With a market cap of $32.3 billion, Saint Petersburg, Florida-based Raymond James Financial, Inc. (RJF) is a diversified financial services firm offering private client, capital markets, asset management, banking, and other specialized services across the U.S., Canada, and Europe. The company supports individuals, corporations, and municipalities with a wide range of financial solutions.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Raymond James Financial fits this criterion perfectly. Its operations span investment advisory, wealth management, investment banking, asset management, and lending products.

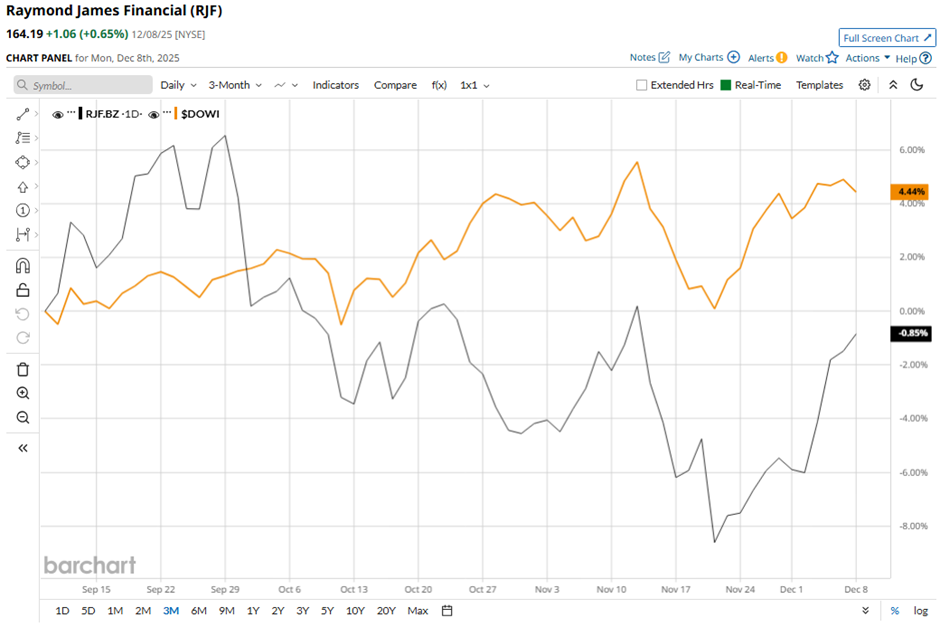

RJF stock has fallen 7.6% from its 52-week high of $177.66. Shares of the firm have declined marginally over the past three months, lagging behind the broader Dow Jones Industrials Average's ($DOWI) 4.9% return over the same time frame.

In the longer term, RJF stock is up 5.7% on a YTD basis, underperforming DOWI’s 12.2% gain. Moreover, shares of RJF have risen marginally over the past 52 weeks, compared to DOWI’s 6.9% increase over the same time frame.

RJF stock has been trading above its 50-day and 200-day moving averages since May. However, it has fallen below its 50-day moving average since October.

Raymond James Financial reported stronger Q4 2025 results on Oct. 22, including capital markets net revenues increasing to $513 million from $483 million and adjusted net income rising to $635 million ($3.11 per share) from $621 million ($2.95). Investor sentiment was further boosted by a rebound in global dealmaking and management’s optimistic outlook for fiscal 2026, supported by record client assets and a strong investment banking pipeline. Nevertheless, the stock fell marginally the next day.

In comparison, RJF stock has outpaced its rival, Blackstone Inc. (BX). BX stock has decreased 19.1% over the past 52 weeks and 12.2% on a YTD basis.

Despite RJF’s underperformance relative to the Dow, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 15 analysts covering it, and the mean price target of $184.38 indicates a 12.3% premium to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.

- Semiconductor Billings Are Surging. That Creates a Buying Opportunity in This 1 Chip Stock.

- Short vs. Long-Term Covered Calls on WFC: Which Works Better?

- S&P Futures Muted Ahead of FOMC Meeting and U.S. JOLTs Report