Insider selling can send chills, especially when it involves a high-growth tech stock like CrowdStrike Holdings (CRWD). Recently, several executives and key insiders have trimmed their CRWD positions from co-founder and leadership stock sales to smaller, yet noticeable, executive share reductions, sparking fresh debate on whether this signals a shift in conviction or simply routine liquidity events.

CrowdStrike insiders sold shares last week totaling roughly $38.81 million, with CEO George Kurtz’s transaction the largest among them. Kurtz disposed of 17,550 shares, generating about $8.4 million in proceeds and bringing his direct stake down to approximately 2.19 million shares. Also, CrowdStrike CFO Burt Podbere sold 10,516 shares of CRWD on Dec. 22, at an average price of $483.33, totaling over $5 million. In fact, insiders didn’t buy any shares in the past year.

So, should you take these insider sales as a sign to rethink your exposure to CRWD?

Nevertheless, the broader investment narrative for CrowdStrike remains positive. Robust demand for its AI-driven cybersecurity Falcon platform and continued institutional interest underpin optimism.

About CrowdStrike Stock

CrowdStrike is a leading cybersecurity technology company specializing in cloud-native endpoint protection, threat intelligence, and cyberattack response solutions through its subscription-based Falcon platform. Headquartered in Austin, Texas, the firm serves a global customer base with advanced tools designed to prevent breaches and secure cloud workloads, identities, and data in real time. The company commands a market cap of around $118.2 billion, reflecting its stature in the technology sector.

CrowdStrike’s stock has delivered a steady performance through 2025, significantly outpacing the broader market and many of its cybersecurity peers. Year-to-date (YTD), CRWD has climbed around 37% compared to the S&P 500 Index’s ($SPX) 16.4% gains YTD, reflecting solid investor appetite as growth expectations and adoption of its AI-driven Falcon platform remain elevated.

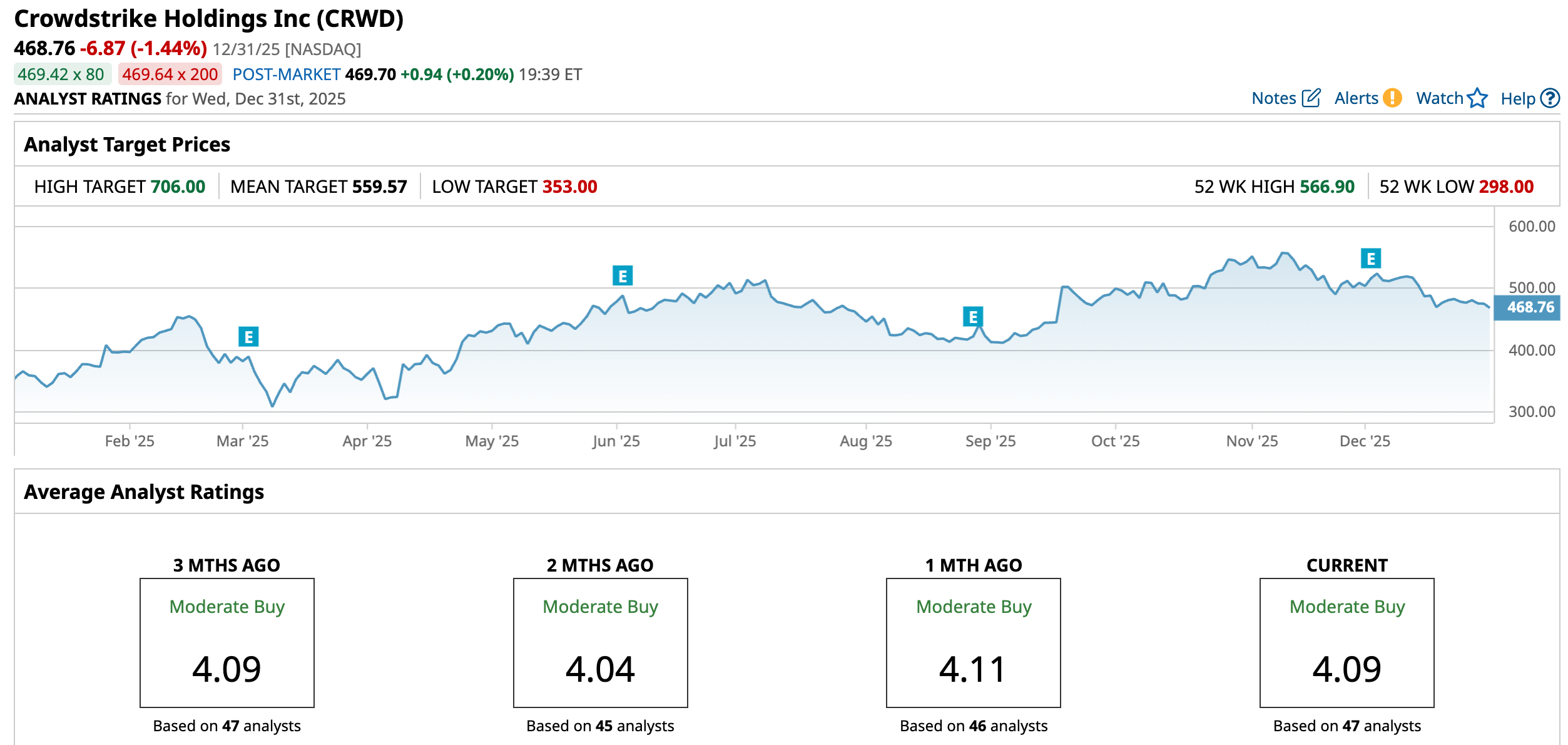

After reaching a 52-week high of $566.90 on Nov. 12, CrowdStrike shares have pulled back 20.94% as investors reassess the premium multiples the stock trades at. It is down 7.93% over the past month.

