With a market cap of $26.2 billion, First Solar, Inc. (FSLR) is a global solar technology company, specializing in the manufacture and sale of photovoltaic solar modules using advanced thin-film semiconductor technology. It provides lower-carbon solar solutions and also offers project development, operations and maintenance services, and PV system sales to utilities, power producers, and commercial customers worldwide.

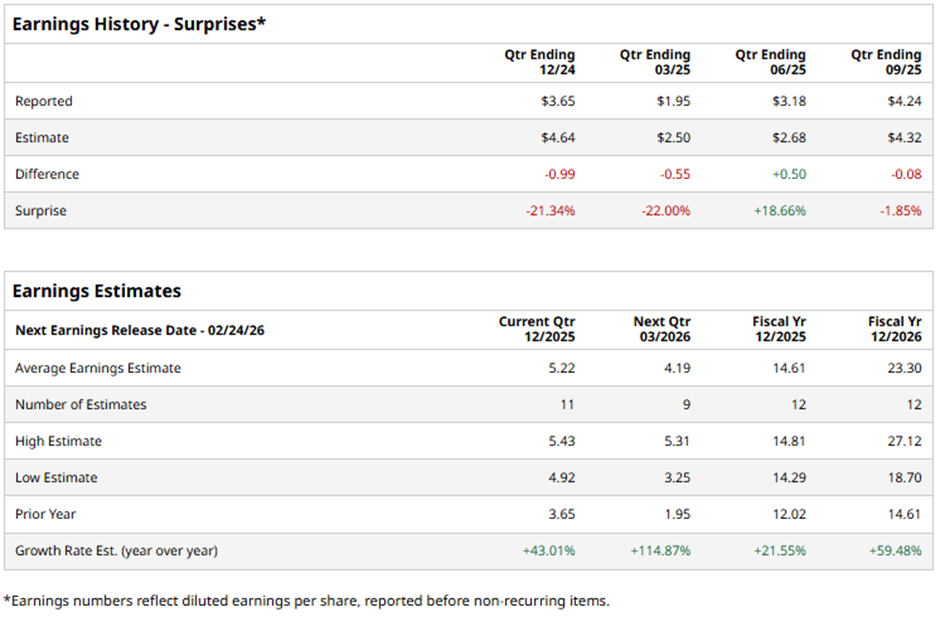

The Tempe, Arizona-based company is slated to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect FSLR to report a profit of $5.22 per share, a 43% surge from $3.65 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts expect the largest U.S. solar company to report EPS of $14.61, an increase of 21.6% from $12.02 in fiscal 2024. In addition, EPS is expected to climb 59.5% year-over-year to $23.30 in fiscal 2026.

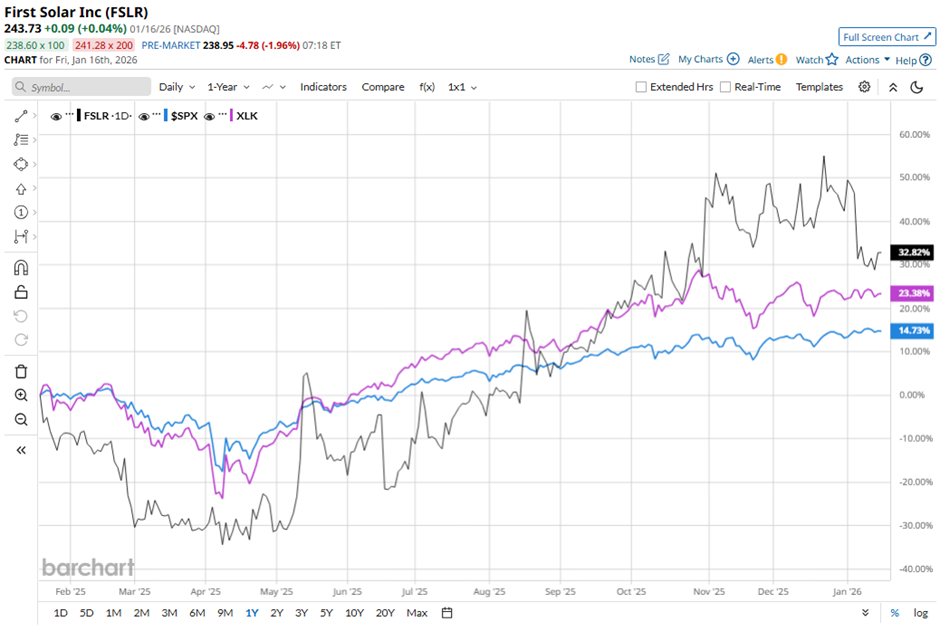

Shares of First Solar have risen 27.7% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 16.9% gain and the State Street Technology Select Sector SPDR ETF's (XLK) 26.4% return over the same period.

Despite reporting weaker-than-expected Q3 2025 EPS of $4.24 and revenue of $1.59 billion on Oct. 30, First Solar shares surged 14.3% the next day as its net income rose about 33% to $455.9 million. The company also announced plans for a new 3.7 GW U.S. manufacturing facility that will boost domestic production and align with federal energy and AI priorities.

Analysts' consensus view on FSLR stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 34 analysts covering the stock, 22 recommend a "Strong Buy," three "Moderate Buys," eight give a "Hold" rating, and one has a "Strong Sell." The average analyst price target for Keurig Dr Pepper is $272.30, suggesting a potential upside of 11.7% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart