With markets pulling back on Wednesday, it’s a good time to check in on our bear put spread screener.

A bear put spread is a vertical spread that aims to profit from a stock declining in price. It has a bearish directional bias as hinted in the name. Unlike the bear call spread, it suffers from time decay so traders need to be correct on the direction of the underlying and also the timing.

A bear put spread is created through buying an out-of-the-money put and selling a further out-of-the-money put.

The maximum profit is equal to the distance between the strikes, less the premium paid. The loss is limited to the premium paid.

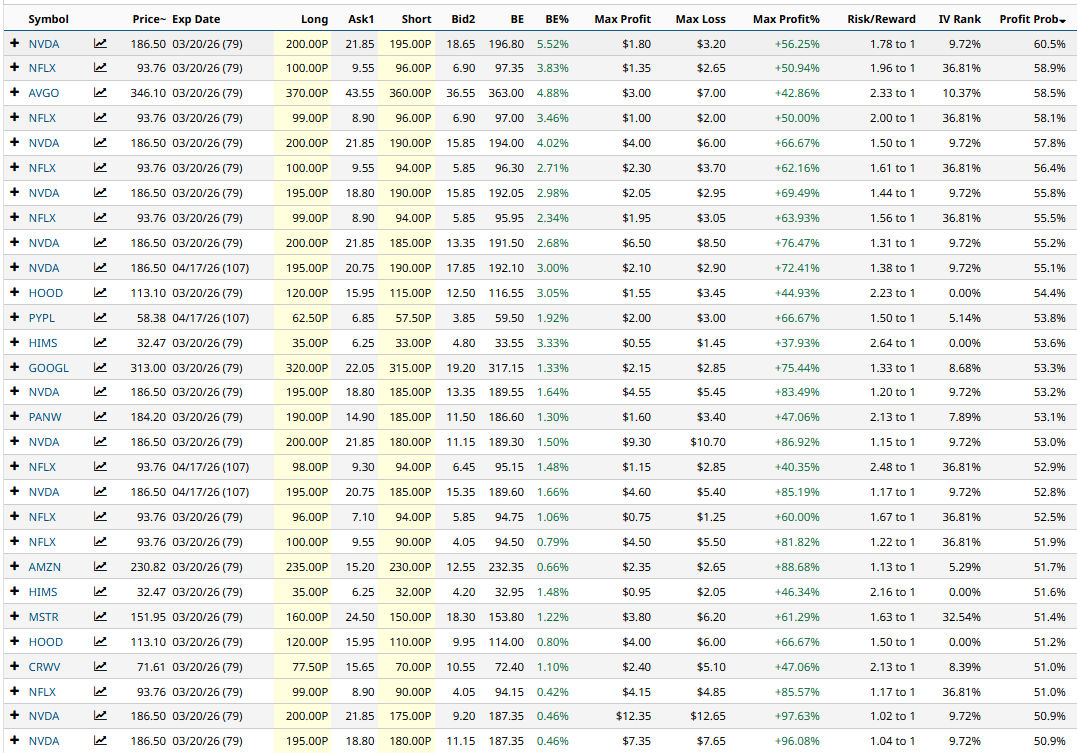

Let’s take a look at Barchart’s Bear Put Spread Screener for today:

Some interesting trades here with impressive Max Profit Percentage. Let’s take a look at the first item in the table – a bear put spread on Nvidia (NVDA).

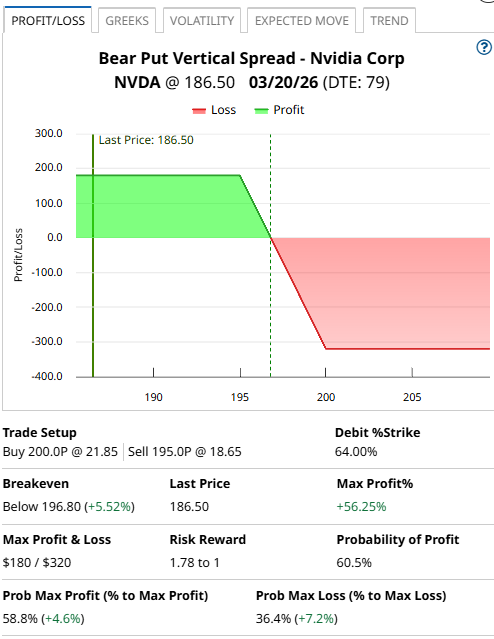

NVDA Bear Put Spread Example

Using the March 20 expiry, this trade involves buying the $200 put and selling the $195 put.