It is trading at 24.6 times forward sales, which is substantially high compared to the sector average of 3.29 times.

Steady Q3 Results

On Dec. 2, CrowdStrike released its third quarter fiscal year 2026 financial results for the period ended Oct. 31. In the quarter, total revenue reached $1.23 billion, up about 22% year-over-year (YOY), reflecting continued strong demand for its cloud-native Falcon cybersecurity platform. Subscription revenue, which makes up the bulk of sales, also grew 21%, while annual recurring revenue (ARR) climbed to $4.92 billion, representing a 23% increase YOY and supported by a record $265.3 million in net new ARR. On an adjusted basis, non-GAAP earnings per share came in at $0.96, compared to the prior year’s value of $0.76.

For the full fiscal year 2026, the company raised its annual revenue outlook to a range of $4.797 billion to $4.807 billion. Management also expects full-year adjusted EPS to come in around $3.70 to $3.72. CrowdStrike also signaled strong underlying growth trends, expecting robust net new annual recurring revenue (ARR) expansion into fiscal 2027.

Analysts tracking CRWD project the company’s EPS to decline 57.1% YOY to $0.21 in fiscal 2026 but grow 295.2% to $0.83 in fiscal 2027.

What Do Analysts Expect for CrowdStrike Stock?

This month, Citizens reiterated its “Market Outperform” rating on CrowdStrike with a $550 price target, citing the company’s leadership in endpoint security, and expanding addressable market and while acknowledging CRWD’s premium valuation, the firm believes the multiple is justified.

Also, Goldman Sachs raised its price target on CrowdStrike to $564 while reiterating a “Buy” rating after the company released its Q3 FY26 report, modestly lifted full-year guidance, and Falcon Flex adoption is seen as a key structural tailwind for long-term retention and growth.

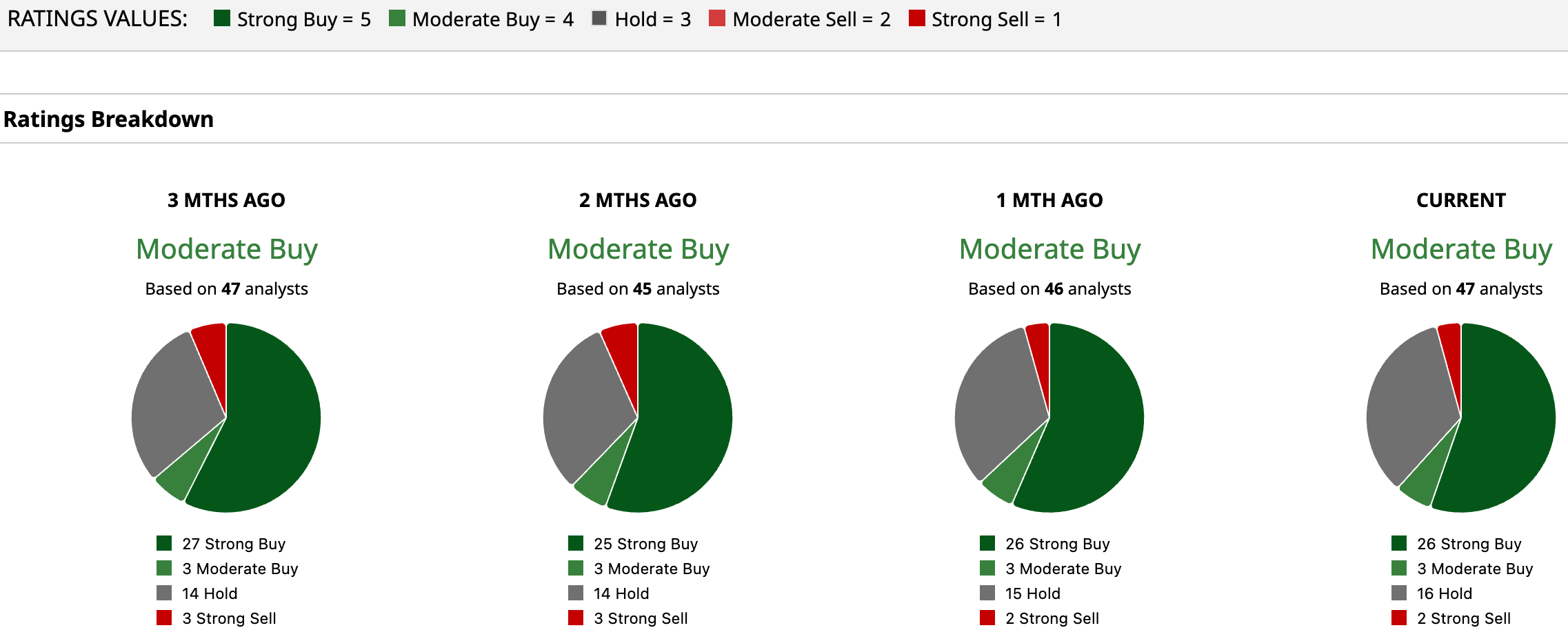

CRWD has a consensus rating of a “Moderate Buy” overall. Of the 47 analysts covering the stock, 26 advise a “Strong Buy,” three suggest a “Moderate Buy,” 16 analysts give it a “Hold” rating and two “Strong Sell.”

While CRWD’s average price target of $559.57 suggests an upside of 19.37%, the Street-high target of $706 signals that the stock could rise as much as 50.61% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026

- As Goldman Sachs Funds the Next Era of AI, Should You Buy, Sell, or Hold the Iconic Bank Stock?