Valued at a market cap of $620 billion, Oracle (ORCL) stock is up 259% in the past five years. Despite its outsized gains, ORCL stock is down 37% from all-time highs, allowing you to buy the dip. The next driver of ORCL stock will be its upcoming earnings, scheduled for release on Wednesday, Dec. 10.

Analysts tracking Oracle forecast revenue to increase to $16.2 billion in fiscal Q2 of 2026 (ended in November), up from $14.2 billion in the year-ago period. Comparatively, adjusted earnings per share are estimated to expand from $1.47 per share to $1.64 per share.

Is Oracle a Good Stock to Own Right Now?

Oracle recently promoted Clay Magouyrk and Mike Sicilia to co-CEOs while founder Larry Ellison remains deeply involved as chairman and chief technology officer. Safra Catz transitions to executive vice chairman after nearly three decades of steering the company alongside Ellison.

The timing of these promotions reflects Oracle's strong momentum in cloud infrastructure and artificial intelligence. Magouyrk has spent the past decade building Oracle Cloud Infrastructure into what he calls a hypergrowth business powered by AI adoption. The company can now embed its entire cloud into customer data centers and partner clouds, a capability no other major provider offers.

Sicilia highlighted how Oracle has evolved from a technology vendor to a strategic partner, offering everything from industry applications to infrastructure. The company is seeing much larger deals as customers want integrated solutions spanning applications, databases, cloud infrastructure, and AI platforms. This end-to-end approach is creating entirely new business models and competitive opportunities.

One compelling example is how Oracle connects different industries through its AI ecosystem. From greater levels of suggestion personalization for advertisers to entirely automatic backup and patching systems using a company's own proprietary systems and data, this level of integration across verticals is unique to Oracle's position as both an infrastructure and applications provider.

Oracle's remaining performance obligations now exceed $500 billion, up from around $50 billion just three years ago. That's a tenfold increase in committed revenue that hasn't been delivered yet. The company isn't struggling to find customers.

However, the real challenge is building data centers fast enough to meet demand. Magouyrk explained how Oracle is solving this capacity crunch. The cloud infrastructure giant is building massive AI data centers as it aims to deploy facilities capable of handling up to 1 gigawatt of power.

A single one-gigawatt data center can generate $10 billion in annual sales over a six-year contract with margins of over 30%. Oracle's customer list includes AI heavyweights like Meta (META) and OpenAI. In fiscal Q2, Oracle inked $65 billion in new infrastructure contracts across seven deals with four different customers, excluding OpenAI.

Oracle has created an AI Data Platform, which enables businesses to use large language models on their private data while keeping everything secure. This solves a huge problem for enterprises that want AI capabilities but can't risk exposing sensitive information.

Oracle's database business, which some thought might be mature, could actually become one of the fastest-growing segments. The company projects $20 billion in AI database revenue by 2030, driven in part by its multi-cloud strategy, which now places Oracle databases on Azure, Google Cloud, and AWS.

Is ORCL Stock Undervalued?

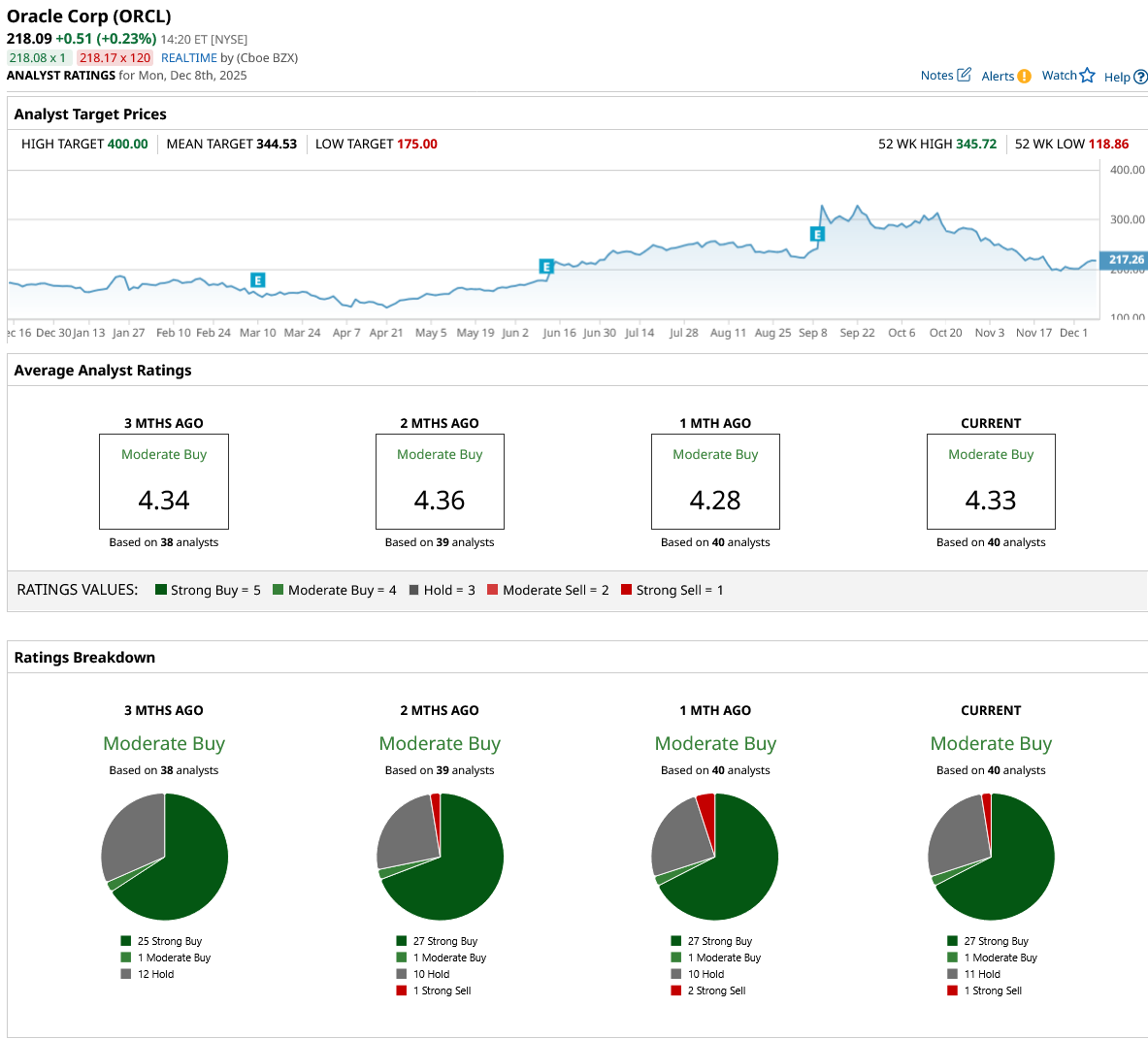

Out of the 40 analysts covering ORCL stock, 27 recommend “Strong Buy,” one recommends “Moderate Buy,” 11 recommend “Hold,” and one recommends “Strong Sell.” The stock's average price target is $344.53, which is 58% above the current trading price.

If ORCL stock is priced at 25x forward earnings, it should trade around $525 per share in 2029, indicating an upside potential of over 120% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy Spotify Stock Ahead of Its Big Music Video Push?

- This Popular Wall Street Strategist Says It’s a ‘High-Risk Bull Market.’ He’s Right, with the Fed in Focus.

- Can Google Stock Hit $400 in 2026?

- Does Nvidia Have Too Much Cash? Unpacking the Case for More NVDA Stock Buybacks, Larger Dividends, and Less Deals.