Carvana (CVNA) clearly has to be one of the most incredible comeback stories of all time in the stock market. Over the span of the past five years, CVNA stock went from an adjusted post-split price of about $400 per share in 2021 to nearly zero in 2023 and has since rebounded to the $450 level at the time of writing.

This move means the company went from a pandemic-era all-time high to penny stock delisting territory before rocketing to another all-time high in the span of about four years. I haven't found another case study like this, and Carvana is certainly among the most intriguing stories in the market for this reason. That's my view anyway.

That said, another piece of incredible news appears to be driving this stock of late. Starting Dec. 22, Carvana will be listed in the S&P 500 ($SPX). It currently sports a market capitalization exceeding that of other large American automakers, as investors jump aboard a company some are calling the biggest meme stock ever.

I'm not sure what to make of this move entirely, so let's dive into what the fundamentals suggest.

Show Me the Money

Carvana's business model is relatively simple. The company operates a large online used car dealership, which rose to prominence thanks to the pandemic and the shuttering of in-person operations across the country. Carvana's signature car vending machines revolutionized how car buying is done. So, if you're the type of buyer that knows exactly the make and model you want, picking it up at the local vending machine after gaining the necessary financing for the vehicle in a seamless fashion, this seems like a good deal.

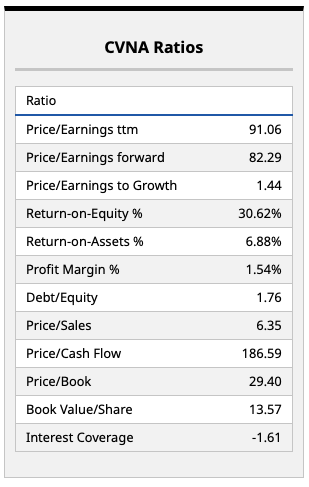

In recent quarters, Carvana has seen a solid pickup in both its revenue and earnings, now providing investors with a positive multiple on both fronts. Valued at more than 6 times sales and more than 80 times forward earnings, Carvana is far from a cheap auto stock. Indeed, forward earnings multiples for most American carmakers have been in the high-single-digit to low-double-digit range for decades. That's because this is typically a low-margin business with plenty of recession risk.

Carvana's profit margin of just 1.5% indicates just what I'm talking about here. That said, the company's more than 30% return on equity is a solid metric and clearly shows that the company's management team is doing good things with the money investors are providing.

From here, it will be interesting to see if Carvana can continue to vertically integrate and capture more value across the entire car-buying value chain. I'd suggest Carvana has done a good job so far of achieving impressive results on these fronts.

With a loyal following (of both consumers and investors), this is a stock that probably should be included in the S&P 500 right now. Let's see whether Main Street and Wall Street diverge in their thinking on this, though.

What Do Wall Street Analysts Think?

I always think it's important to gauge sentiment not only among meme stock traders and those on retail investing forums, but also what the big money investors are doing and what Wall Street analysts are saying. After all, these are the folks with the fancy models who spend hours analyzing these companies and picking apart every headwind, tailwind, competitive advantage, or market threat.

In the case of Carvana, analysts have clearly shifted toward taking a more bullish tone on the stock, though Carvana's impressive move today has led to this stock trading above its consensus price target.

Indeed, it's impossible for any of us (even those who seemingly have the crystal balls on Wall Street) to predict how violent near-term price swings can be in a stock like Carvana. With so many traders speculating on continued rises for CVNA stock using options, there's likely going to be more fireworks on the horizon.

In my view, there's likely to be more fireworks ahead than I'm comfortable with, so I'm going to stick on the sidelines with this name. But there's a reason this stock is being included in the S&P 500, and Carvana will certainly be one of the most exciting stocks to watch moving forward. I've got my popcorn out.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 8% in December, Investors Should Wait Until Late January to Buy Harley-Davidson

- Protect Your Babies and Your Portfolios with This ‘Strong Buy’ Stock

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?