Despite a bumpy start to the year, with shares still down nearly 20% year-to-date and trailing the S&P 500 Index’s ($SPX) 16.4% gain, Marvell (MRVL) has staged an impressive rebound. Over the past three months, the stock has surged 33%, driven by the strong performance of its data center busniness.

The catalyst behind this sharp turnaround was Marvell’s latest earnings release. The company reported strong momentum in its data center segment. Management has also delivered an upbeat outlook, signaling that data center strength isn’t a short-term blip. With new product cycles kicking in and AI-driven spending expected to ramp further over the next several years, Marvell is well-positioned to deliver strong growth.

Marvell designs specialized semiconductors that enable cloud computing, networking, and custom AI systems used by tech giants. As the world races to build out AI data centers, Marvell expects this market to become an increasingly powerful engine of long-term revenue.

While the broader semiconductor sector remains highly competitive, Marvell’s position in the infrastructure side of the AI boom gives it a compelling growth runway.

Data Center Business to Accelerate MRVL’s Growth

Marvell Technology is in a solid growth phase led by booming demand for data center and AI infrastructure. The company’s data center business surged 38% year-over-year in the third quarter, and the momentum is likely to stay strong in the years ahead. With customers racing to expand AI computing capacity, Marvell will benefit from being a core technology supplier in the build-out of next-generation cloud infrastructure.

The company’s long-term partnerships and strong bookings provide a solid base for significant growth in fiscal 2027 and accelerate even further in fiscal 2028.

While the company benefits from a rapidly expanding AI market, it also has internal catalysts driving its trajectory. Upcoming product launches, strong market tailwinds, and deeper customer integration are expected to drive massive growth over the next few years. While Marvell already projected more than 25% data center revenue growth for fiscal 2027, it now sees an even stronger outlook for fiscal 2028.

A key growth engine is Marvell’s interconnect business, which currently accounts for about half of its data center revenue. Management expects this segment to deliver solid growth. Meanwhile, its custom silicon business, roughly a quarter of the data center total, is forecasted to grow at least 20% next year, with performance skewed toward the second half of the fiscal year as next-generation chips ramp.

One major transition ahead is the shift to a next-generation XPU program for a large customer, with purchase orders already secured to cover Marvell’s current expectations for the full fiscal year. Beyond that, the company has multiple high-volume custom chip projects in development, expected to deliver meaningful revenue starting in fiscal 2028.

Importantly, current projections do not yet include any contribution from Celestial AI, the cutting-edge interconnect company that Marvell recently announced to acquire. The deal is expected to close in the first quarter of fiscal 2026 and could accelerate its growth by capturing the massive scale-up of optical and AI data movement within cloud infrastructure.

Overall, management expects data center revenue to remain strong in fiscal 2027, followed by an even sharper rise in fiscal 2028. In short, Marvell appears well-positioned for a sustained period of exceptional growth powered by AI, next-generation connectivity, and deepening strategic relationships with the largest cloud providers.

Is MRVL Stock a Buy, Sell, or Hold?

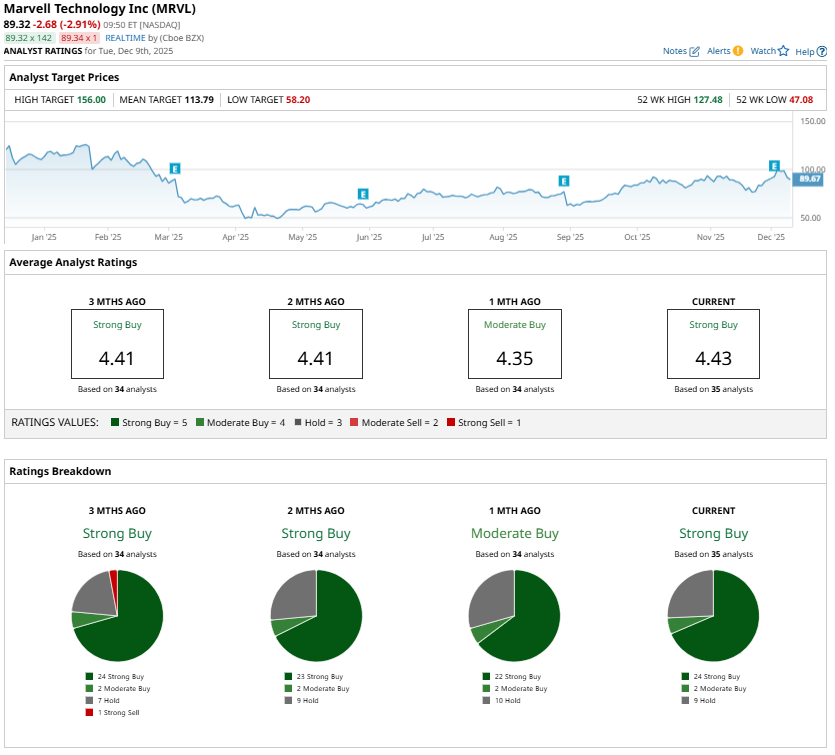

Marvell Technology remains a favorite on Wall Street, with analysts maintaining a “Strong Buy” consensus rating. The chipmaker is well-positioned for significant growth led by the data center end market.

That said, Marvell stock isn’t cheap. Marvell currently trades at roughly 45 times its expected future earnings, which is high relative to the earnings growth forecast. But given its strong data-center momentum and promising growth outlook over the next few years, its premium valuation is warranted, making it an attractive semiconductor stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Morgan Stanley Is Sweetening on MP Materials Stock Following ‘Historic Deal.’ Should You Buy MP Here?

- This Semiconductor Giant Is in Talks With Microsoft for Custom Chips. Should You Buy Its Stock Now?

- Is MicroStrategy Stock a Buy Now Amid the Bitcoin Rally?

- Apple Stock Marks a Solid Comeback. Is AAPL a Buy, Sell, or Hold for 2026?