Atlanta, Georgia-based The Coca-Cola Company (KO) is a beverage company that manufactures, sells, and markets Coca-Cola and a wide portfolio of other non-alcoholic beverages, including sparkling soft drinks, juices, waters, sports drinks, tea, coffee, and energy beverages. Valued at a market cap of $303.3 billion, the company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

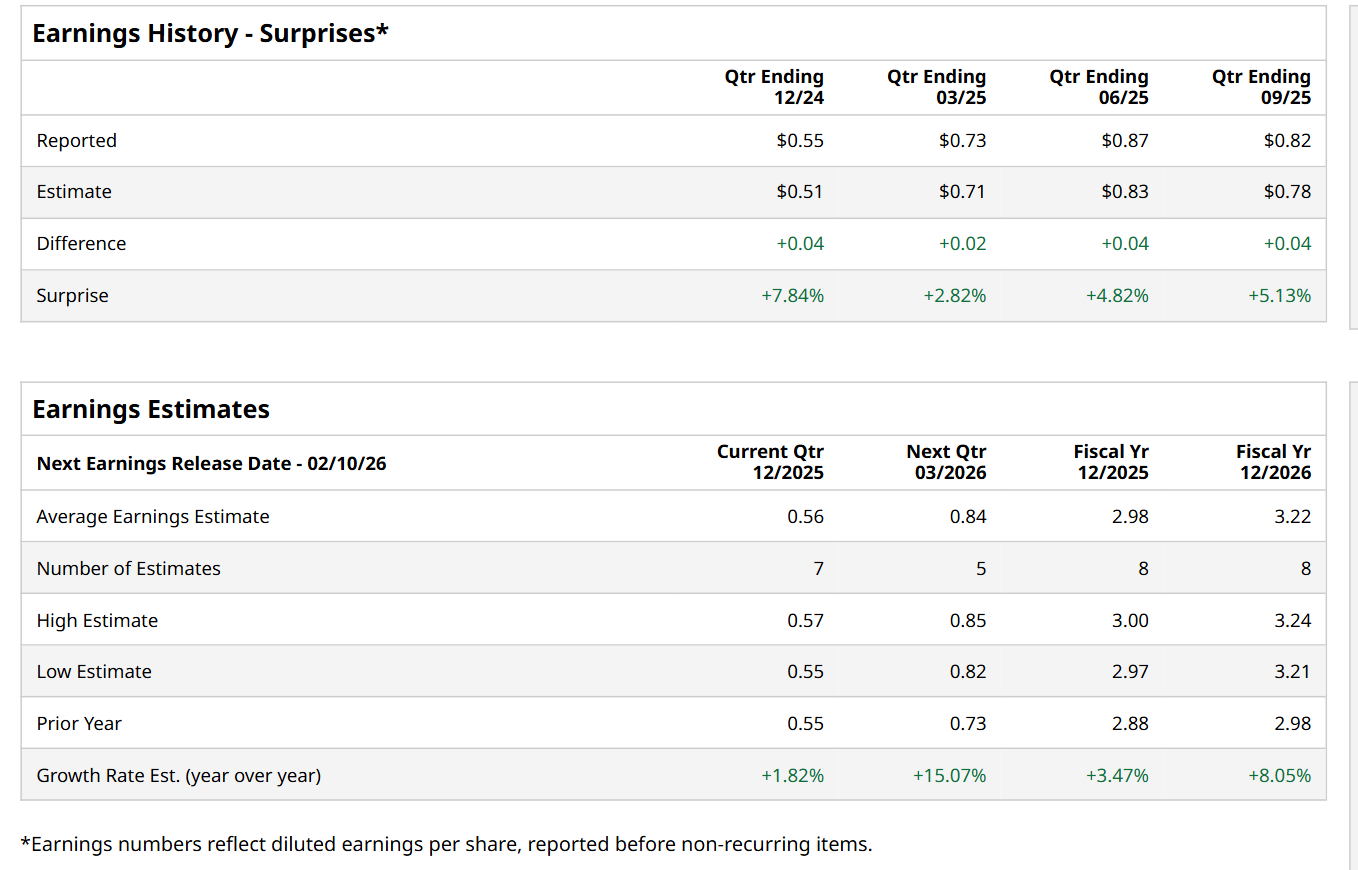

Before this event, analysts expect this beverage company to report a profit of $0.56 per share, up 1.8% from $0.55 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.82 per share in the previous quarter exceeded the forecasted figure by 5.1%.

For the current fiscal year, ending in December, analysts expect KO to report a profit of $2.98 per share, up 3.5% from $2.88 per share in fiscal 2024. Furthermore, its EPS is expected to grow 8.1% year-over-year to $3.22 in fiscal 2026.

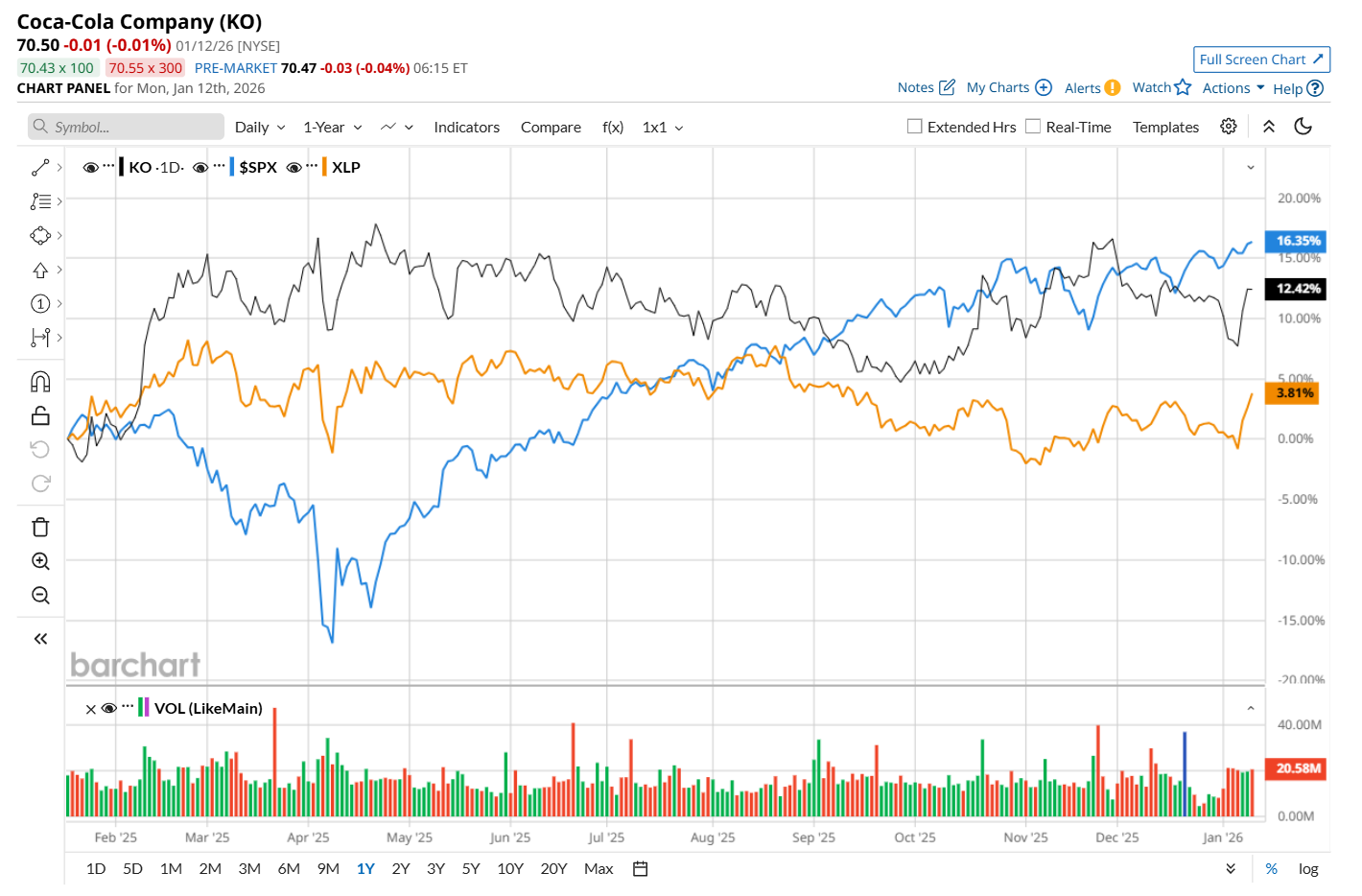

Shares of KO have gained 15.4% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 19.7% return over the same time frame. However, zooming in further, it has outpaced the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 5% uptick over the same time period.

On Dec. 3, the city of San Francisco sued several major food manufacturers, including The Coca-Cola Company and Nestlé S.A. (NSRGY), alleging that ultraprocessed foods have contributed to a public health crisis. The lawsuit claims that consumption of these foods is closely linked to serious health conditions such as Type 2 diabetes, fatty liver disease, and cancer.

Wall Street analysts are highly optimistic about KO’s stock, with an overall "Strong Buy" rating. Among 24 analysts covering the stock, 19 recommend "Strong Buy," two indicate “Moderate Buy,” and three suggest "Hold.” The mean price target for KO is $80.83, indicating a 14.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart