With a market cap of $27 billion, Charter Communications, Inc. (CHTR) is a U.S.-based broadband connectivity and cable operator that provides subscription-based internet, video, mobile, and voice services to residential and commercial customers under the Spectrum brand. The company also delivers advanced WiFi, advertising, data connectivity, and managed communication solutions to businesses, carriers, and community housing properties.

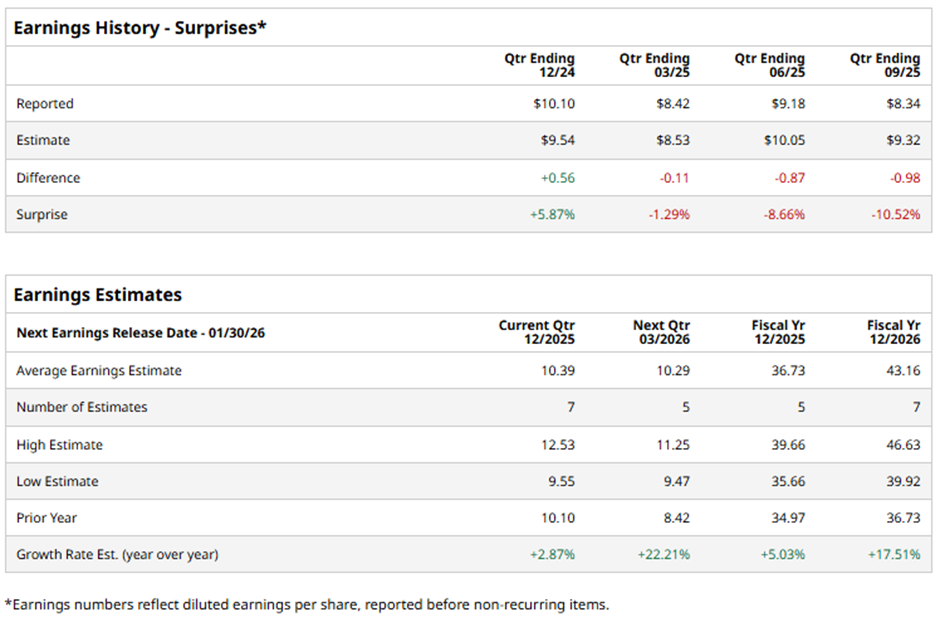

The Stamford, Connecticut-based company is expected to announce its fiscal Q4 2025 results on Friday, Jan. 30. Ahead of this event, analysts predict CHTR to report an EPS of $10.39, up 2.9% from the previous year's $10.10. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the cable provider to post an EPS of $36.73, a rise of 5% from $34.97 in fiscal 2024. Moreover, the company’s EPS is projected to increase 17.5% year-over-year to $43.16 in fiscal 2026.

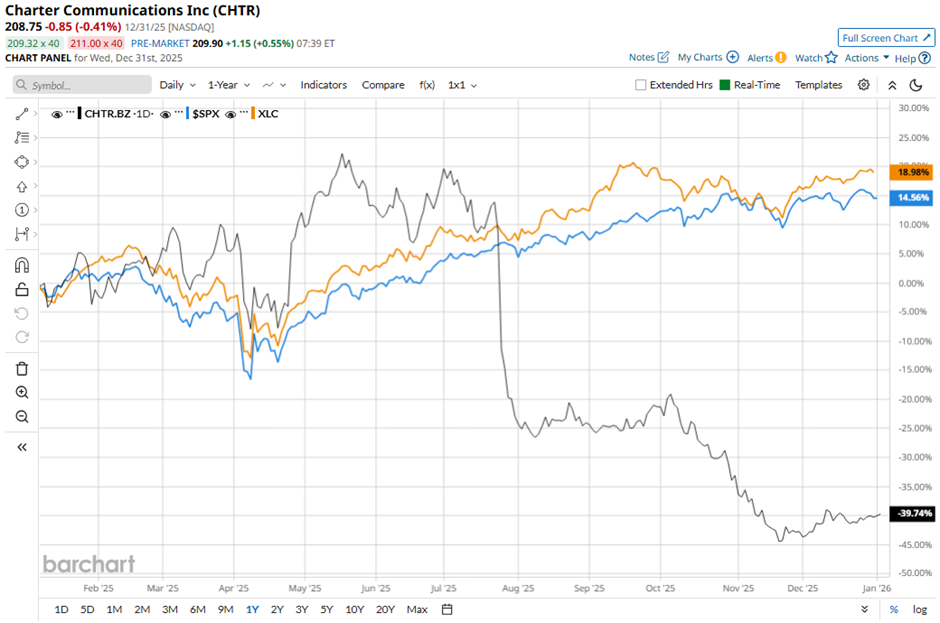

CHTR stock has decreased 39.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.4% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) 21.2% return over the same period.

Shares of Charter Communications fell nearly 5% following its Q3 2025 results on Oct. 31. The company reported weaker-than-expected profit of $8.34 per share and revenue of $13.67 billion. The company also posted a larger-than-expected decline in broadband subscribers, losing 109,000 customers, reflecting intensified competition from wireless carriers’ fixed-wireless access services.

Analysts' consensus view on CHTR stock is cautious, with a "Hold" rating. Out of 22 analysts covering the stock, seven give a "Strong Buy," 11 have a "Hold," and four give a "Strong Sell" rating. This configuration is less bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

The average analyst price target for Charter Communications is $322.18, indicating a potential upside of 54.3% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart