Devon Energy Corporation (DVN) has established itself as a powerhouse in U.S. oil and gas production, backed by a strategically diversified portfolio across multiple high-quality basins. At the heart of its success lies a world-class footprint in the Delaware Basin and a disciplined business model that balances profitability, steady free cash flow, and meaningful shareholder returns, all while maintaining a strong commitment to safety and sustainability.

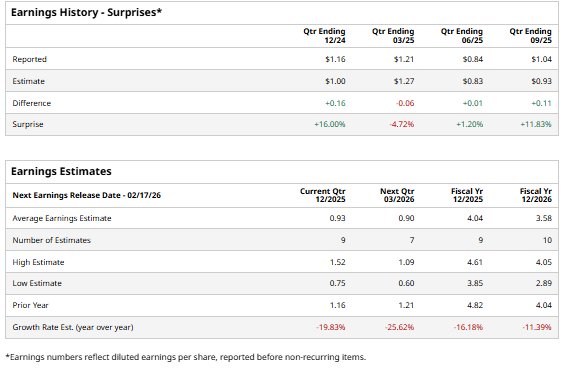

With a market capitalization of roughly $23 billion, the Oklahoma-based company is all set to report its fiscal 2025 fourth-quarter results on Tuesday, Feb. 17, after the close of U.S. financial markets. Ahead of the earnings release, analysts expect Devon Energy to report fourth-quarter earnings of $0.93 per share, marking a 19.8% decline from the same period last year. That said, the company has a history of outperforming expectations, having surpassed Wall Street’s bottom-line estimates in three of the past four quarters, with just one miss along the way.

Looking ahead, the earnings trajectory remains subdued. Devon’s full-year EPS for 2025 is projected at $4.04, down 16.2% from the prior year, before slipping further by 11.4% to $3.58 in 2026.

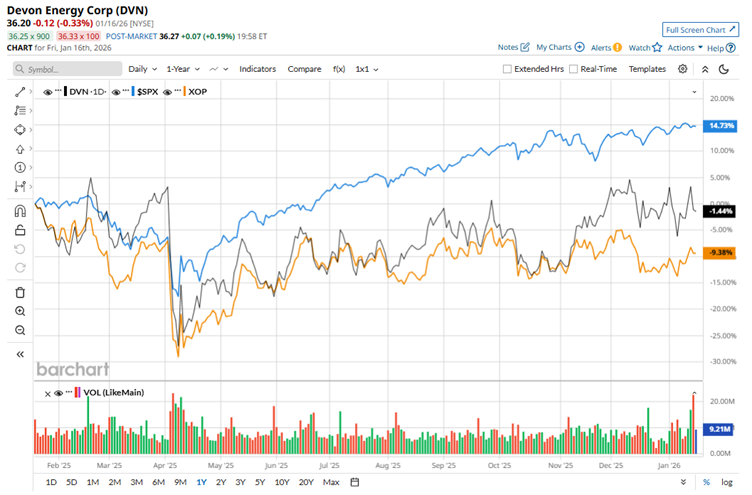

Devon Energy’s share price has had a relatively underwhelming run in 2025. Over the past year, the stock has slipped nearly 5.8%, trailing the broader S&P 500 Index ($SPX), which surged 16.9% over the same period. That said, the performance looks more resilient in a sector context. Compared with the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which tumbled 10.7%, Devon has held up considerably better.

Devon Energy delivered a strong performance in its fiscal 2025 third quarter, releasing results on Nov. 5 that comfortably beat Wall Street’s expectations on both the top and bottom lines. The company averaged 390,000 barrels of oil per day, hitting the upper end of its production guidance, while returning $401 million to shareholders through dividends and share repurchases.

Devon also strengthened its position in the Delaware Basin by acquiring roughly 60 net drilling locations for $168 million through strategic lease purchases. Financially, the company reported net earnings of $687 million, or $1.09 per diluted share. On a core basis, which excludes certain one-time items, earnings came in at $656 million, or $1.04 per share, well ahead of the consensus estimate of $0.93.

Despite the recent pullback in shares, Wall Street remains firmly optimistic about Devon Energy’s prospects. The stock currently sports a consensus “Strong Buy” rating, reflecting broad analyst confidence in its outlook. Out of 30 analysts covering the company, a clear majority of 21 recommend a “Strong Buy,” while two call it a “Moderate Buy,” and just seven take a more cautious “Hold” stance.

Adding to the bullish sentiment, the average price target of $45.86 implies potential upside of about 26.7% from current levels, suggesting analysts see meaningful room for the stock to rally ahead.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart