With soybean (ZSF26) and wheat (ZWH26) (KEH26) markets presently on a slippery slope and corn (ZCH26) grinding sideways, grain traders will get to feast on a fresh batch of economic data from the United States Department of Agriculture early this week.

On Tuesday, the USDA will release its December World Agricultural Supply and Demand Estimates (WASDE). Analysts surveyed by Bloomberg, on average, look for the agency to lower its estimate of U.S. corn ending stocks by 8.2 million bushels from its November figure to 2.146 billion bushels. The analysts look for USDA to peg U.S. soybean ending stocks up 16 million bushels, to 306.1 million bushels. And analysts, on average, look for USDA to peg U.S. wheat stocks down 7.2 million bushels at 893.8 million bushels.

Corn Trapped in a Sideways Grind

March corn futures last week lost 3 cents from the week prior. Corn is trading right in the middle of a choppy range, suggesting more of the same price action in the near term.

Growing weather in South American corn regions will move to center stage of the market in the coming weeks. Weather forecasters say frequent rain and improving conditions for crops will continue through the next two weeks in most growing regions of Brazil. In Argentina, timely rains are expected through the next two weeks.

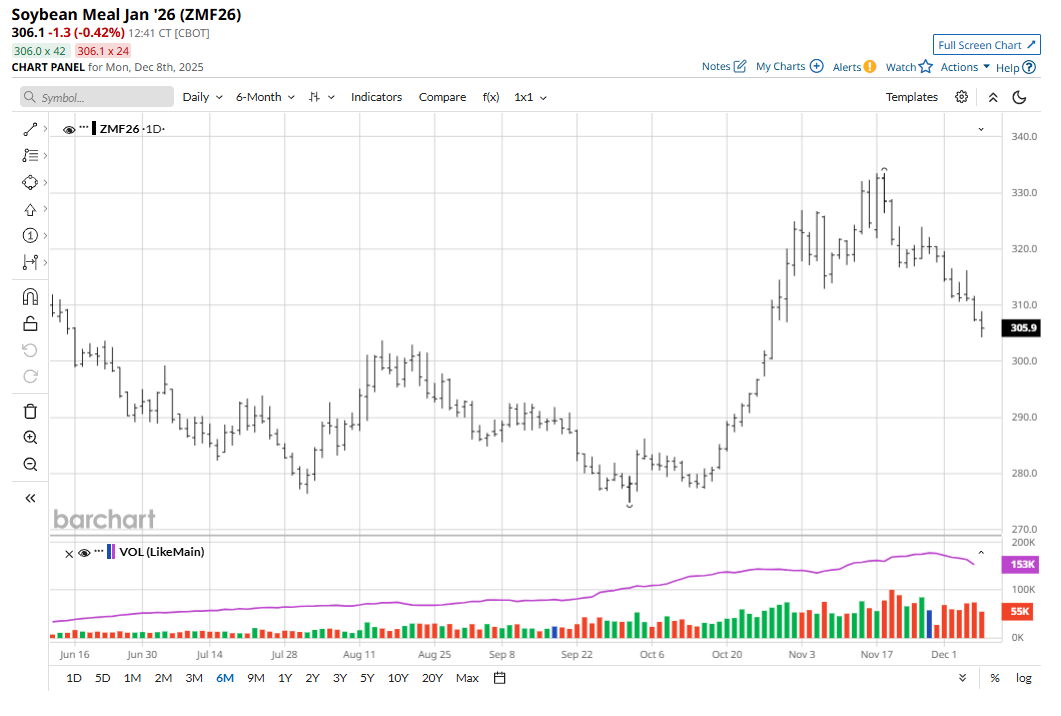

Soybean Bears Gain Momentum

January soybeans Friday hit a four-week low and for the week were down 32 1/2 cents. January soybean meal (ZMF26) Friday hit a four-week low and on the week was down $11.30. The soybean and meal futures markets bulls faded again last week, to suggest near-term market tops are in place. Technically bearish head-and-shoulder top reversal patterns on the daily bar charts have formed in both markets. Friday’s technically bearish weekly low closes in soybeans and meal set the stage for more chart-based selling pressure this week.

Focus of soybean traders is also turning to production potential in South America. Weather forecasters late last week said improving rainfall in Brazil will bolster soil moisture for better soybean crop development in the next couple of weeks. Soil moisture in Argentina is rated favorably in most soybean-growing regions.

Brazil’s soybean shipments in November jumped 64% from year-ago to 4.2 MMT. Meantime, the USDA attaché in Beijing left the forecast for China’s 2025/26 marketing year soybean imports at 106 MMT, down 1 MMT year-over-year as the government “continues efforts to limit import growth.” The attaché sees China soybean production at 19.9 MMT. In the coming months, soybean traders will continue to monitor China purchases of U.S. soybeans, to see if that nation lives up to its commitment to buy more U.S. beans made at this fall’s summit meeting between presidents Donald Trump and Xi Jinping.

Winter Wheat Markets Trapped in Price Downtrends

March soft red winter (SRW) wheat futures last week were down 2 3/4 cents on the week. March hard red winter (HRW) futures on the week were up 3 3/4 cents. The winter wheat market bulls have seen choppy and sideways price action in the past two weeks but remain trapped in price downtrends on the daily bar charts. That keeps the bears holding the near-term technical edge. Ample global supplies continue to hang over the wheat market, with Canada last week affirming its estimate of a record wheat crop.

The ongoing Russia-Ukraine peace talks have not yet yielded a ceasefire between the two warring nations. While there have been reports of some progress being made, most agree that a lasting ceasefire remains very elusive. Wheat traders will continue to monitor this situation. A ceasefire would imply more wheat supplies being shipped out of the Black Sea region in the coming months.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.