Valued at a market cap of $13.5 billion, CF Industries Holdings, Inc. (CF) is a leading global manufacturer and distributor of nitrogen-based fertilizer and hydrogen products that are essential to modern agriculture and other industrial applications. Headquartered in Northbrook, Illinois, the company operates multiple large-scale manufacturing complexes in the United States, Canada, and the United Kingdom, producing core products such as ammonia, granular urea, urea ammonium nitrate (UAN), and ammonium nitrate, as well as related chemicals like diesel exhaust fluid and nitric acid.

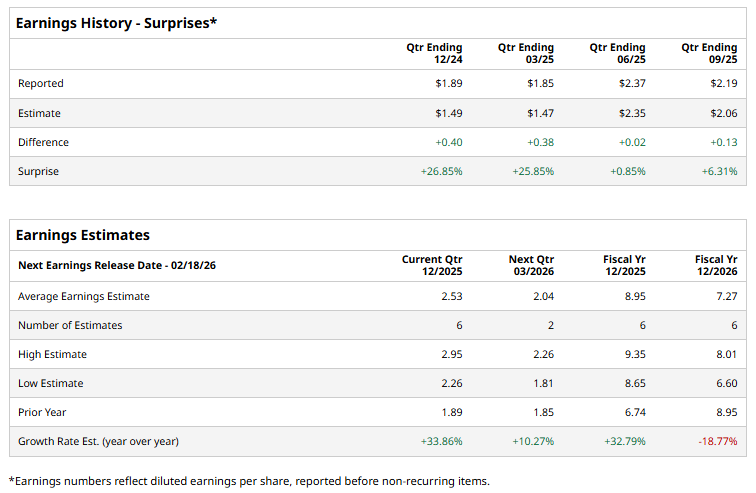

The company is expected to announce its fiscal Q4 earnings for 2025 shortly. Before this event, analysts expect this agricultural fertilizer manufacturer to report a profit of $2.53 per share, up 33.9% from $1.89 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2025, analysts expect CF to report a profit of $8.95 per share, representing a 32.8% increase from $6.74 per share in fiscal 2024. However, its EPS is expected to decline 18.8% year over year to $7.27 in fiscal 2026.

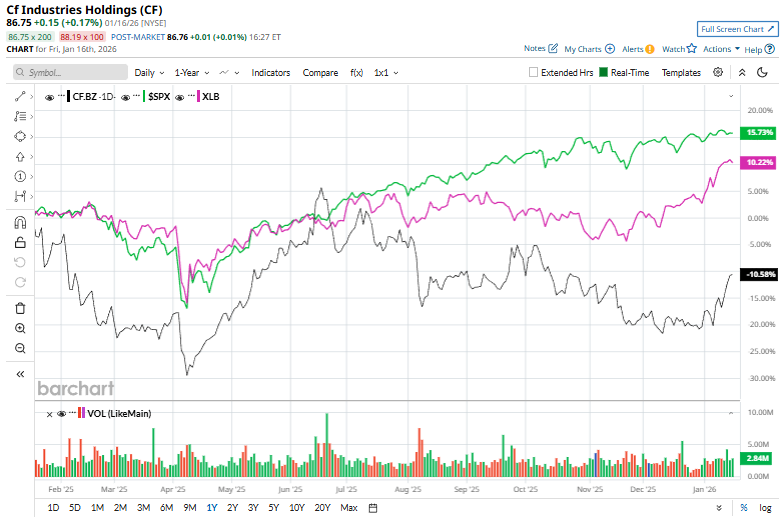

CF has declined 10.8% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.9% uptick and the Materials Select Sector SPDR Fund’s (XLB) 10.9% rise over the same time period.

Over the past year, CF’s share price has been weighed down by cyclical and sector-specific pressures, such as normalization of fertilizer prices following a prior boom, input cost volatility (notably natural gas, a key production cost), and occasional earnings or margin misses that have dampened investor enthusiasm. Technical weakness, including trading below key moving averages, has further contributed to relative underperformance despite solid revenue and earnings growth.

Wall Street analysts are cautious about CF’s stock, with an overall "Hold" rating. Among 19 analysts covering the stock, four recommend "Strong Buy," 14 suggest "Hold,” and one indicates a "Moderate Sell” rating. The mean price target for CF is $89.94, implying a 3.7% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart