With a market cap of $43.8 billion, Delta Air Lines, Inc. (DAL) is one of the largest U.S. airlines, providing passenger and cargo air transportation across a broad global network spanning hundreds of destinations on six continents. Headquartered in Atlanta, Georgia, Delta operates multiple hubs and employs roughly 100,000 people.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Delta Air Lines fits this criterion perfectly. In addition to commercial flights, the company offers cargo services, aircraft maintenance and engineering, and a major loyalty program, making it a significant player in international aviation and logistics.

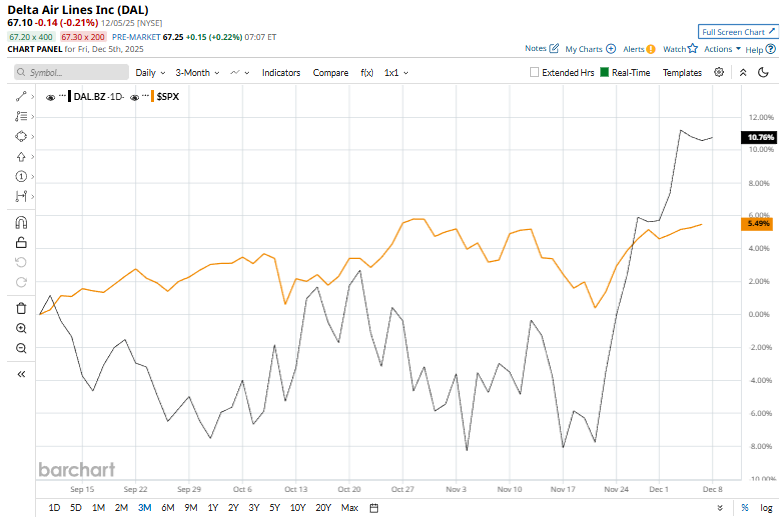

Shares of the airline company have decreased 4.1% from its 52-week high of $69.98. Delta Air Lines’ shares have increased 9.7% over the past three months, outperforming the S&P 500 Index ($SPX) 6% surge over the same time frame.

In the longer term, DAL stock is up 10.9% on a YTD basis, compared to $SPX’s 16.8% return. Moreover, shares of the airline have soared 2% over the past 52 weeks, lagging behind the index’s 13.1% return over the same time frame.

Yet, the stock has been trading above its 50-day moving average recently. Also, it has remained above its 200-day moving average since early August.

On Oct. 9, DAL shares rose over 4% after reporting its Q3 results. Its revenue of $16.7 billion beat the consensus estimates by 3.8%. The company’s EPS was $2.17, surpassing the consensus estimates by 39.8%. Strong demand, particularly in premium and corporate travel, along with effective cost management, helped drive profitability.

Its key rival, United Airlines Holdings, Inc.’s (UAL) shares have surged 8.1% on a YTD basis and nearly 2.5% over the past 52 weeks, following a similar trend as DAL.

Despite the stock’s underperformance over the past year, analysts remain highly optimistic about its prospects. DAL stock has a consensus rating of “Strong Buy” from 20 analysts in coverage, and the mean price target of $73.64 is a premium of nearly 9.7% to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart