Nvidia’s (NVDA) meteoric rise over the past two years has been fueled by unprecedented demand for its artificial intelligence (AI) chips, and with that surge has come something else: an avalanche of cash. The chipmaker is now sitting on a financial war chest that would have been unimaginable just a few years ago. And as that pile of cash continues to swell, one debate on Wall Street is getting louder: Does Nvidia now have too much cash?

That question gained new momentum following the company’s latest string of deals, including a $2 billion investment in chip design firm Synopsys (SNPS) last week. With tens of billions in cash and more pouring in each quarter, investors are wondering what comes next. Should Nvidia double down on strategic investments? Ramp up stock buybacks? Or boost its tiny dividend?

Let’s take a closer look.

About Nvidia Stock

Nvidia is a premier technology firm known for its expertise in graphics processing units and artificial intelligence solutions. The company is renowned for its pioneering contributions to gaming, data centers, and AI-driven applications. NVDA’s technological solutions are developed around a platform strategy that combines hardware, systems, software, algorithms, and services to provide distinctive value. The chipmaker’s market cap stands at $4.43 trillion, ranking it as the most valuable company in the world.

Shares of the AI darling have climbed 37% on a year-to-date (YTD) basis. NVDA stock has gone essentially nowhere since my previous article, as investors appear to continue digesting The Information report about the potential Meta-Google deal. While occasional dip-buying has helped the stock hold the $180 support level, there’s still no clear bullish momentum on the chart, suggesting the stock may continue to consolidate around this level.

Is Nvidia Making the Right Moves With Its Massive Cash Pile?

As Nvidia continues to make headlines with its massive investments, investors are increasingly convinced the company has too much cash, raising the key question of how it should deploy it most effectively. Last week, the chipmaker announced it would take a $2 billion stake in chip design firm Synopsys. This follows a series of major investments announced this year, including a $1 billion stake in Nokia (NOK), a $5 billion investment in Intel (INTC), and a $10 billion investment in Anthropic—totaling $18 billion across just those four deals. And let’s not forget the biggest commitment of all: a planned $100 billion purchase of OpenAI shares over several years, though no final agreement has been reached yet, Nvidia finance chief Colette Kress said last week at the UBS Global Technology and AI conference.

Let’s take a moment to look at Nvidia’s numbers. At the end of the third quarter, Nvidia had $60.6 billion in cash and short-term investments. That’s up significantly from $13.3 billion in January 2023, shortly after OpenAI released ChatGPT—the event that propelled Nvidia’s chips into becoming one of the most sought-after technologies in the world. So, it’s clear that Nvidia has plenty of cash to write big checks. However, investors and analysts have been debating whether the company should allocate more of its cash to buybacks and dividends rather than pursuing additional deals.

Buybacks are nothing new for Nvidia. During the first nine months of fiscal 2026, Nvidia returned $37 billion to shareholders through share repurchases and dividends. As of the end of the third quarter, the company had $62.2 billion left under its share repurchase authorization. Notably, the company’s board last expanded its share repurchase authorization in August, adding $60 billion to the total.

It’s also worth noting that Nvidia is prioritizing buybacks over dividends, as it pays only a penny per share quarterly, resulting in a yield of just 0.02%. And while income-focused investors may be disappointed, buybacks actually make more sense for tech giants like Nvidia. The first example that comes to mind is Apple (AAPL), which hasn’t generated strong revenue growth in recent years but still delivered double-digit EPS growth thanks to its buybacks. Though Nvidia’s earnings growth remains strong, even without any boost from buybacks, thanks to booming demand for its AI chips. Second, buybacks highlight management’s confidence in the company’s long-term growth potential. Finally, buybacks help offset the dilution from stock-based compensation (SBC) granted to employees, which has been significant in Nvidia’s case. Interestingly, “Big Short” investor Michael Burry argued last month that Nvidia’s buybacks since 2018 have generated “zero” additional shareholder value due to SBC-related dilution, though Nvidia has denied that claim.

CEO Jensen Huang said on last month’s earnings call, “We’re going to continue to do stock buybacks.” Analysts expect the company to generate $96.85 billion in free cash flow this year and $576 billion over the next three years. “Nvidia is set to generate over $600B in free cash flow over the next few years, and it should have a lot left over for opportunistic buybacks,” wrote Melius Research analyst Ben Reitzes in a note last Monday. With that, I think it’s highly likely the company will continue to increase its stock buybacks, though I don’t expect any meaningful dividend hikes in the foreseeable future, as buybacks remain the company’s clear priority. And, in general, that should help support the stock, though it won’t be a major catalyst on its own.

More Buybacks? Dividends? Or R&D?

I also want to highlight what critics are saying about Nvidia’s buybacks and add my two cents on each argument. The most common argument I’ve seen is that Nvidia should spend more on research and development for its product pipeline instead of buying back shares. Well, the company has already been increasing its R&D expenses over time—they grew 38.6% year-over-year (YoY) to $4.7 billion in the third quarter alone. And more importantly, Nvidia remains on track to update its chips on an annual basis as promised, with its next-generation Rubin GPUs, successors to Blackwell, scheduled for release in 2026. And the second common argument is that Nvidia should instead use its cash for strategic acquisitions. But Nvidia is actually very limited in its ability to acquire other companies, especially large ones. I’m sure some of you remember when Nvidia attempted to buy chip designer Arm (ARM) for $40 billion in 2020 but ultimately had to abandon the deal due to regulatory hurdles. That said, Nvidia’s investments in other companies have replaced acquisitions, which is why I believe they’re important and shouldn’t be sacrificed in favor of larger buybacks or dividends. Notably, in an October filing, Nvidia said it has already invested $8.2 billion in private companies.

