Rosenblatt Securities launched coverage of Rigetti Computing (RGTI) with a “Buy” rating and an ambitious $40 price target. The target implies a potential of around 60% from current levels as Wall Street grows increasingly bullish on quantum computing's commercial potential.

Analyst John McPeake highlighted the company's modular approach to scaling quantum processors and its internal fabrication capabilities as key competitive advantages in the rapidly evolving sector.

The optimism comes despite some near-term technical challenges. Rigetti recently announced delays to its 108-qubit Cepheus system due to two-qubit gate error rates of 99.0%, which fall short of the targeted 99.5%.

However, management reiterated confidence in resolving these issues by the end of the first quarter. McPeake's team noted that while competitors IBM (IBM) and IQM (IQM) have achieved superior error rates of 99.92% and 99.85%, respectively, Rigetti's fundamentals remain compelling.

Rigetti operates its own quantum processing unit fabrication facility and maintains an installed base of 18 machines. Further, six of these machines are deployed at customer sites, and 12 are accessible via cloud platforms.

Rosenblatt views Rigetti's ability to network multiple quantum processors through tunable couplers as a key technological differentiator. The investment firm also cited the company's partnership with quantum error correction specialist Riverlane as a medium- to long-term catalyst.

Mizuho Securities echoed the bullish sentiment with its own “Buy” rating. The coverage initiation reflects growing investor interest in quantum computing stocks. According to a report from Seeking Alpha, Rosenblatt simultaneously launched coverage of Quantum Computing with a $22 price target.

Is Rigetti Computing a Good Stock to Buy Right Now?

Despite ongoing technical hurdles, Rigetti has achieved encouraging results on smaller systems. It reported 99.7% fidelity on its 9-qubit system and 99.6% on its 36-qubit configuration. This indicates that the scaling challenges are concentrated in larger, more complex architectures.

Management expressed confidence in their understanding of the path to hitting performance targets, noting that they plan another chip iteration to resolve the issues. The strategic collaboration with Nvidia (NVDA) could be a potential game-changer for Rigetti's commercialization timeline. The company joined Nvidia's NVQLink platform, which provides low-latency connectivity between traditional CPUs, GPUs, and quantum processing units.

The integration addresses industry consensus that practical quantum computing requires tight coupling with classical supercomputing infrastructure. Rigetti's superconducting qubits offer fast gate speeds, making them particularly suitable for these hybrid systems.

The partnership builds on earlier work where Rigetti integrated its Novera QPU with Nvidia DGX Quantum to demonstrate AI-accelerated calibration of quantum computers. This capability could prove crucial as the industry works toward building logical qubits and running commercially viable hybrid applications.

With an installed base of 18 quantum machines and a proprietary modular architecture, Rigetti maintains a competitive position despite near-term execution risks.

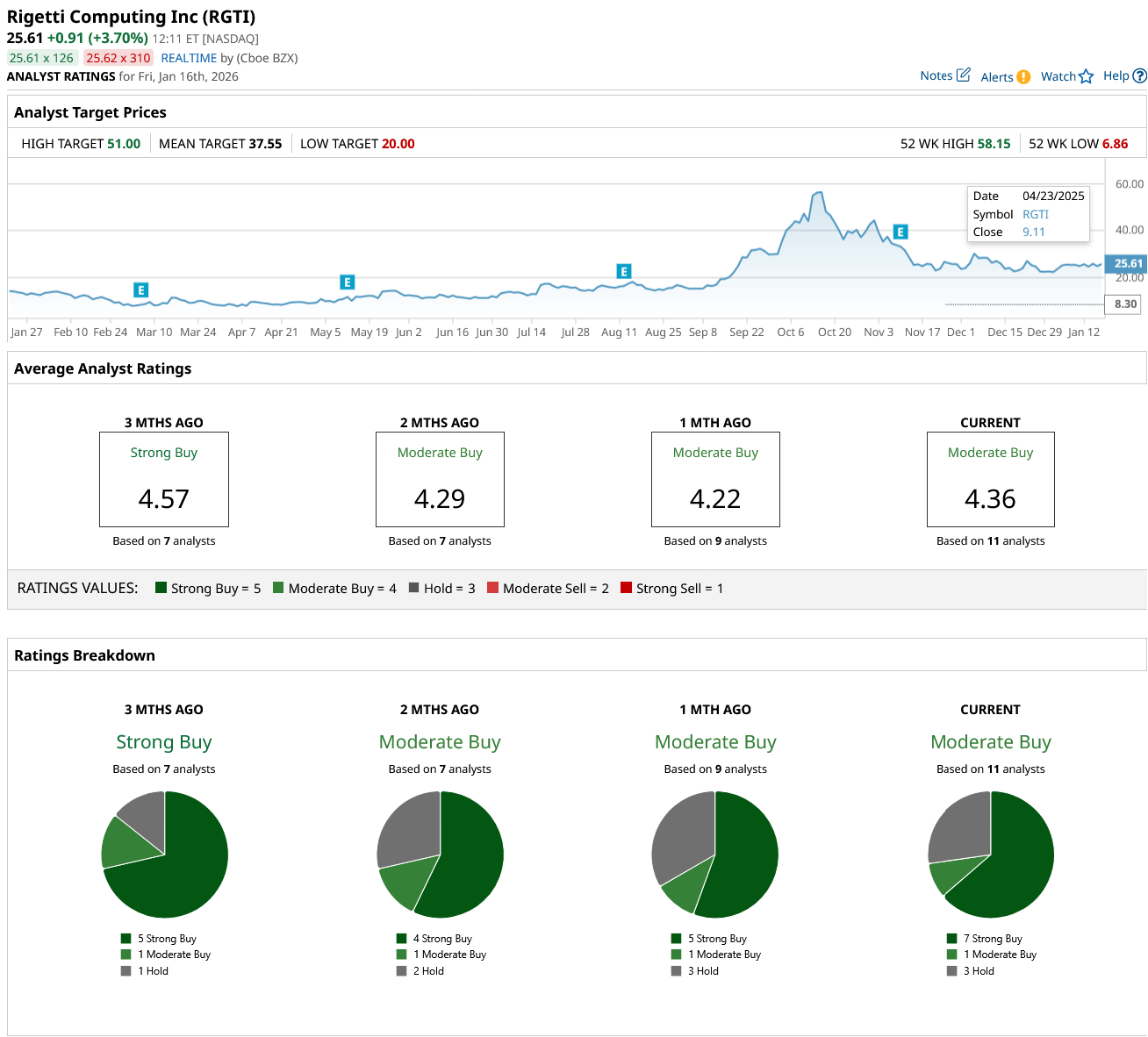

What Is the RGTI Stock Price Target?

Analysts tracking RGTI stock forecast revenue to increase from $7.61 million in 2025 to $197 million in 2029. However, it is estimated to report a free cash flow of $112 million in 2029, compared to a free cash outflow of $75 million in 2025. With close to $450 million in cash and a debt-free balance sheet, Rigetti has enough liquidity to support its cash burn rates over the next three years.

Out of the 11 analysts covering RGTI stock, seven recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average RGTI stock price target is $37.55, indicating an upside potential of 47% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Applied Materials Stock Just Hit a New All-Time High. Should You Buy AMAT Here?

- Dear AMC Stock Fans, Mark Your Calendars for February 2

- Why Selling Costco and 3 Other Unusually Active Puts Could Save You From Overpaying

- Barclays Calls This 1 AI Server Stock ‘Best in Class’ Amid Upgrade to ‘Overweight’ Rating