As Peter Lynch once said, insiders might sell their shares for many reasons… but there is typically only one reason an insider buys:

➡️ They believe the stock is undervalued.

And the bigger the insider buy, the higher the conviction.

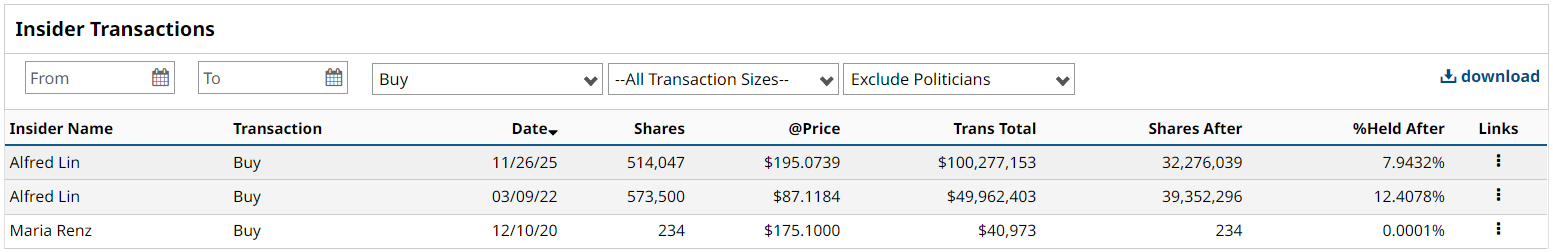

That’s exactly how DoorDash (DASH) stock ended up making its debut in the latest Market on Close livestream, when insider Alfred Lin – a longtime director at DASH who’s also a former Zappos exec and a current partner at Sequoia Capital – made a whale-sized purchase.

Senior Market Strategist John Rowland, CMT, and co-host Twitter Tom highlighted that this is one of the biggest insider buys we’ve seen all year, totaling over $100 million in DASH shares.

This isn’t a token gesture. It’s a nine-figure bet made with personal capital, and it has traders asking whether DoorDash is becoming a quiet breakout opportunity.

Let’s break down the technicals, the insider signal, and what to watch next.

Why This Insider Buy Is a Big Deal

As Tom notes on the show, insider sales often make headlines, but insider buys of this magnitude are extremely rare.

Here’s what makes this purchase stand out:

- Size: Over $100M worth of stock

- Timing: After a long period of underperformance

- Skin in the game: Buying stock outright signals conviction

John summed it up perfectly:

“If someone puts $100 million of their own money into a stock… you have to at least start looking at it.”

He also notes the stock’s positive returns since Lin’s previous purchase of about $50 million in DASH stock – made back in March 2022, when the shares were around $87 each.

DoorDash is Quietly Outperforming the S&P 500

While mega-cap tech grabs all the attention, DASH has started to outperform the S&P 500 ($SPX) on a relative strength basis.

John pointed out two technical signals that can’t be ignored:

1. DASH just recaptured its 200-day moving average.

The last time that happened, the stock launched into a strong trend.

2. The stock is now trading inside a technical gap.

Gap fills often act like magnets, and DASH’s 50-day moving average sits right inside that zone.

This creates a clear bullish roadmap:

- Hold above the 200-day

- Push into the gap

- Target the 50-day moving average

- Look for a breakout continuation toward $230 (ATR-based signal)

Why the Bull Case for DASH Goes Beyond Technicals

Beyond the charts and insider buying, here are the strategic drivers that DASH bulls are watching:

- Expansion into grocery: A Kroger (KR) grocery partnership unlocks high-frequency, repeat-use customers — the most valuable type for delivery platforms.

- DoorDash’s growing advertising business: High-margin, recurring, and increasingly central to the company’s profitability story.

- Industry consolidation: DASH continues to expand into new geographies and categories faster than competitors.

- Logistics dominance: DoorDash is proving it’s more than a food delivery app; it’s becoming a last-mile ecosystem.

Insiders don’t put $100 million into a company unless they believe the underlying growth engines are about to accelerate.

Bottom Line

A $100 million insider buy is not noise; it’s a signal worth tracking.

Whether you prefer to combine this type of indicator with technicals or fundamentals, insider conviction of this magnitude deserves attention — especially when paired with improving chart structure and market outperformance.

DoorDash may be moving from “ignored delivery stock” to “emerging momentum play”… and smart money may have just confirmed it.

Watch this quick clip on DASH:

- Stream the full episode of Market on Close

- Analyze DASH with Barchart’s Technical Analysis & Top Trade Alerts

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Options Market Is Pricing in Huge Uncertainty for AST SpaceMobile (ASTS): Here’s How to Break the Deadlock

- How to Make a 1.1% Yield Shorting One-Month Microsoft Puts

- What’s Behind This Massive $100 Million Insider Buy on DoorDash Stock?

- Down 8% in December, Investors Should Wait Until Late January to Buy Harley-Davidson