Income investors tend to gravitate towards covered calls, and blue-chip high yielding stocks are a great place to start.

Wells Fargo (WFC) has been a strong performer in 2025 and is up 28.22% so far this year.

WFC also pays a reasonable dividend with the current dividend yield sitting at 1.89%.

Using options, we can generate an additional income from high yielding stocks via a covered call strategy.

WFC Covered Call Examples

Let’s look at two different covered call examples on WFC stock. The first will use a monthly expiration and the second will use a seven-month expiration.

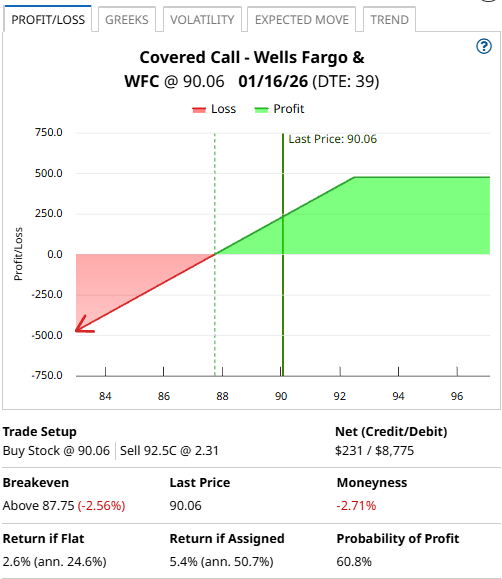

Let’s evaluate the first WFC covered call example. Buying 100 shares of WFC would cost around $9,006. The January 16, 92.50 strike call option was trading yesterday for around $2.31, generating $231 in premium per contract for covered call sellers.

Selling the call option generates an income of 2.6% in 39 days, equalling around 24.6% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of $92.50?

If WFC closes above $92.50 on the expiration date, the shares will be called away at $92.50, leaving the trader with a total return 5.4%, which is 50.7% on an annualized basis.

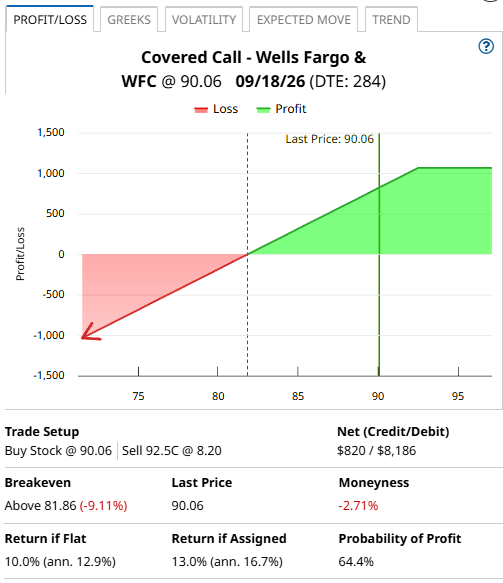

Instead of the January 92.50-strike, let’s look at selling the September 18, 2026 $92.50-strike call instead. Selling the September 2026 call option for $8.20 generates an income of 10.0% in 284 days, equalling around 12.9% annualized.

If WFC closes above $92.50 on the expiration date, the shares will be called away at $92.50, leaving the trader with a total return of 13.0%, which is 16.7% on an annualized basis.

These figures don’t include any potential dividends received during the course of the trades.

Of course, the risk with the trade is that the WFC might drop, which could wipe out any gains made from selling the call.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Implied volatility is at 24.07% compared to a 12-month low of 20.49% and a 12-month high of 61.76%.

Company Description

Wells Fargo & Company is one of the largest financial services companies in the U.S. The company provides banking, insurance, trust and investments, mortgage banking, investment banking, retail banking, brokerage services and consumer and commercial finance through more than 4,700 retail bank branches, broad automated telling machines (ATMs) network, the Internet and other distribution channels globally.

It has 4 segments. Consumer Banking and Lending offers products and services like checking and savings accounts, credit and debit cards, as well as home, auto, personal and small business lending to consumers and small businesses.

Commercial Banking provides banking and credit products across industries, and treasury management.

Corporate and Investment Banking delivers services related to capital markets, banking and financial products.

Wealth and Investment Management provides personalized wealth management, brokerage, financial planning, lending, private banking, trust and fiduciary products and services.

Of the 26 analysts following WFC stock, 13 have a Strong Buy rating, 4 have a Moderate Buy rating and 9 have a Hold rating.

Covered calls can be a great way to generate some extra income from your core portfolio holdings.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- After a Red-Hot Rally on S&P 500 Inclusion, Carvana Stock Needs a ‘Cool’ Option Collar. How to Trade CVNA Here.

- Short vs. Long-Term Covered Calls on WFC: Which Works Better?

- A Major Shift in Adobe’s (ADBE) Risk Geometry Points to Fresh Upside

- Snowflake Stock is Down But Its FCF Margin Guidance Could Lead to a 22% Higher Price Target