With a market cap of $25.1 billion, American Water Works Company, Inc. (AWK) is a major U.S. provider of water and wastewater services, serving roughly 3.5 million customers across 14 states. Through its extensive infrastructure, spanning treatment plants, wells, pumping stations, storage facilities, and thousands of miles of mains, it supports residential, commercial, industrial, and public sector clients.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and American Water Works fits this criterion perfectly. Headquartered in Camden, New Jersey, the company also operates on military installations and manages municipal water and wastewater systems.

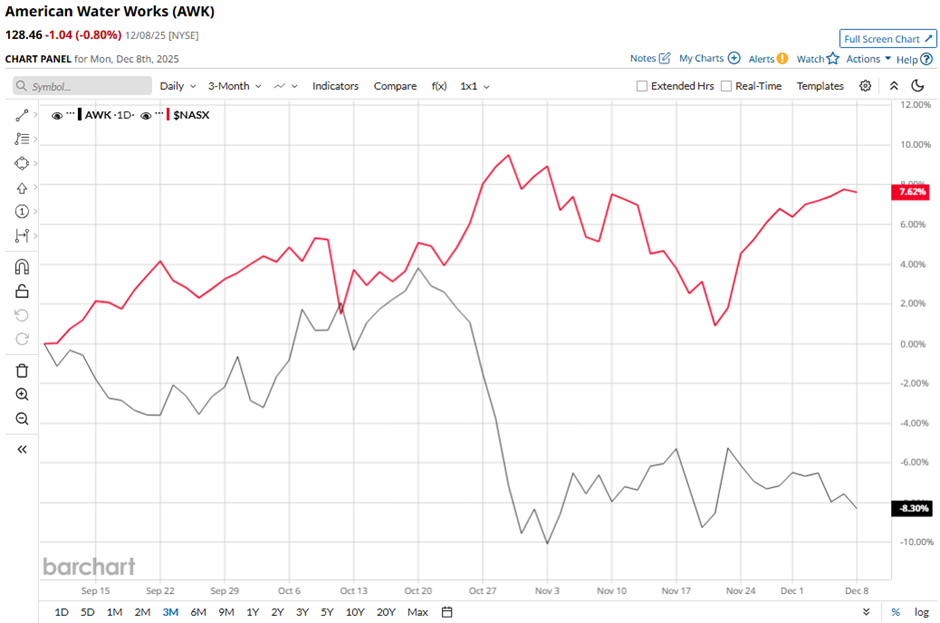

Shares of the water utility company have declined 17.4% from its 52-week high of $155.50. Over the past three months, its shares have dipped 8.3%, underperforming the broader Nasdaq Composite’s ($NASX) over 8% gain during the same period.

Longer term, AWK stock is up 3.2% on a YTD basis, lagging behind NASX's 21.9% return. In addition, shares of American Water Works have dropped nearly 3% over the past 52 weeks, compared to the NASX’s 18.6% increase over the same time frame.

AWK has shown a bearish trend, trading below its 50-day and 200-day moving averages since late October.

Despite reporting better-than-expected Q3 2025 EPS of $1.94 and revenue of $1.45 billion on Oct. 29, shares of AWK fell 2.6% the next day. Investors were also concerned about rising costs and leverage, with operating expenses up 7.3% to $837 million and long-term debt increasing 4% to $13.02 billion.

AWK stock has slightly outpaced its rival, Essential Utilities, Inc. (WTRG). WTRG stock has gained 3.1% YTD and declined 3.8% over the past 52 weeks.

Due to AWK’s weak performance, analysts are cautious about its prospects. The stock has a consensus rating of “Hold” from the 14 analysts covering the stock, and the mean price target of $143.91 indicates a 12% premium to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.

- Semiconductor Billings Are Surging. That Creates a Buying Opportunity in This 1 Chip Stock.

- Short vs. Long-Term Covered Calls on WFC: Which Works Better?

- S&P Futures Muted Ahead of FOMC Meeting and U.S. JOLTs Report