Datadog, Inc. (DDOG) is a New York-based cloud software company that provides a unified observability and security platform. Valued at $53.1 billion by market cap, its services monitor and analyze infrastructure (servers, databases, cloud services), applications, logs, network, and more, giving real-time visibility and analytics across a company’s entire technology stack.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DDOG perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the software - application industry. Founded in 2010, Datadog enables DevOps and IT teams to ensure system reliability, optimize performance, and troubleshoot issues across complex cloud or hybrid environments. Its platform is widely used by organizations adopting cloud computing and microservices, making Datadog a key player in the modern enterprise software and monitoring space.

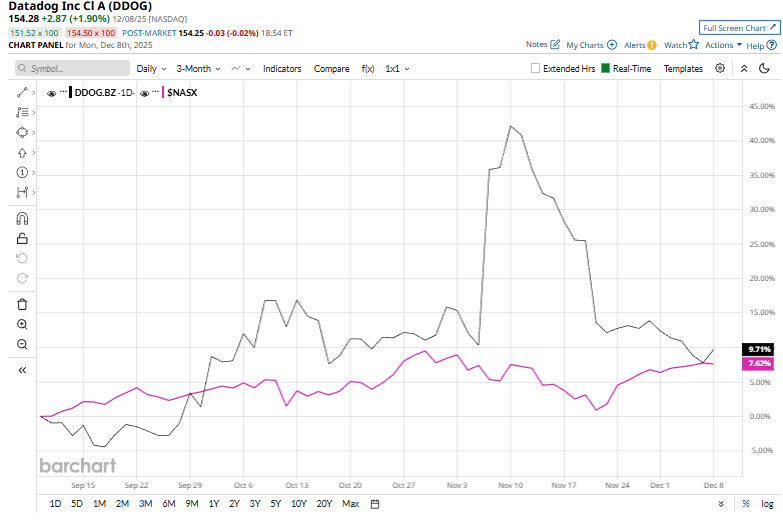

Despite its notable strength, DDOG slipped 23.5% from its 52-week high of $201.69, achieved on Nov. 11. Over the past three months, DDOG stock has gained 13.1%, surpassing the Nasdaq Composite’s ($NASX) 8% rise during the same time frame.

In the longer term, shares of DDOG surged 8% on a YTD basis, underperforming NASX’s YTD gains of 21.9%. Moreover, DDOG shares declined 8.5% over the past 52 weeks, falling behind NASX’s solid 18.6% returns over the last year.

While DDOG has been trading above its 200-day moving average since mid-June, it dipped below its 50-day moving average recently.

On Nov. 20, Datadog shares dropped 8.5% as markets reversed course after the announcement of a stronger-than-expected jobs report reduced expectations for near-term rate cuts, triggering a sell-off in high-growth tech stocks.

In the competitive arena of the software industry, Dynatrace, Inc. (DT) has lagged behind DDOG, with a 17.6% downtick on a YTD basis and a 23.2% dip over the past 52 weeks.

Wall Street analysts are bullish on DDOG’s prospects. The stock has a consensus “Strong Buy” rating from the 42 analysts covering it, and the mean price target of $216.62 suggests a potential upside of 40.4% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart