With a market cap of $36.1 billion, The Hartford Insurance Group, Inc. (HIG) is a long-established provider of insurance and financial services operating across the United States, the U.K., and internationally. The company serves both individuals and businesses through segments that include Business Insurance, Personal Insurance, Employee Benefits, Property & Casualty Other Operations, and Hartford Funds.

Companies worth more than $10 billion are generally labeled as “large-cap” stocks and Hartford fits this criterion perfectly. Its offerings range from property, casualty, and employee benefits coverage to investment management and mutual fund products.

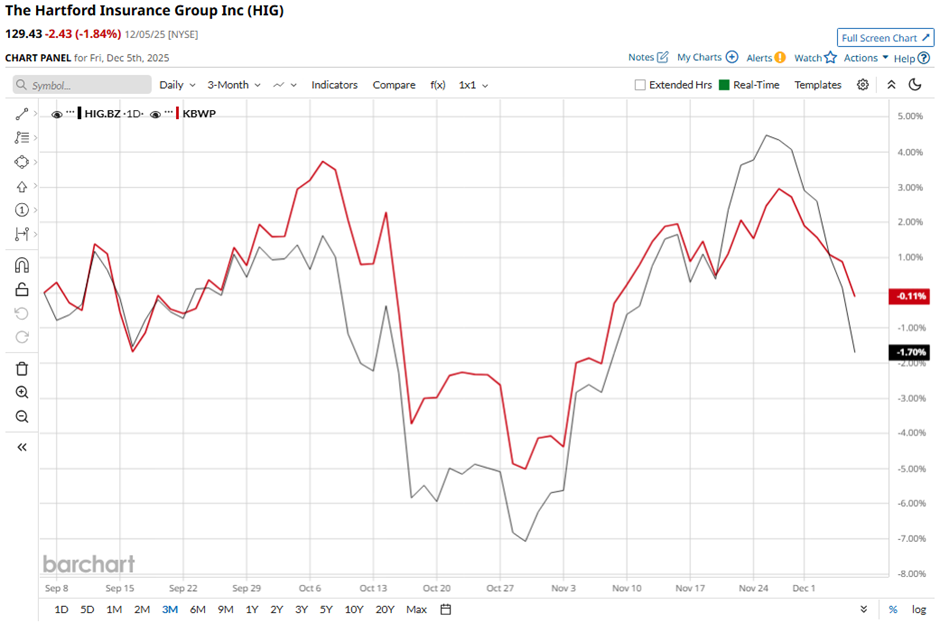

The Hartford, Connecticut-based company's stock has dipped 6.6% from its 52-week high of $138.64. Shares of Hartford Insurance have fallen 1.7% over the past three months, lagging behind the Invesco KBW Property & Casualty Insurance ETF’s (KBWP) marginal drop over the same time frame.

In the longer term, HIG stock is up 18.3% on a YTD basis, outperforming KBWP’s 4.4% gain. Moreover, shares of the property and casualty insurance firm have increased 6.8% over the past 52 weeks, compared to KBWP’s 2.9% decrease over the same time frame.

HIG stock has been trading above its 200-day moving average since last year. In addition, it has moved above its 50-day moving average since mid-February.

The Hartford reported a 41% jump in Q3 2025 profit on Oct. 27, with net income climbing to $1.07 billion ($3.77 per share) from $761 million ($2.56 per share) a year earlier. Investors also reacted positively to strong underwriting results, including a combined ratio of 88.8% in the business insurance segment, an improvement from 92.2% last year. Additionally, property and casualty written premiums grew 7%, driven by a 9% surge to $3.57 billion in business insurance premiums, aided by a quiet catastrophe season. However, the stock fell 1.8% the next day.

In comparison, rival The Allstate Corporation (ALL) has lagged behind HIG stock. Shares of Allstate have gained 4.9% on a YTD basis and declined marginally over the past 52 weeks.

While HIG stock has outperformed over the past year, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 25 analysts' coverage, and the mean price target of $143.14 is a premium of 10.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart