Confluent (CFLT) shares closed nearly 30% higher on Monday morning after International Business Machines (IBM) said it’s buying the California-based data streaming platform for $11 billion in cash.

IBM’s proposal values each CFLT share at a huge premium of $31. According to its press release, “Confluent has the most capable technology to unlock the real-time value of data.”

Despite the aforementioned surge, Confluent stock remains down over 20% versus its year-to-date high set in early February.

Why Is IBM Buying Confluent?

IBM is spending billions on acquiring Confluent as it will enable the giant to tap on real-time data streaming and processing to feed and scale its current and future AI models/agents.

Speaking with CNBC, its chief executive Arvind Krishna said “this ability to have one layer, one control plane, I think, is going to unlock a lot.”

Wedbush Securities senior analyst Dan Ives also dubbed the transaction a “strong move” aimed at accelerating the giant’s artificial intelligence strategy.

In a research note today, he maintained IBM shares at “overweight” with a price objective of $325, indicating potential upside of another 5% from here.

Is There Any Upside Left in CFLT Stock?

While the IBM development is positive for Confluent, it’s difficult to justify initiating a new position in it at current levels.

Why? Because the market has priced in nearly the entire deal premium already, leaving little to no further upside in CFLT shares for new investors.

More importantly, Confluent will go private once the aforementioned transaction closes in the first half of 2026. So, it’s highly unlikely that CFLT stock will trade at north of $31 unless a competing bidder unexpectedly enters the fray.

Simply put, the window for outsized returns in this real-time data streaming company has already closed.

IBM Didn’t Undervalue Confluent Shares

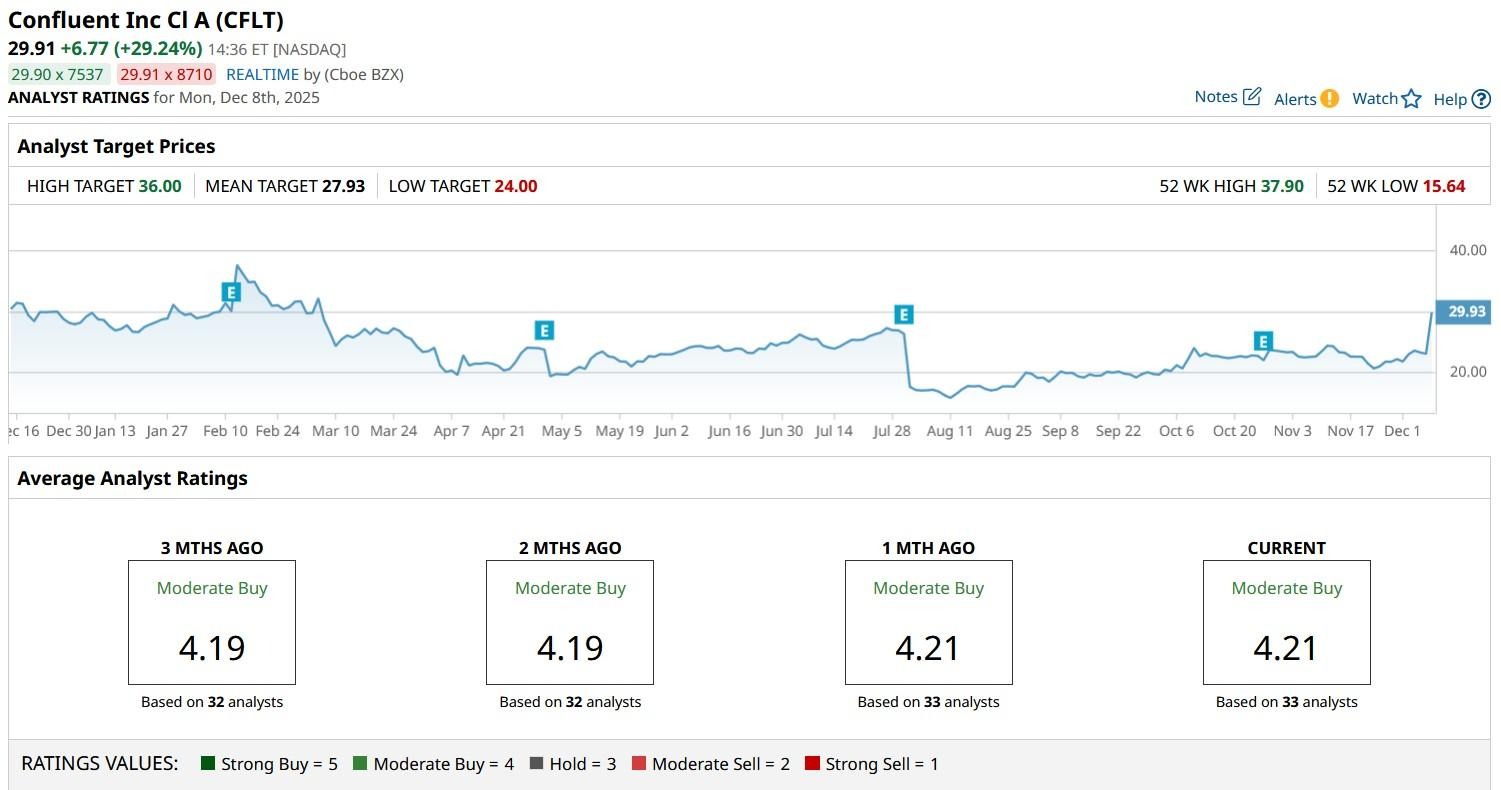

While the consensus rating on Confluent shares is somewhat irrelevant now, it’s worth mentioning that the mean target on them heading into Monday was nearly $28.

This means CFLT stock wasn’t broadly expected to trade above its current price anyways.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A Low-Cost Model 3 Just Hit the Streets in Europe. Can That Help Turn Tesla Stock Around?

- Is It Too Late to Chase the IBM-Driven Rally in Confluent Stock?

- Here Is Where Option Traders Expect Carvana Stock to Be When It Joins the S&P 500 Index

- Should You Buy Spotify Stock Ahead of Its Big Music Video Push?