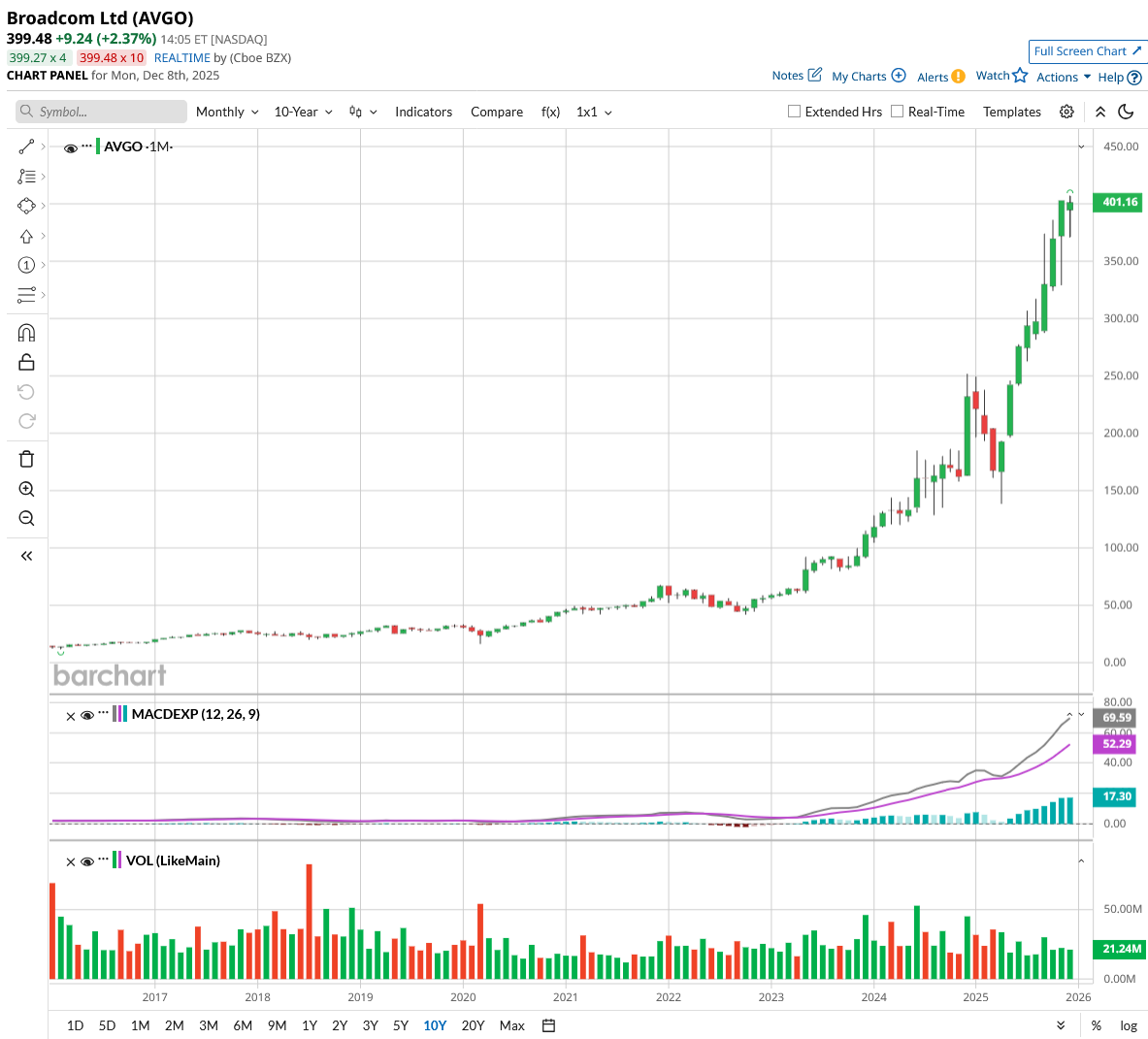

Valued at a market cap of $1.84 trillion, Broadcom (AVGO) stock has returned about 120% since last December and is up over 2,500% in the past decade. Broadcom is gaining significant traction in the rapidly expanding AI market and continues to power AI infrastructure.

Susquehanna analyst Christopher Rolland just raised the price target on AVGO stock to $450 from $400 and maintained a “positive” rating. The optimism centers on Google's (GOOG) (GOOGL) new TPUv7 chip, which is performing better than expected and attracting major customers like Anthropic and Meta (META).

These companies are ordering massive quantities of AI processing units, with Anthropic alone committing to potentially 1 million TPUs. CEO Hock Tan revealed that one customer prospect turned into over $10 billion in AI rack orders expected in the second half of fiscal 2026.

Broadcom supplies networking gear and custom processors that hyperscalers need to build their AI infrastructure. A recent deal with OpenAI for up to 10 gigawatts of AI racks demonstrates how central Broadcom has become to the industry's fastest-growing segment.

A few days back, AVGO stock surged 11% in a single trading session as investors recognized its widening AI moat. Let’s see if the mega-cap stock is still a good buy right now.

The Bull Case of Investing in Broadcom

Broadcom CEO Hock Tan just gave investors a glimpse of how massive the AI opportunity could become for his company, and the numbers are staggering. Speaking at the Goldman Sachs technology conference, Tan revealed that his compensation package, tied to 2030 targets, includes achieving AI revenue over $120 billion. That compares to just $20 billion in AI revenue for fiscal 2025, suggesting Broadcom expects its AI business to grow roughly sixfold over the next five years.

The chipmaker is laser-focused on a small but incredibly lucrative customer base. Tan explained that Broadcom is only pursuing about seven customers building large language models and racing toward what he calls super intelligence.

These companies are spending enormous amounts on AI compute infrastructure, collectively investing around $30 billion annually. That concentrated market is where Broadcom sees its biggest opportunity, rather than the thousands of enterprise customers who might spend $10 million each on merchant GPUs.

In addition to custom chips it designs for these hyperscalers, Broadcom’s networking infrastructure also connects massive clusters of processors. Tan emphasized that networking might actually be the bigger technical challenge than building powerful individual chips.

When you need 100,000 or even 1 million processors working together to train AI models, the network becomes the computer. Broadcom provides the switching and interconnect technology that makes these enormous systems possible.

The company is already working on next-generation optical networking solutions capable of 100 terabits per second, connecting hundreds or even thousands of processors within a single rack. This technology shift from copper to optical connections should start happening in 2027, creating another wave of demand for Broadcom's networking products.

Tan also confirmed that Broadcom expects its AI revenue growth to accelerate beyond the 60% rate previously guided for fiscal 2026. It sees demand intensifying as customers scale up their infrastructure to train new models and deploy inference capabilities to monetize their AI investments.

With Google's TPUv7 ramping up and new customers like Anthropic coming online, Broadcom appears positioned to capture an outsized share of the infrastructure spending fueling the AI race.

Is AVGO Stock Still Undervalued?

Analysts tracking AVGO stock are forecasting it to grow from $63.43 billion in fiscal 2025 (ended in October) to $177 billion in fiscal 2029. In this period, its free cash flow is forecast to improve from $29.51 billion to $94 billion.

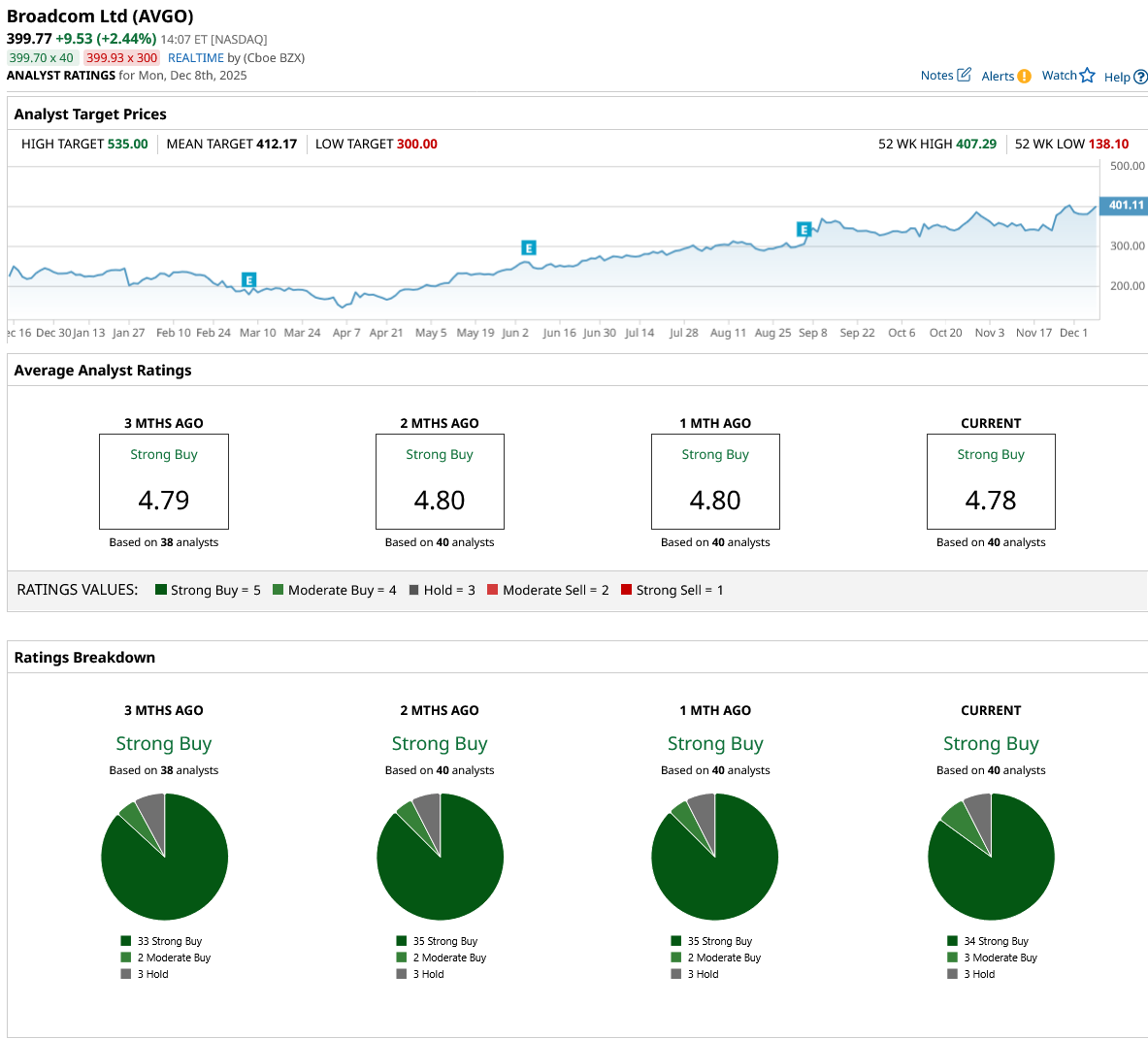

If AVGO stock is priced at 30x forward FCF, which is lower than the current multiple of 47x, it could increase 53% over the next three years. Out of the 40 analysts covering AVGO stock, 34 recommend “Strong Buy,” three recommend “Moderate Buy,” and three recommend “Hold.” The average Broadcom stock price target is $412, about 3% above the current price of $400.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart