SoFi Technologies (SOFI) stock tanked roughly 7% on Dec. 5 after the fintech announced a $1.5 billion convertible notes offering, raising immediate dilution concerns.

The selloff pushed SOFI decisively below its 100-day moving average (MA) on Friday, indicating continued bearish momentum in the near to medium term.

Following today’s decline, SoFi shares are down nearly 16% versus their recent (November) high.

Does the Offering Warrant Selling SoFi Stock?

SOFI shares are in the red today primarily because convertible note offerings tend to dilute existing shareholders.

Still, long-term investors may consider buying the dip as the company plans on using the proceeds partly for “funding incremental growth and business opportunities.”

So, the optics sure are daunting in the near term, but in the long run, the capital raise may actually help accelerate growth, potentially unlocking significant further upside in SoFi stock.

Investors should also note that this fintech stock has a history of starting the new year with a bang.

Over the past four years, it has rallied a remarkable 22.50% on average in January, making up for another strong reason to buy SOFI heading into 2026.

SOFI Shares Aren’t Inexpensive to Own

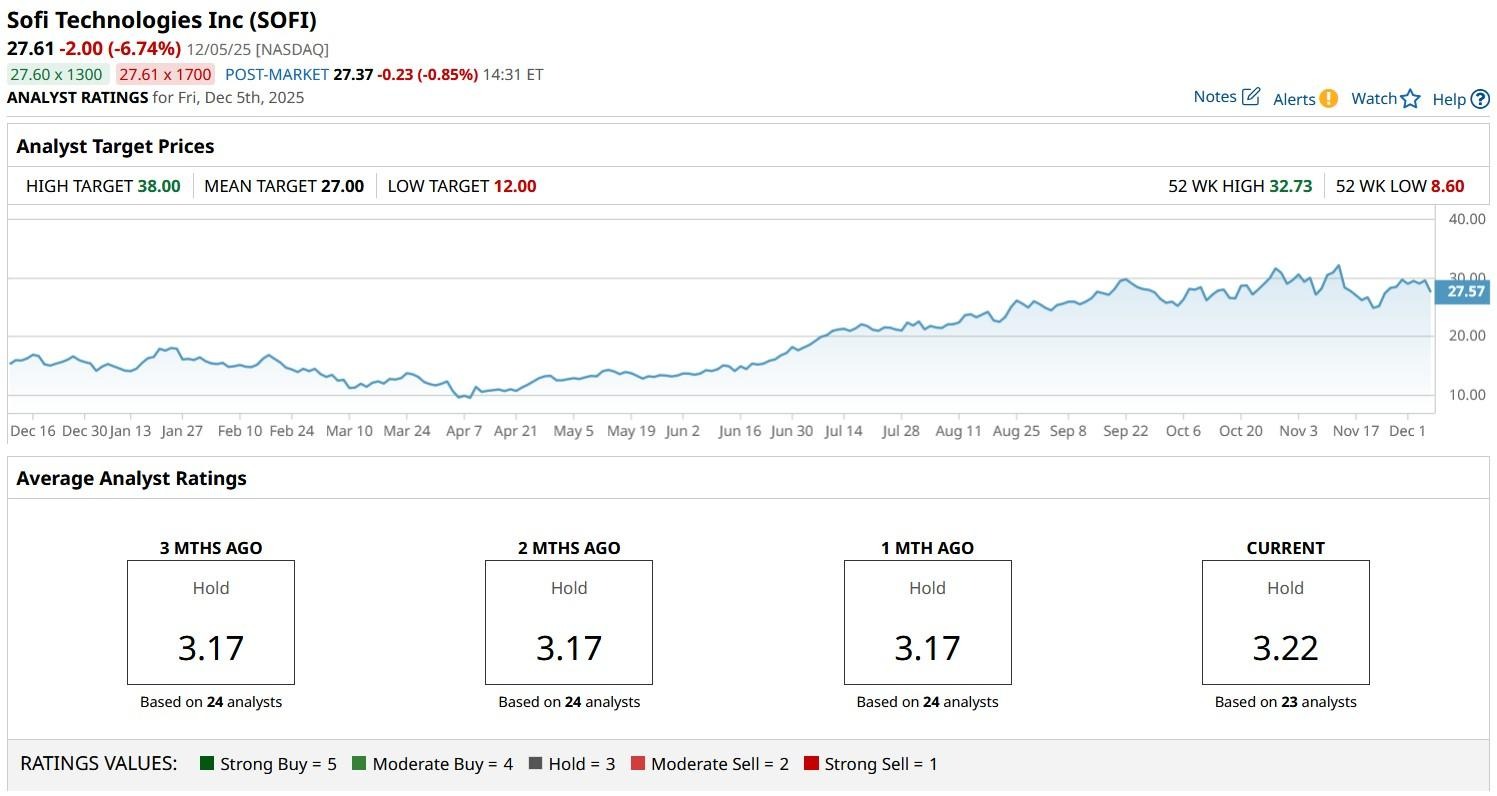

Despite dilution risk tied to SoFi’s convertible notes offering, Mizuho’s senior analyst Dan Dolev continues to forecast upside in the fintech stock to $31 over the next 12 months.

In his latest research note, Dolev struck a positive tone on the company’s reentry in crypto trading and blockchain-enabled remittances this year.

According to him, SOFI shares will push higher as the Nasdaq-listed firm continues to expand its product suite, potentially driving millions of new members to its diversified financial technology platform in 2026.

That said, SoFi Technologies is currently trading at a forward price-earnings (P/E) ratio of about 78x, which suggests it isn’t an inexpensive stock to own heading into the new year.

How to Play SoFi Technologies Heading into 2026

While SoFi sure is growing at a fast clip and remains committed to sustainable profitability as well, valuation risk and the 100-day MA hinting at continued downward momentum warrant caution in initiating a new position in SOFI stock at current levels.

That’s why the consensus rating on SoFi shares also currently sits at “Hold” only with the mean target of about $27 indicating potential downside from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Legendary Investor Muddy Waters Is Making a Rare Bullish Bet on This Gold Stock. Should You Buy It Too?

- TD Cowen Says This Memory Chip Maker Is One of the Best Stocks to Buy for 2026

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?

- Netflix Is Buying Warner Bros. Discovery. Should You Buy NFLX Stock?