The price for the trade is $3.20 which means the trader would pay $320 to enter the trade. This is also the maximum loss. The maximum gain be calculated by taking the width between the strikes and subtracting the premium paid:

5 – 3.20 x 100 = $180.

The breakeven price for the trade is equal to the long put strike, less the premium. In this case, that gives us a breakeven price of $196.80.

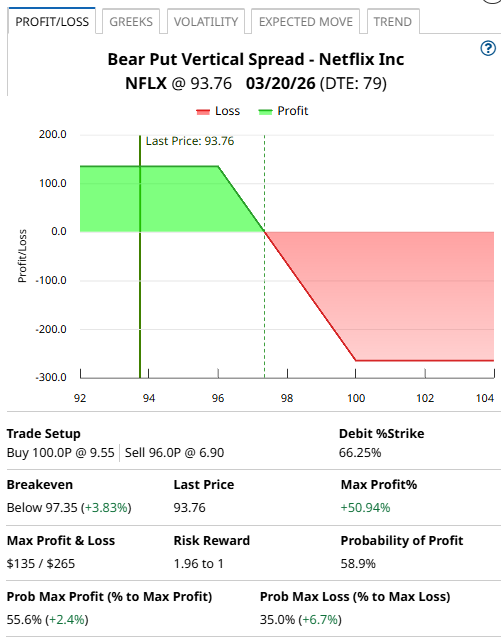

Let’s look at another example. This time on Netflix (NFLX).

Netflix Bear Put Spread Example

The first Netflix bear put spread is also using the March 20 expiry and involves buying the $100 strike put and selling the $96 strike put.

The cost of the trade is $265 which is also the maximum loss with the maximum possible gain being $135. The maximum gain would occur if Netflix stays below $100 on the expiration date.

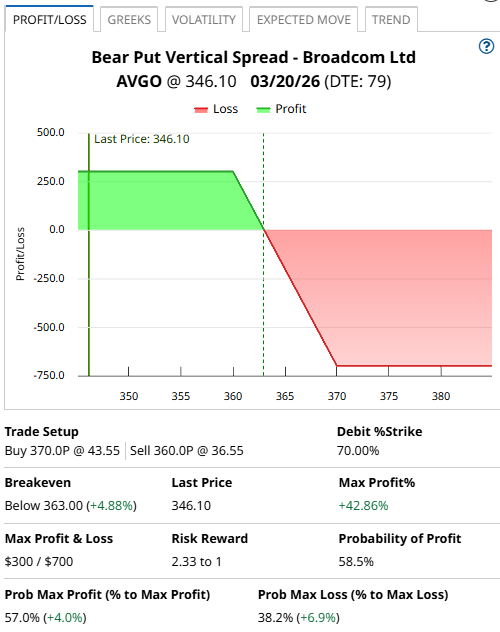

Let’s look at another example, this time on Broadcom (AVGO).

Broadcom Bear Put Spread Example

The AVGO trade is also using the March 20 expiry and involves buying the $370 strike put and selling the $360 strike put.

The cost of the trade is $700 which is also the maximum loss with the maximum possible gain being $300. The maximum gain would occur if AVGO stock stays below $370 on the expiration date.

Mitigating Risk

Thankfully, bear put spreads are risk defined trades, so they have some build in risk management.

For each trade consider setting a stop loss of 30% of the max loss.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Bear Put Spread Screener Results for January 2nd

- NVDA, NKE, and CM: Bet on These 3 Stocks With Surging Unusual Options Activity for 2026 Gains

- Unusual Activity in Occidental Petroleum Call Options - A Signal Investors Expect a Dividend Hike

- Ethereum Has Crashed, but the Option Strategy I Showed You 3 Months Ago Is Hanging Tough. Now What?