Tuesday’s trading saw 60 stocks on the NYSE hit new 52-week lows, while 195 on the Nasdaq did the same. With President Trump in Davos today to speak at the World Economic Forum, investors are likely to be quick on the sell button.

Among the 195 Nasdaq stocks hitting new 52-week lows, Adobe (ADBE) and Intuit (INTU) were both on the list. The former finished the day down 33.5% over the past 12 months, while the latter is off by 13.2%.

These two tech titans have lost ground in the first month of 2026 amid investor concerns that artificial intelligence (AI) could hurt SaaS companies’ future growth and profits.

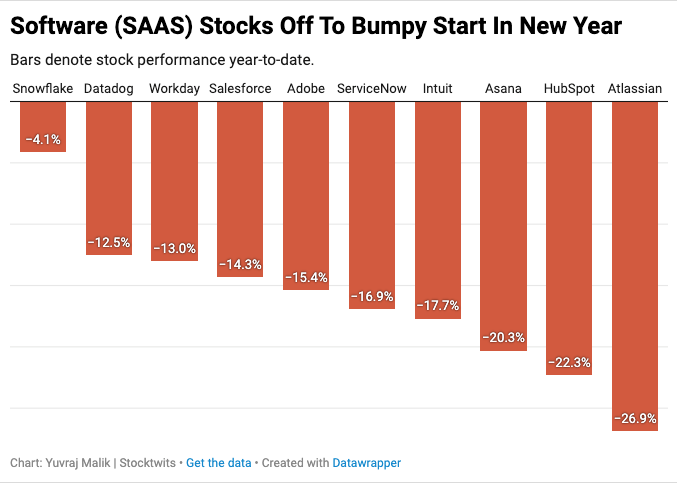

The Stocktwits chart below highlights the troubles SaaS stocks have faced so far in 2026.

Stocktwits notes that earnings for SaaS stocks in the S&P 500 are expected to grow by 14% this year, down 500 basis points from 2025.

If January’s performance is any indication of what lies ahead in 2026, none of these stocks may be worthwhile buys.

However, if you are deciding between Adobe and Intuit, here’s the better buy.

Adobe’s Had a Rough Go the Past Five Years

Over the past five years, ADBE stock has lost 38.5% of its value, with most of the retreat occurring between July 2025 and January 2026.

It doesn’t pay a dividend, so that’s also its total return over this period. By comparison, the SPDR S&P 500 ETF’s (SPY) annualized total return was 13.6%.

That’s embarrassing for any tech stock, let alone a tech titan like Adobe.

So, the question investors face right now is whether the current downturn is a blip that began last June, or a sign that tough times will continue for years, not months.

What do analysts think?

Of the 37 analysts covering the stock, 20 rate it a Buy (3.81 out of 5), down from 25 (4.16 out of 5) three months ago. However, on a positive note, the 12-month target price is $436.21, which is 50% above its current price.

I’m always skeptical of analyst target prices because they're often very late to lower them, but it’s something to keep in mind.

Yesterday, Barchart columnist Rich Duprey discussed Adobe’s future amid AI eating into its software sales as companies slowed hiring or reduced headcount, cutting the licenses required to get work done.

Duprey suggested that Adobe’s survival could come down to its ability to harness tools like its Firefly AI to generate increased outcome- or usage-based revenue.

That’s the million-dollar question.

I like that Adobe has taken a gradual approach to rolling out AI tools so that it can analyze what’s helping creators and what’s merely fluff. That will ensure it can survive in an AI-dominated world.

At the end of the day, Adobe’s revenue and cash flow have never been higher -- in the trailing 12 months ended Nov. 28, 2025, they were $23.77 billion and $10.03 billion, respectively, according to S&P Global Market Intelligence -- so buying Adobe while the stock is down-and-out is a bet that mean reversion will materialize at the same time as the company’s AI tools gain significant traction with its millions of users.

Intuit’s Not Much Better

Over the past five years, Intuit’s stock gained 41.1%. It has also seen significant value destruction over the past six months, losing 33%.

Unlike Adobe CEO Shantanu Narayen, who's been in the top job for 18 years, Intuit CEO Sasan Goodarzi’s been in charge since 2019, at the bottom end of the average tenure for S&P 500 CEOs of 7-9 years.

However, since Goodarzi took the reins on Jan. 1, 2019, Intuit’s stock has gained 170% over seven years, a compound annual growth rate (CAGR) of 15.24%. That’s compared to 506% (10.53% CAGR) for Narayen over a little more than 18 years, a worse return when compounded.

So, it’s possible that Narayen’s been in the CEO role too long, and Goodarzi has yet to hit his stride with Intuit.

A recent MarketWatch article highlighted comments from Mizuho analyst Siti Panigrahi on Intuit, including that it trades at a historically low forward P/E ratio. According to S&P Global Market Intelligence, it’s currently 22.30x; it hasn’t been below 30x in the past decade.

“Panigrahi expects Intuit to deliver over 10% of TurboTax revenue growth in fiscal 2026, beating guidance of 7.5% to 8.0%. ‘Intuit’s integrated data, compliance expertise and end-to-end workflow remain difficult to replicate with general-purpose AI tools,’ Panigrahi wrote,” reported MarketWatch contributor Christine Ji on Jan. 17.

Reading into the comments, Intuit has time to experiment with AI tools such as Intuit Intelligence, which it launched this past October. With its long history of providing online financial products to businesses and individuals, I expect it knows a thing or two about data and automation. I wouldn’t be too concerned about its inability to harness AI for growth.

Better Buy: ADBE Vs. INTU?

When it comes down to it, both companies have excellent cash flow margins -- 42.2% for Adobe compared to 33.4% for Intuit -- and don’t appear to be regressing much; Intuit’s actually have moved higher in recent years.

It’s a tough choice, but if I could only buy one, Intuit’s historically low valuation tips the scale for me.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart