Gilead Sciences, Inc. (GILD) is a leading biopharmaceutical company headquartered in Foster City, California, known for discovering, developing, and commercializing innovative medicines that address serious unmet medical needs in areas such as HIV/AIDS, viral hepatitis, COVID-19, oncology, and inflammation. Gilead Sciences has a market cap of around $155 billion, reflecting its position as a significant player in the healthcare and biotechnology sectors.

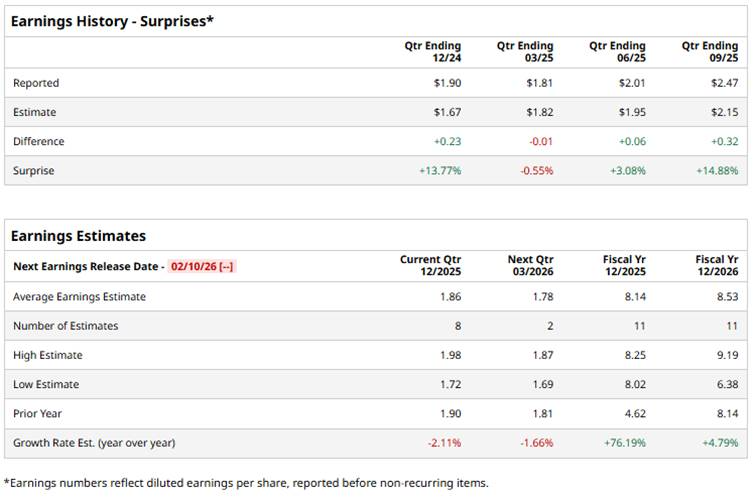

The company is set to announce its fiscal Q4 earnings results soon. Ahead of the event, analysts expect GILD to report a profit of $1.86 per share, down 2.1% from $1.90 per share in the year-ago quarter. The company surpassed Wall Street’s bottom-line estimates in three of the past four quarters and missed on another occasion.

For fiscal 2025, analysts expect GILD to report EPS of $8.14, up 76.2% from $4.62 in fiscal 2024. Also, its EPS is forecasted to rise by 4.8% in fiscal 2026, reaching $8.53.

GILD has surged 36.3% over the past year, outpacing the S&P 500’s ($SPX) 16.9% gains and the State Street Health Care Select Sector SPDR ETF’s (XLV) 10.4% return over the same time frame.

Gilead’s stock has been rising as investors are encouraged by new product approvals and pipeline progress, notably the boost from the HIV prevention drug Yeztugo and solid HIV franchise performance. The FDA approval and commercial rollout of the new HIV prevention product, the twice-yearly injectable Yeztugo, will expand the company’s potential market and boost investor confidence.

The consensus opinion on GILD is bullish, with an overall “Strong Buy” rating. Among the 30 analysts covering the stock, 22 advise a “Strong Buy,” two recommend a “Moderate Buy,” and six suggest “Hold.” GILD’s average analyst price target is $135.67, indicating a potential upside of 8.6% from the current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Taiwan Semi Crushed Q4 Earnings. That Makes This 1 AI Chip Stock a Top Buy.

- As Trump Hits AMD MI325X Chips with a 25% Tariff, How Should You Play AMD Stock?

- Why You Should Play Record Gold Prices with the GLD ETF

- Bondholders Are Suing Oracle for Its AI Losses. Is There a Case to Keep Buying ORCL Stock and Waiting for AI to Pay Off?