North Chicago, Illinois-based AbbVie Inc. (ABBV) discovers, develops, manufactures, and sells pharmaceuticals worldwide. With a market cap of $403.8 billion, the company discovers and develops medicines and therapies that solve health issues across immunology, oncology, aesthetics, neuroscience, and eye care. The drug giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

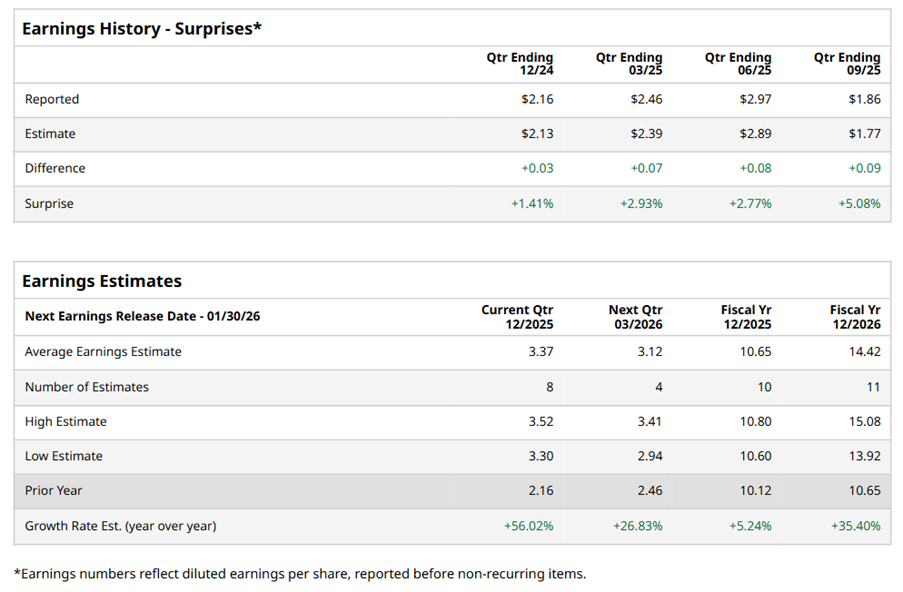

Ahead of the event, analysts expect ABBV to report a profit of $3.37 per share on a diluted basis, up 56% from $2.16 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect ABBV to report EPS of $10.65, up 5.2% from $10.12 in fiscal 2024. Its EPS is expected to rise 35.4% year over year to $14.42 in fiscal 2026.

ABBV stock has outperformed the S&P 500 Index’s ($SPX) 16.4% gains over the past 52 weeks, with shares up 29.7% during this period. Similarly, it outperformed the Health Care Select Sector SPDR Fund’s (XLV) 12.8% returns over the same time frame.

AbbVie's strong performance is driven by the success of Skyrizi and Rinvoq, double-digit neuroscience growth, and strategic acquisitions, including Gilgamesh and Capstan Therapeutics. They're expanding manufacturing with a $195 million investment in North Chicago and a $70 million expansion in Worcester, advancing pipeline programs for alopecia areata, vitiligo, and Parkinson's. Despite aesthetic challenges, AbbVie's focus on immunology and neuroscience fuels growth.

On Oct. 31, ABBV shares closed down by 4.5% after reporting its Q3 results. Its adjusted EPS of $1.86 beat Wall Street expectations of $1.77. The company’s revenue was $15.8 billion, beating Wall Street's $15.6 billion forecast. ABBV expects full-year adjusted EPS in the range of $10.61 to $10.65.

Analysts’ consensus opinion on ABBV stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 28 analysts covering the stock, 16 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 11 give a “Hold.” ABBV’s average analyst price target is $245.81, indicating a potential upside of 7.6% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stock Index Futures Climb in Strong Start to 2026

- FTAI Aviation Is Getting into the Data Center Game. Should You Buy FTAI Stock Here?

- CrowdStrike Insiders Are Offloading CRWD Stock. Should You?

- After Record Runs for Western Digital and Sandisk in 2025, Consider This 1 Data Center Storage Stock for 2026