Trane Technologies plc (TT), valued at a market cap of $92.2 billion, is a global climate innovator and industrial technology company specializing in heating, ventilation, air conditioning (HVAC), and refrigeration solutions for buildings, homes, and transport applications. Headquartered in Swords, Ireland, the company has a corporate lineage dating back to the 19th century and operates worldwide under leading brands such as Trane and Thermo King.

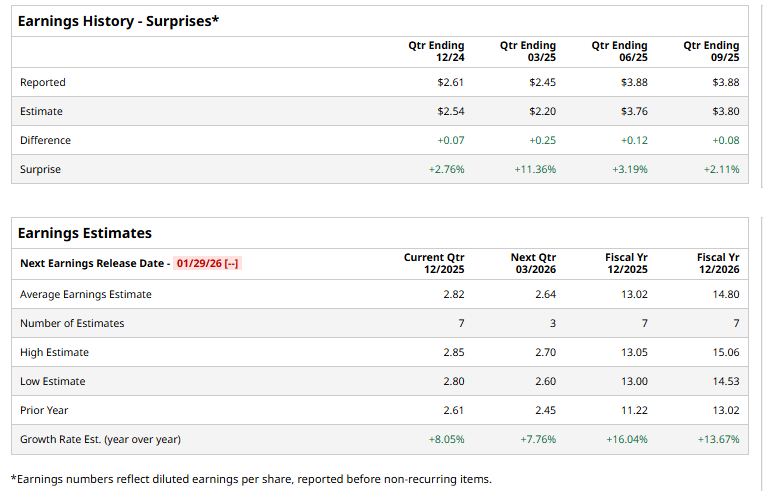

The industrial titan is expected to announce its fiscal fourth-quarter earnings shortly. Ahead of the event, analysts expect TT to report a profit of $2.82 per share on a diluted basis, up 8.1% from $2.61 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports, which is impressive.

For the current year, analysts expect TT to report EPS of $13.02, up 16% from $11.22 in fiscal 2024. Its EPS is expected to rise 13.7% year over year to $14.80 in fiscal 2026.

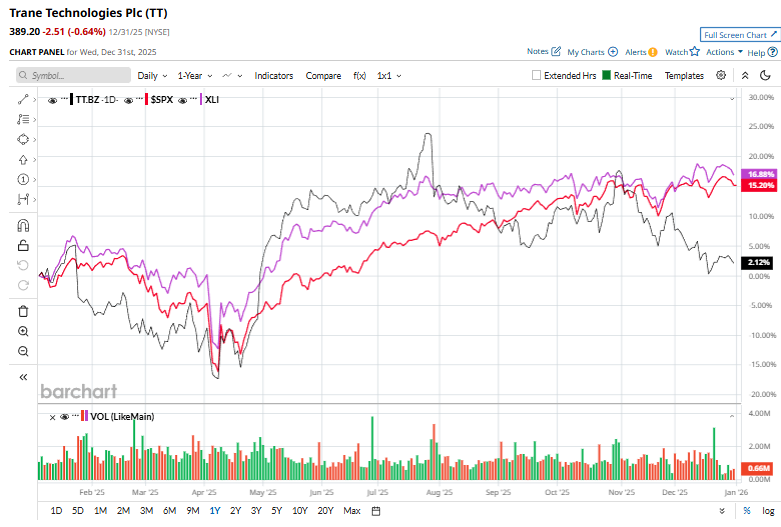

Over the past year, TT shares have increased 5%, underperforming the S&P 500 Index’s ($SPX) 16.4% gains and the Industrial Select Sector SPDR Fund’s (XLI) 17.6% gains over the same time frame.

On Dec. 2, Trane Technologies announced a definitive agreement to acquire the Digital business of Stellar Energy International, a provider of liquid-to-chip data center cooling solutions. Based in Jacksonville, Florida, Stellar Energy designs and builds modular cooling plants and related infrastructure for liquid-cooled data centers, addressing rising demand for scalable, pre-fabricated thermal systems. The deal includes Stellar Energy’s digital operations, two assembly facilities, and a workforce of about 700 employees, strengthening Trane’s position in the fast-growing data center thermal management market and expanding its modular design and engineering capabilities across commercial end markets.

Analysts’ consensus opinion on TT stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 22 analysts covering the stock, eight advise a “Strong Buy” rating, 13 give a “Hold,” and one recommends a “Strong Sell.” TT’s average analyst price target is $478.16, indicating a potential upside of 22.9% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart