Valued at a market cap of around $36 billion, Charter Communications, Inc. (CHTR) is a major U.S. telecommunications company. The Connecticut-based operator of the Spectrum brand provides broadband internet, cable television, mobile, and voice services to residential and business customers across 41 states.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CHTR fits the label perfectly. As one of the nation’s largest broadband and cable providers by subscriber base, Charter serves tens of millions of customers and maintains a major presence in the domestic communications and entertainment market.

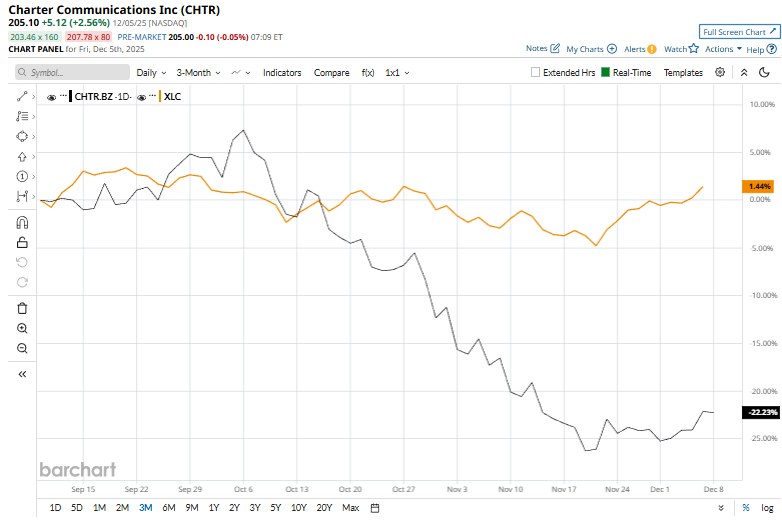

Despite its notable strength, shares of the broadband connectivity provider have slipped 53.1% from its 52-week high of $437.06, reached on May 16. Moreover, shares of CHTR have declined 21.6% over the past three months, significantly underperforming the Communication Services Select Sector SPDR ETF Fund’s (XLC) 2.1% gains during the same time frame.

In the longer term, CHTR stock has fallen 49.3% over the past 52 weeks, lagging behind XLC’s 17.1% uptick over the same time period. Moreover, on a YTD basis, shares of CHTR are down 40.2%, compared to XLC’s 21% return.

To confirm its bearish trend, the stock has been trading below its 200-day moving average since late July, and has remained below its 50-day moving average since mid-July.

On Oct. 31, CHTR reported its Q3 results, and its shares slumped 5% in the following trading session. The company reported earnings per share of $8.34, below the Wall Street consensus of $9.32, reflecting margin pressure and higher operating costs. Revenue for the quarter reached $13.67 billion, slightly under analysts’ estimates of $13.74 billion, driven by softer subscriber trends across broadband and video services.

CHTR stock has also lagged behind its rival, Comcast Corporation (CMCSA), which declined 36.2% over the past 52 weeks and 27.2% on a YTD basis.

The stock has a consensus rating of "Hold” from the 24 analysts covering it, and the mean price target of $336.31 suggests a 64% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart