITDA margins. However, the stock fell 3.1% the next day.

In comparison, rival GE Vernova Inc. (GEV) has outperformed IR stock. GEV stock has climbed 92.1% YTD and 81.5% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. IR stock has a consensus rating of “Moderate Buy” from 16 analysts in coverage, and the mean price target of $88.36 is a premium of 10.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple Made a Comeback with the iPhone 17, But Will Executive Exits Pull Down AAPL Stock?

- This Former Penny Stock Just Doubled for the Second Time This Week. Should You Chase the Rally Here?

- 3 High-Yield Stocks to Invest in Oracle’s AI Growth with Less Volatility

- iPhone Revenue Just Jumped 40%. Should You Buy AAPL Stock Here?