Putting it all together, I think what Nvidia is doing right now, increasing its buybacks as cash flow grows and investing in other companies, is actually the golden mean. The growth Nvidia has experienced and now anticipates in its free cash flow means it “has to do something, as shareholders don’t want to earn market interest rates on a giant, growing cash pile sitting on the balance sheet,” according to Dan O’Brien, chief operating officer at the Futurum Group. He added that he views stock buybacks and private-market investments as “the most logical options” for the company when deciding where to allocate capital.

What Do Analysts Expect for NVDA Stock?

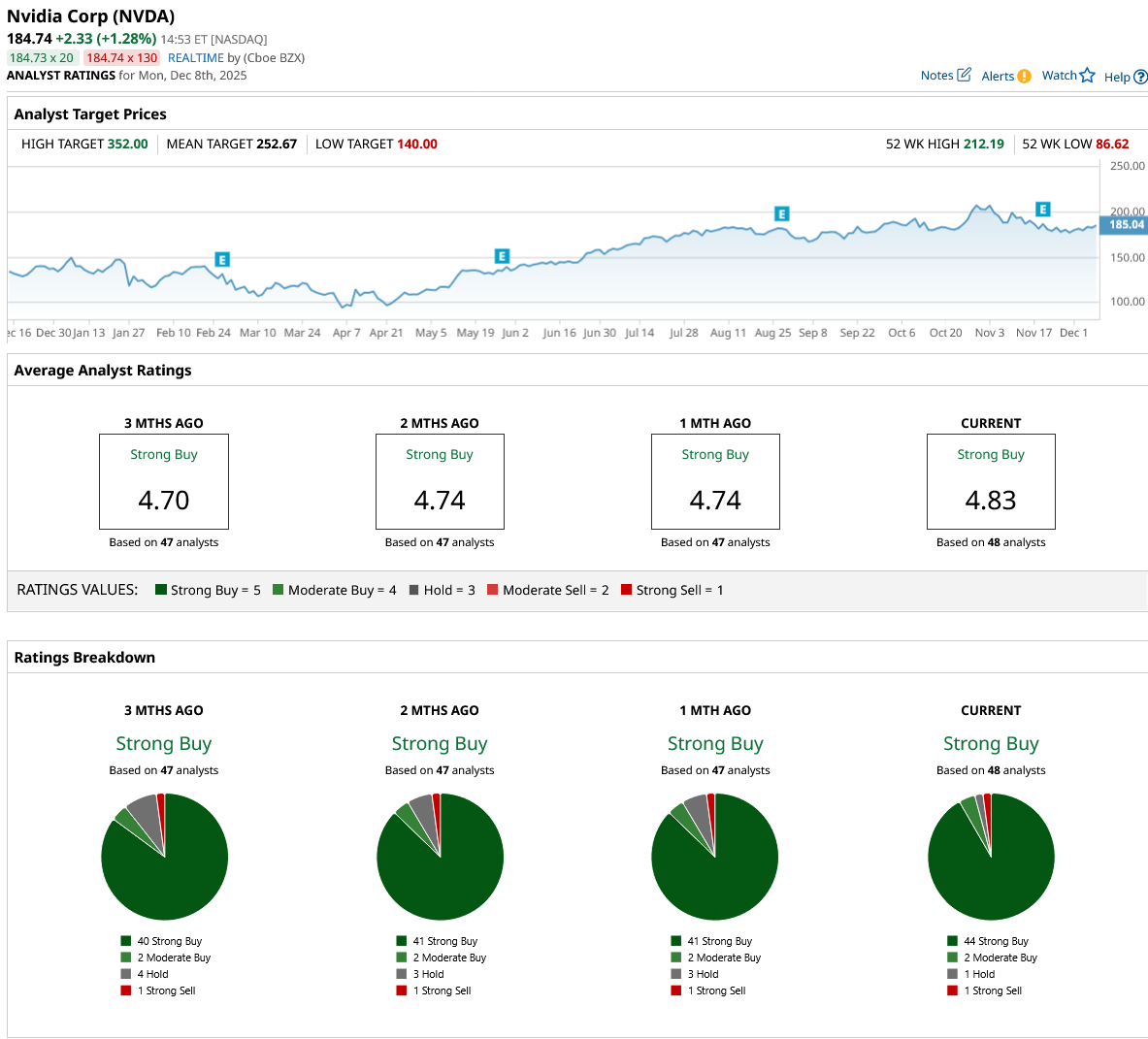

Wall Street analysts remain broadly optimistic about Nvidia’s outlook, as reflected in the stock’s top-tier consensus “Strong Buy” rating. Out of the 48 analysts covering NVDA stock, 44 rate it a “Strong Buy,” two call it a “Moderate Buy,” one suggests holding, and the remaining one gives it a “Strong Sell” rating. The average price target for NVDA is $252.67, suggesting a 37% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is It Too Late to Chase the IBM-Driven Rally in Confluent Stock?

- Here Is Where Option Traders Expect Carvana Stock to Be When It Joins the S&P 500 Index

- Should You Buy Spotify Stock Ahead of Its Big Music Video Push?

- This Popular Wall Street Strategist Says It’s a ‘High-Risk Bull Market.’ He’s Right, with the Fed in Focus.