Quantum computing is widely viewed as the force poised to ignite a new wave of technological expansion. Bank of America Corporation (BAC) analysts even suggest the field could represent “humanity’s biggest breakthrough since the discovery of fire,” underscoring the magnitude of expectations surrounding this next computing revolution.

Within this landscape, D-Wave Quantum (QBTS) stands out as a leading pure-play contender. As the world’s first commercial provider of quantum computers, the company recently created a dedicated business unit tasked with accelerating the adoption of its quantum technologies across U.S. government agencies.

The division is headed by seasoned government and public-sector executive Jack Sears Jr., who will guide D-Wave’s broader government-focused initiatives. With federal interest in quantum capabilities rising rapidly, the expansion positions D-Wave to benefit meaningfully as agencies seek advanced tools for national-interest missions.

Following the announcement, the stock jumped approximately 5% on Dec. 2, added another 11.5% the next day, and climbed 14.6% as of Dec. 4. Now up 224% year-to-date (YTD), the stock leaves investors weighing whether D-Wave’s momentum still has room to run or if enthusiasm has already been priced in.

About D-Wave Quantum Stock

Headquartered in Palo Alto, D-Wave Quantum builds quantum computing hardware, software, and cloud-based solutions. With a market cap of over $10 billion, its portfolio includes the Advantage quantum systems, Ocean developer tools, and the Leap platform, which blends quantum and classical resources to tackle complex, real-world computational challenges.

QBTS shares have delivered staggering gains, jumping 860% over the past 52 weeks. Momentum intensified further, with the stock climbing 77% in the last three months. Even in the past five trading days, the stock advanced 20%, driven by the company’s government alliances and robust quarterly performance report.

At present, QBTS trades at a lofty 395.54 times sales, far above typical industry levels. The valuation signals the substantial premium investors appear willing to pay in recognition of D-Wave’s leadership in quantum technologies and its perceived long-term growth potential.

D-Wave Quantum Surpasses Q3 Earnings

On Nov. 6, D-Wave reported its Q3 fiscal 2025 results, delivering performance that exceeded Wall Street expectations. Revenue rose 99.9% year-over- year (YOY) to $3.7 million, beating consensus estimates by 19.84%. Net loss per share stood at $0.41, widening 272.7% YOY, but coming in significantly better than analysts’ projection of $0.07 loss per share.

The company also posted $2.4 million in bookings, an 80% jump from the prior quarter’s $1.3 million. Non-GAAP gross profit increased 131.2% from last year to reach $2.9 million, while adjusted net loss contracted 21.8%, bringing the figure down to $18.2 million.

Its financial position strengthened as well. As of Sep. 30, D-Wave held a record $836.2 million in cash, marking an extraordinary over 2700% surge from fiscal 2024’s third-quarter total of $29.3 million, along with a 2% sequential increase from fiscal 2025’s second-quarter level of $819.3 million.

Customer activity remains a highlight, too. D-Wave is working with Badische Anilin- & Soda-Fabrik (BASF), a German multinational chemical company, on quantum hybrid initiatives. Additionally, the Advantage2 quantum system recently became operational for U.S. government use, supporting “mission-critical” defense and national-security applications, an area with substantial growth potential.

Analysts expect continued improvement ahead. They project Q4 fiscal 2025 loss per share to narrow 86.5% YOY to $0.05. For the full fiscal year 2025, loss per share is forecast to shrink 72% to $0.21, followed by an additional 9.5% improvement in fiscal 2026 to $0.19.

What Do Analysts Expect for D-Wave Quantum Stock?

