Valued at a market cap of $30.1 billion, Buffalo, New York-based M&T Bank Corporation (MTB) is a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association. Operating through its Commercial Bank, Retail Bank, and Institutional Services and Wealth Management segments, the company provides a comprehensive suite of financial products and services.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and M&T Bank fits this criterion perfectly. M&T Bank offers commercial lending, consumer banking, wealth management, and trustee and investment services to individuals, businesses, and institutional clients nationwide.

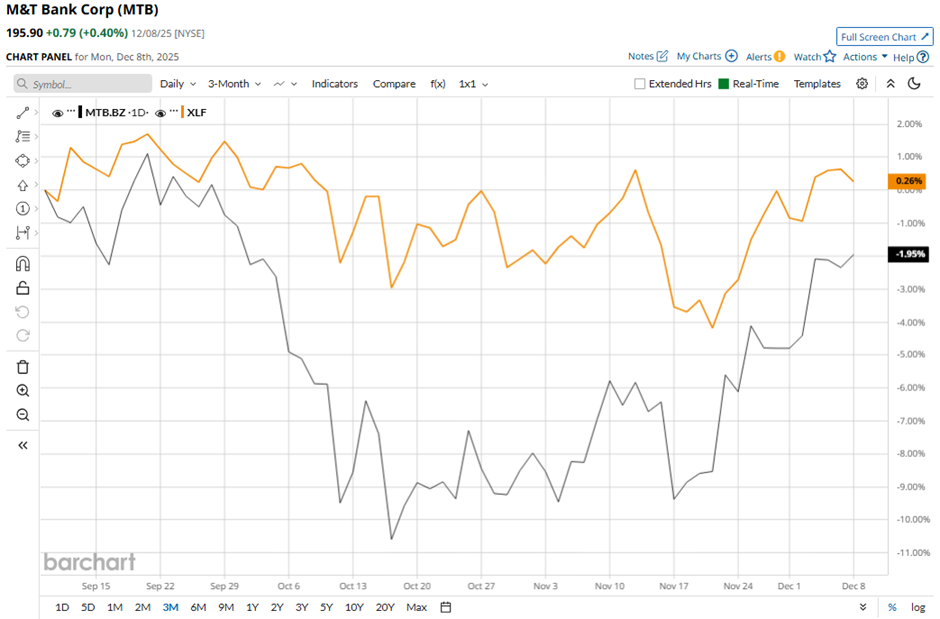

MTB stock has dipped 7.3% from its 52-week high of $211.23. Shares of the company have decreased 1.7% over the past three months, lagging behind the Financial Select Sector SPDR Fund’s (XLF) marginal rise during the same period.

In the longer term, shares of M&T Bank have risen 4.2% on a YTD basis, underperforming XLF's 10.7% surge. Over the past 52 weeks, MTB stock has declined 7.3%, compared to XLF’s 6.1% return over the same period.

Yet, MTB stock has moved above its 50-day and 200-day moving averages since late November.

Despite reporting strong Q3 2025 net income of $792 million ($4.82 per share), M&T Bank’s shares fell 3.5% on Oct. 16 due to higher net charge-offs of $146 million compared with $108 million in Q2, signaling rising credit risk. Additionally, non-interest expenses increased due to $20 million in severance-related costs and an impairment of a renewable energy tax credit investment.

In comparison, rival Citizens Financial Group, Inc. (CFG) has outperformed MTB stock. CFG stock has gained 27.4% on a YTD basis and 18.6% over the past 52 weeks.

Despite MTB's underperformance over the past year, analysts are moderately optimistic about the stock's prospects. The stock has a consensus rating of “Moderate Buy” from the 23 analysts covering it, and the mean price target of $220.70 indicates a 12.7% premium to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Even If There Is an AI Bubble, Wall Street Says You Should Keep Buying This Magnificent 7 Stock

- Nvidia Just Gave Its CUDA Platform a Major Revamp. Will That Move the Needle for NVDA Stock?

- Dear Carvana Stock Fans, Mark Your Calendars for December 22

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.