London-U.K.-based Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking, and solutions company. Its solutions include risk management, benefits optimization, and capability expansion. Valued at $30.7 billion by market cap, WTW operates through Risk & Broking and Health, Wealth & Career segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." WTW fits the bill perfectly, showcasing its substantial size and influence in the insurance and risk management space.

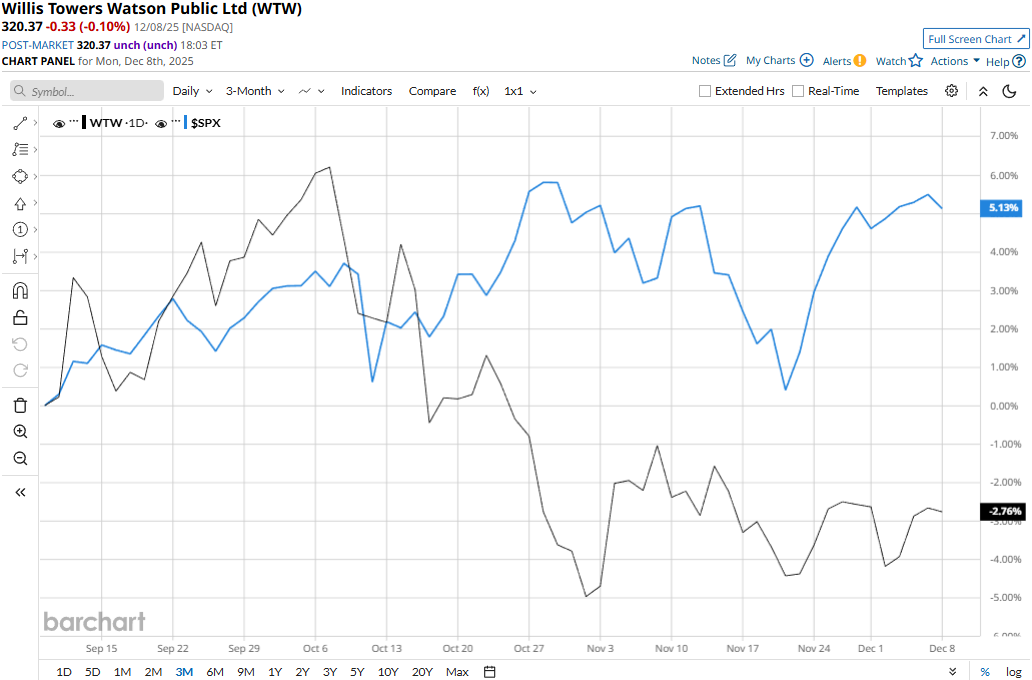

WTW stock has dropped 9.2% from its all-time high of $352.79 touched on Oct. 7. Meanwhile, the stock has declined 3.6% over the past three months, lagging behind the S&P 500 Index’s ($SPX) 5.4% uptick during the same time frame.

Willis Towers Watson has underperformed the S&P 500 over the longer term as well. WTW stock has gained 2.3% on a YTD basis and dipped 68 bps over the past 52 weeks, compared to SPX’s 16.4% surge in 2025 and 12.4% gains over the past year.

WTW stock has dropped below its 50-day moving average since mid-October and traded mostly below its 200-day moving average since late October, underscoring its downtrend.

Willis Towers Watson’s stock prices remained mostly flat in the trading session following the release of its Q3 results on Oct. 30. The company’s organic revenues grew by 5%, but due to the sale of TRANZACT, its overall topline remained flat at $2.3 billion, exceeding the Street’s expectations by 53 bps. Meanwhile, the company observed a solid improvement in margins, leading to an impressive 10.8% year-over-year growth in adjusted EPS to $3.07, beating the consensus estimates by 2.3%.

Meanwhile, WTW has outperformed its peer Arthur J. Gallagher & Co.’s (AJG) 16.2% decline on a YTD basis and 19.8% plunge over the past 52 weeks.

Among the 23 analysts covering the WTW stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $366.68 suggests a 14.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- These 2 High-Yield Dividend Stocks Are Some of the Safest Buys Right Now

- A Low-Cost Model 3 Just Hit the Streets in Europe. Can That Help Turn Tesla Stock Around?

- Is It Too Late to Chase the IBM-Driven Rally in Confluent Stock?

- Here Is Where Option Traders Expect Carvana Stock to Be When It Joins the S&P 500 Index