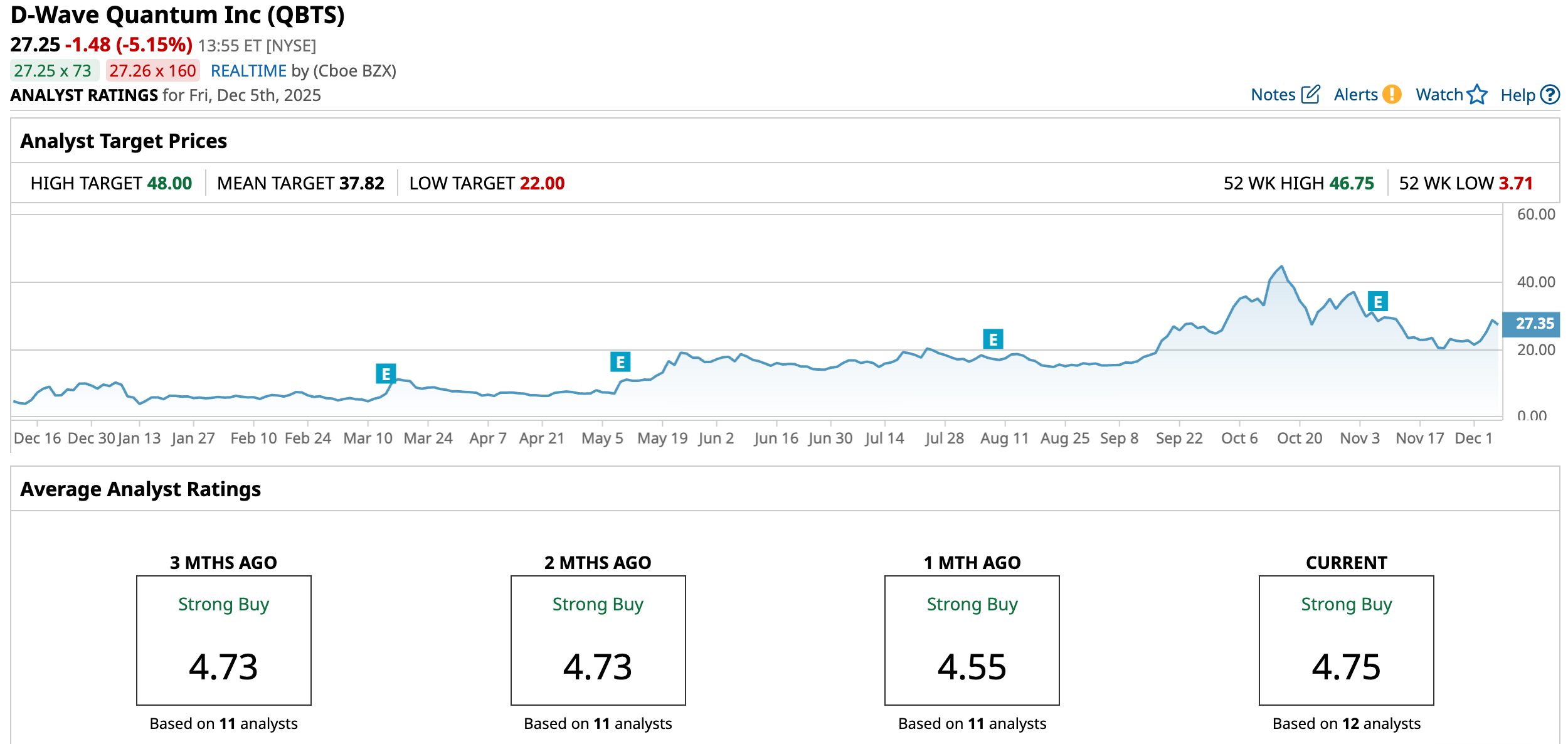

Analyst sentiment remains notably bullish. Evercore (EVR) ISI’s Mark Lipacis maintains an “Outperform” rating alongside a $44 price target, arguing that D-Wave may be positioned more favorably than widely assumed as quantum adoption accelerates.

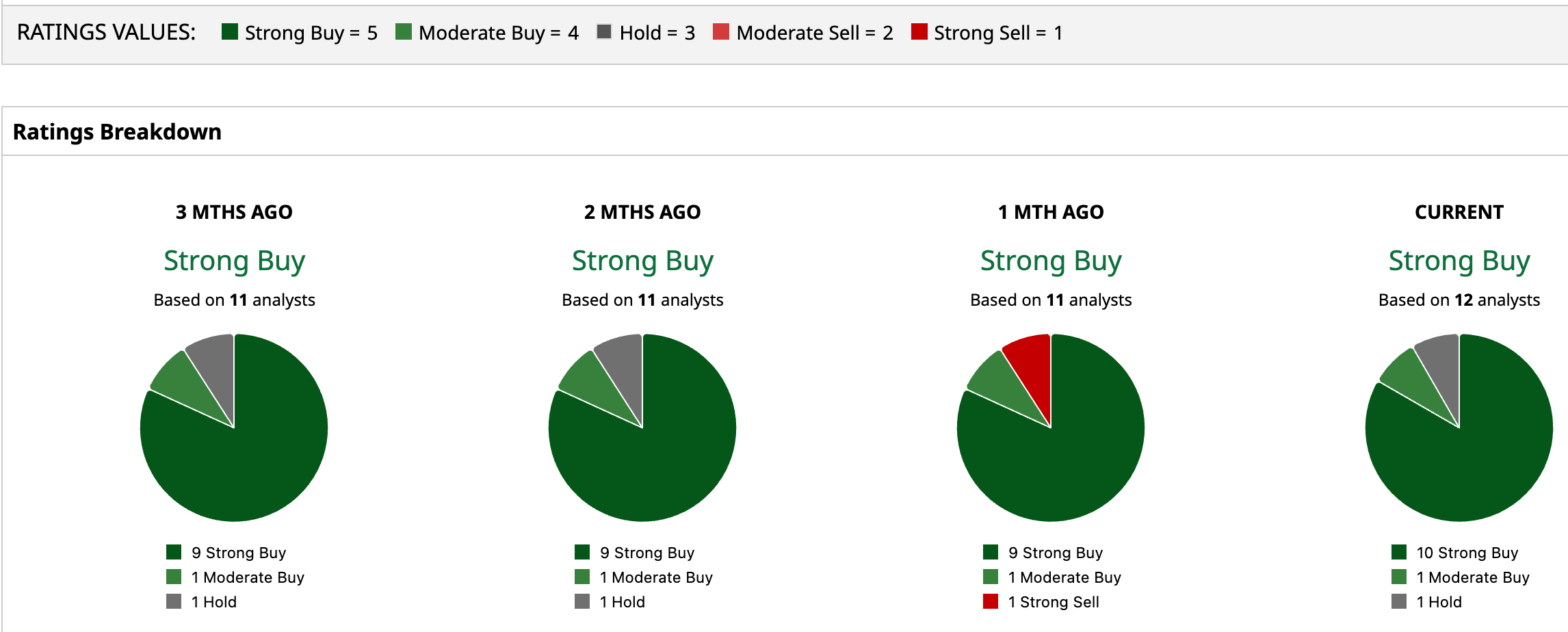

Analysts are overwhelmingly positive for QBTS, assigning it an overall rating of “Strong Buy.” Among 12 covering analysts, 10 rate the stock “Strong Buy,” one recommends “Moderate Buy,” and one suggests “Hold.”

QBTS’ average price target of $37.82 represents potential upside of 38.6%. Meanwhile, the Street-high target of $48 suggests potential gain of 76% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: 3 Stocks Flashing High-Probability Trading Setups to Consider This Week

- As D-Wave Launches a New Government Unit, Should You Buy, Sell, or Hold the Quantum Computing Stock Here?

- Salesforce Is One of the Dogs of the Dow. Should You Buy the Dip in CRM Stock Now?

- Most “Safe” Dividend Stocks Don’t Grow Like This… But These 3 Did