Carvana (CVNA) shares rallied nearly 12% on Monday following news that the online used car retailer will become a part of the benchmark S&P 500 Index ($SPX) on Dec. 22.

Investors cheered CVNA today also because Michael McGovern, a senior Bank of America expert, said the upcoming index inclusion positions the stock to extend its rally in 2026.

BofA’s call is significant given Carvana is already trading at more than 2.8x its price in early April.

Where Options Data Suggests Carvana Stock Is Headed

Options traders seem to share Bank of America’s optimism on Carvana stock.

According to Barchart, derivatives data currently signals a continued rally in the NYSE-listed firm to north of $550 in the first quarter of 2026.

In the near-term, through the end of next week, as well, the expected move is 7.41%, which means CVNA shares may be trading at a new all-time high of $487 by the time it joins the S&P 500.

Note that Carvana’s long-term relative strength index (100-day) sits at about 58 only, reinforcing that the broader upward momentum is far from exhaustion heading into the new year.

What Index Inclusion Means for CVNA Shares Heading into 2026

BofA’s senior analyst Michael McGovern sees CVNA stock pushing further up next year as index-tracking funds are forced to initiate or expand their positions in the e-commerce company.

Additionally, the Tempe-headquartered firm will “surpass CarMax in quarterly units sold at some point in 2026,” he told clients in a research note today.

According to him, Carvana will succeed in maintaining a compound annualized unit growth rate of about 20% through the end of this decade.

Joining the benchmark index may lower the cost of capital for CVNA as well, further strengthening the case for keeping it as a long-term holding, McGovern concluded.

How Wall Street Recommends Playing Carvana

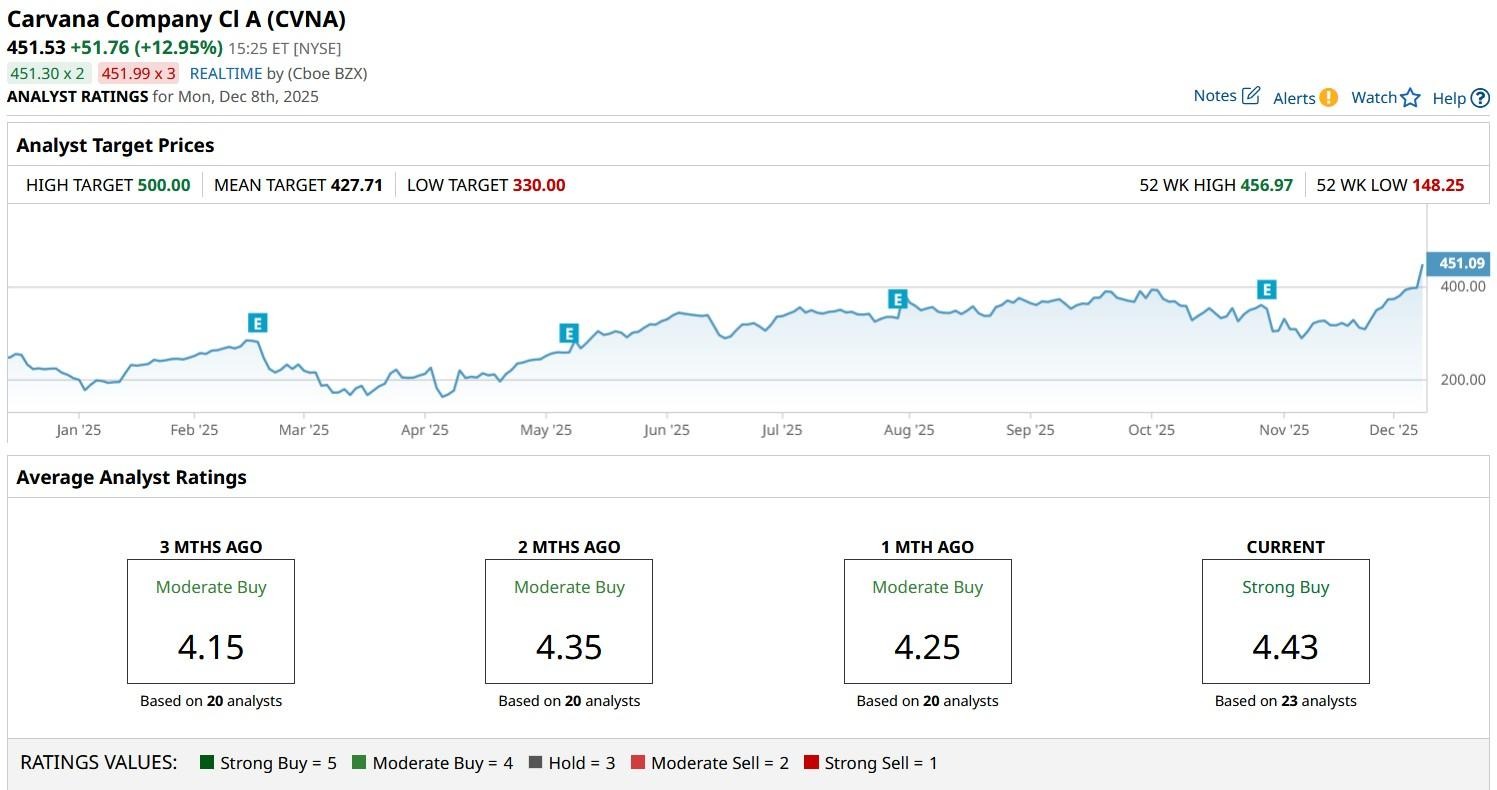

Wall Street more broadly remains bullish on Carvana shares for the next 12 months as well.

According to Barchart, the consensus rating on CVNA stock remains at “Strong Buy” with price targets going as high as $500, indicating potential upside of another 10% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A Low-Cost Model 3 Just Hit the Streets in Europe. Can That Help Turn Tesla Stock Around?

- Is It Too Late to Chase the IBM-Driven Rally in Confluent Stock?

- Here Is Where Option Traders Expect Carvana Stock to Be When It Joins the S&P 500 Index

- Should You Buy Spotify Stock Ahead of Its Big Music Video Push?