Levi’s (LEVI) is a comeback story that, full disclosure, I already bought into last year. The apparel stock has risen 23.5% in the last 52 weeks and is up 3.5% since the beginning of this year. But currently, even with those stats, Levis is in a period of low volatility, known as the TTM Squeeze – a condition that typically precedes high-volatility breakouts.

As a caveat, the TTM Squeeze indicator doesn't predict which direction the market will move, but merely that the conditions exist for such a breakout. However, looking at a few other key

Indicators would suggest that the path of least resistance for Levi’s could be higher.

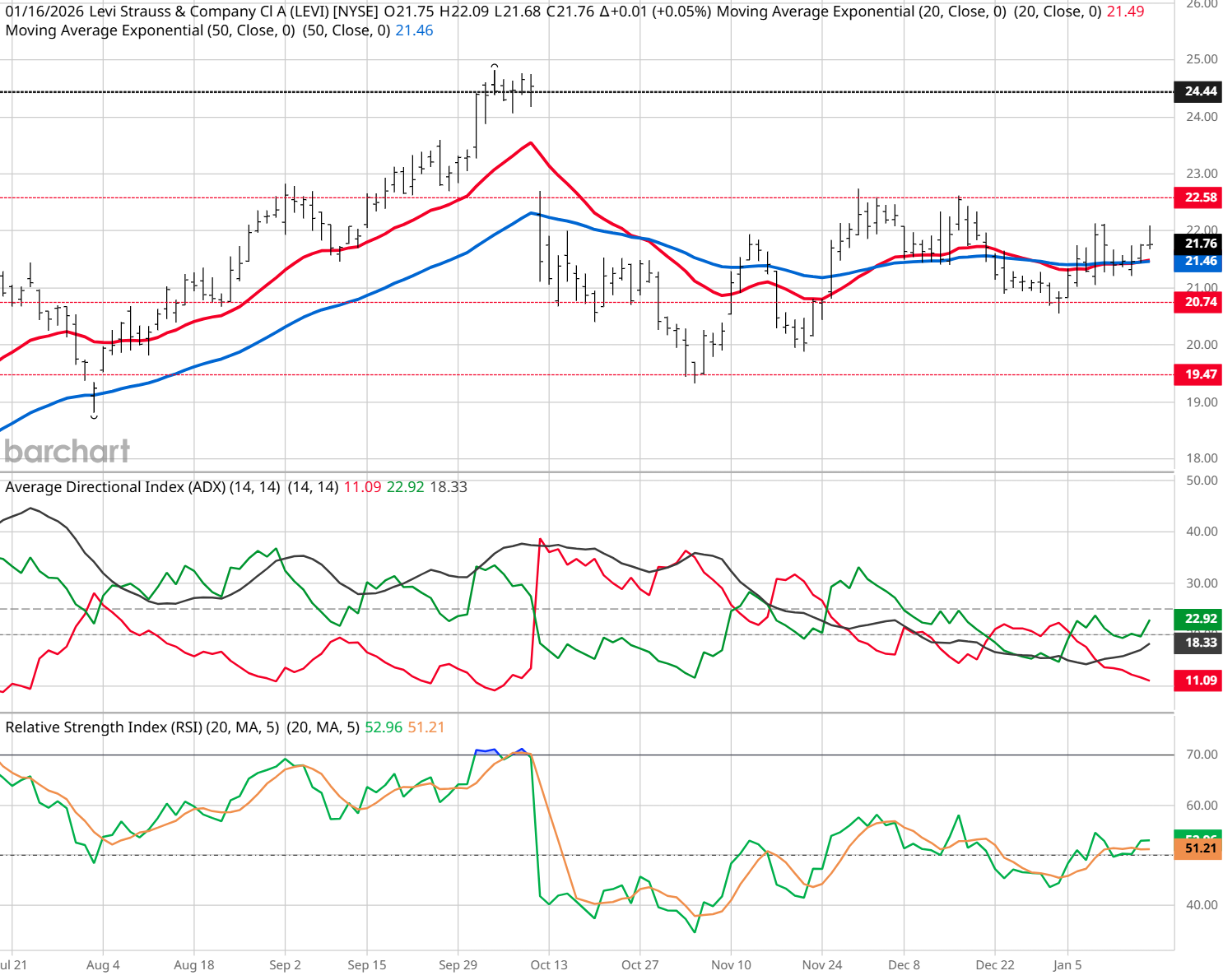

LEVI is currently trading above both its 20- and 50-day moving averages, while the 20-day is merging with its 50-day counterpart as both begin to slope higher, which is typically a bullish indicator. Plus, the stock has a “Buy” signal from Barchart's Trend Seeker, and is in a rising ADX and RSI environment.

Though Levi has been rangebound between 20.74 and 22.60, a breakout above the multi-week high of 22.74 should send Levi on a rapid ascent into a gap fill above $24 and position it to challenge the multi-year high of $24.82 (a roughly 10% gain). The key here would be the "firing" of the “Squeeze,” which should occur above $22.25.

Could this prophetic signal be telling us the time is right to slip into our favorite jeans, Levi's?

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart