With a market cap of $253 billion, Applied Materials, Inc. (AMAT) is a global provider of materials engineering solutions, equipment, services, and software for the semiconductor and related industries. It operates through its Semiconductor Systems and Applied Global Services (AGS) segments to support the manufacturing of semiconductor wafers, chips, and other electronic devices.

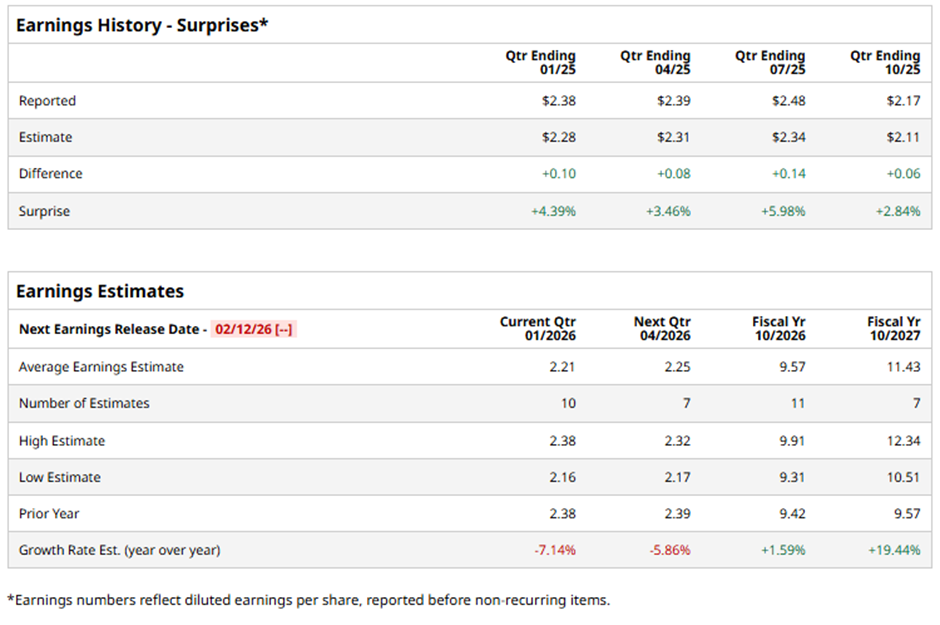

The Santa Clara, California-based company is slated to announce its fiscal Q1 2026 results soon. Ahead of this event, analysts expect AMAT to report an adjusted EPS of $2.21, a 7.1% decline from $2.38 in the year-ago quarter. However, it has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts expect the semiconductor equipment maker to report adjusted EPS of $9.57, a rise of 1.6% from $9.42 in fiscal 2025. In addition, adjusted EPS is expected to grow 19.44% year-over-year to $11.43 in fiscal 2027.

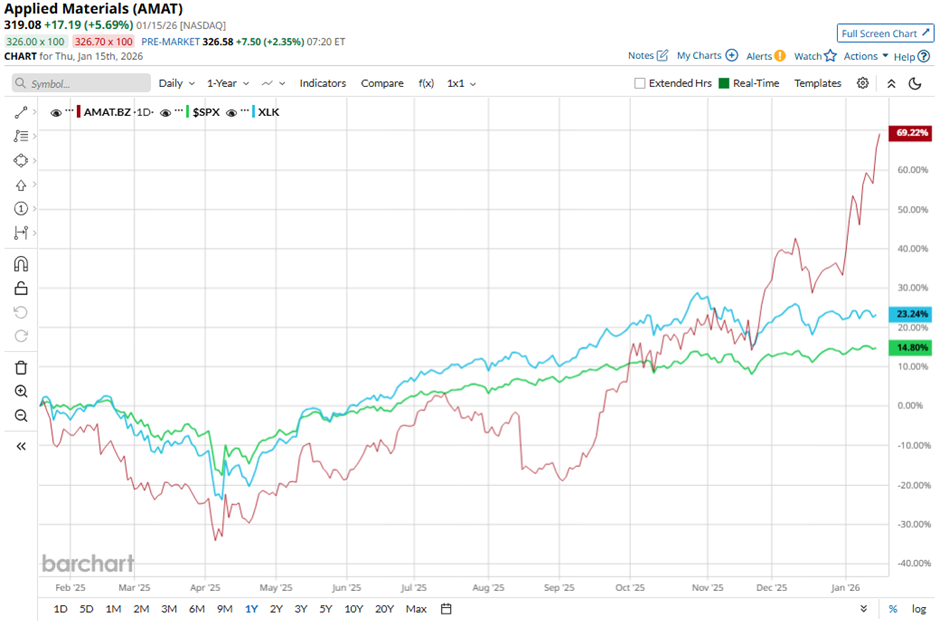

Shares of Applied Materials have climbed 78.9% over the past 52 weeks, outpacing the broader S&P 500 Index's ($SPX) 16.7% gain and the State Street Technology Select Sector SPDR ETF's (XLK) 25.2% return over the same period.

Shares of Applied Materials recovered 1.3% following its Q4 2025 results on Nov. 13 as adjusted EPS came in at $2.17 and revenue reached $6.8 billion, topping forecasts. The company reported record full-year revenue of $28.37 billion and record adjusted EPS of $9.42, reflecting strong demand driven by AI-related semiconductor investments. Investors were further encouraged by management’s outlook projecting Q1 2026 revenue of about $6.85 billion and adjusted EPS of $2.18.

Analysts' consensus view on AMAT stock remains moderately optimistic, with a "Moderate Buy" rating overall. Out of 36 analysts covering the stock, 20 recommend a "Strong Buy," four "Moderate Buys," and 12 give a "Hold" rating. As of writing, it is trading above the average analyst price target of $279.45.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Dial In on the Best Option Strategy and Strike for Your Trading Goals

- Why Unity Software (U) Stock Could Be Due for a Big Earnings Surprise

- Cathie Wood Is Selling Meta Platforms Stock. Should You?

- NAND Demand Stays Strong as Chip Sales Slump. Is Sandisk or Western Digital Stock a Better Buy in January 2026?