Humana (HUM) stock has remained sideways for the year with the company lowering its full-year earnings outlook. While Humana believes that headwinds Medicare Advantage market is likely to sustain, there are factors that can trigger growth beyond the current challenges.

One possible catalyst is Humana working with Mark Cuban on a potential pharmacy partnership. The likely objective of this partnership would be to simplify the drug supply chain.

It’s worth noting that Humana is already expanding its pharmacy business through the CenterWell division. Once further details emerge on the partnership, it’s likely that HUM stock will witness positive price-action.

About Humana Stock

Humana, headquartered in Louisville, Kentucky, is the second-largest provider of Medicare Advantage insurance. In addition to the insurance segment, the company also operates the CenterWell healthcare services, which was serving 447,100 patients as of September 2025.

For Q3 2025, Humana reported revenue of $32.6 billion, which was higher by 10.9% on a year-on-year (YoY) basis. However, the company revised its FY 2025 GAAP EPS guidance to $12.26 from previous estimates of $13.77.

Even with the near-term disappointment, most of the stock's yearly losses having occurred in the last three months, HUM stock has still trended higher by 12.5% in the last six months. The reasons for the gradual uptrend include attractive valuations and a positive long-term outlook for care growth.

CenterWell Can Create Significant Value

For Q3 2025, CenterWell contributed to 18.9% of the company’s total revenue. However, the segment has immense potential and can support margin expansion.

To put things into perspective, CenterWell’s business includes Primary Care, Pharmacy, and Home Solutions. For the first two segments, Humana is targeting high single-digit margins.

Further, Humana believes that the market opportunity is worth $1.6 trillion across the three business lines. This implies ample headroom for growth over the next few years.

It’s worth noting that the company has acquired more than 100 primary care centers in 2023 and 2024. Inorganic growth will continue to boost the company’s top-line. Also, the potential partnership with Mark Cuban can serve as a growth catalyst for the Pharmacy segment.

Significant Margin Expansion Likely

While CenterWell has the potential to support margin expansion, Humana is also looking to boost margins in its core business. The company has guided for improvement in Medicaid pre-tax margin by 200 to 300 basis points by 2028.

Similarly, the group Medicare Advantage margin is expected to swell by 500 to 700 basis points by 2028. Enterprise level operating leverage is therefore likely to be a key earnings growth driver in the next few years.

This will translate into higher cash flows and improvement in credit metrics. Currently, Humana offers a dividend yield of 1.37%. Considering the earnings growth expectation, it’s likely that dividends will increase in the coming years. At the same time, higher cash flows will support the company’s objective of growing inorganically.

Besides these factors, it’s expected that the Medicare-eligible population enrolled in Medicare Advantage will increase by 6% between 2024 and 2030. Growth in addressable market is another factor that’s likely to drive operating leverage.

What Analysts Say About HUM Stock

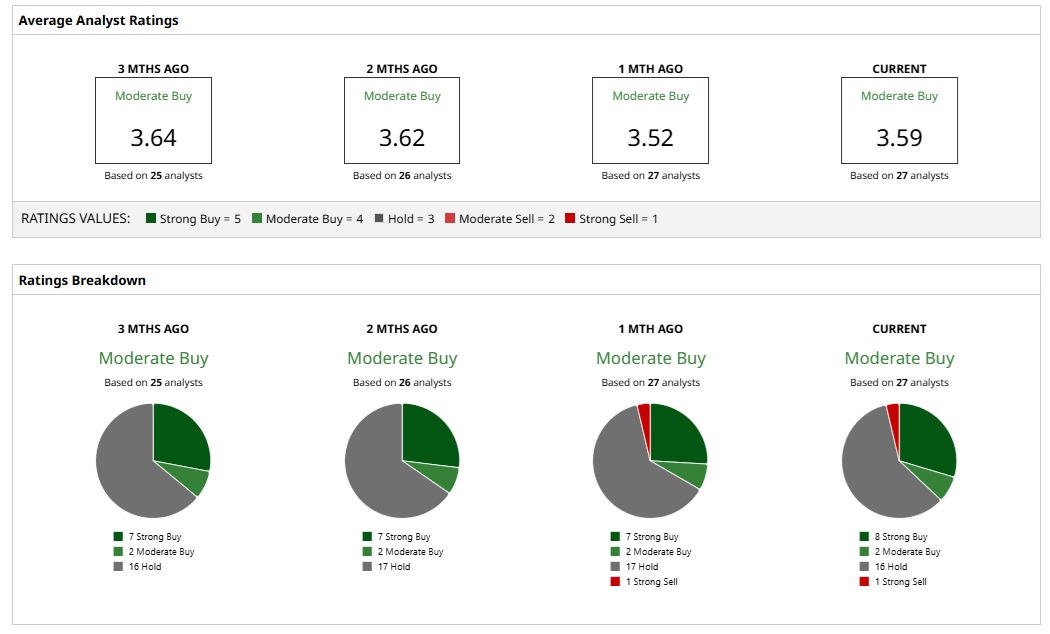

Based on the rating of 27 analysts, HUM stock is a consensus “Moderate Buy.”

While eight analysts have assigned a “Strong Buy” rating, two and 16 analysts have a “Moderate Buy” and “Hold” rating, respectively. Only one gives HUM stock a “Strong Sell.”

Based on these ratings, the analysts have a mean price target of $283.61. This would imply an upside potential of 10%. Further, considering the most bullish price target of $341, the upside potential is 32.2%.

Recently, Jefferies upgraded Humana to “Buy” with the diversification strategy for its Medicare Advantage offering being the key upgrade catalyst. Jefferies believes that Humana is likely to deliver earnings per share of $14.19 and $24.10 for 2026 and 2027 respectively. Given the robust earnings growth estimate, a forward price-earnings ratio of 14.8 looks attractive.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart