With a market cap of $27.3 billion, FirstEnergy Corp. (FE) is a regulated electric utility holding company focused on the transmission and distribution of electricity across the Midwest and Mid-Atlantic regions of the United States. Headquartered in Ohio, the company serves millions of customers through a network of operating subsidiaries spanning states such as Ohio, Pennsylvania, New Jersey, West Virginia, and Maryland.

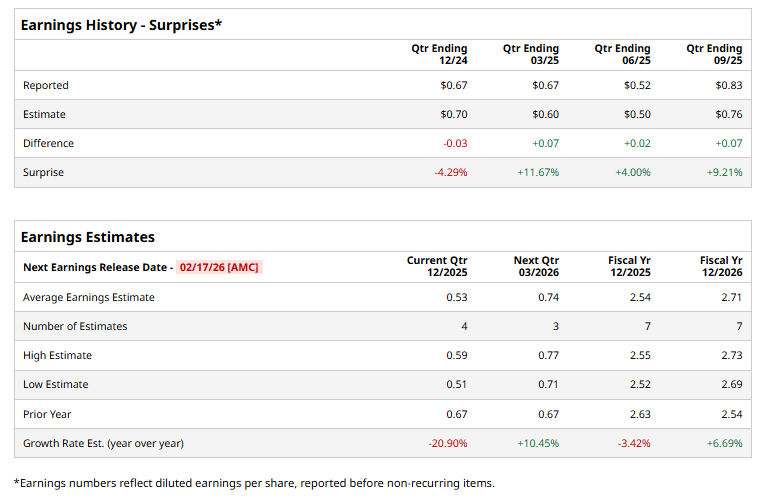

The utility company is set to announce its fiscal Q4 2025 earnings results after the market closes on Wednesday, Feb. 17. Ahead of this event, analysts expect FirstEnergy to report an adjusted EPS of $0.53, down 20.9% from $0.67 in the year‑ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the utility company to report adjusted EPS of $2.54, a decline of 3.4% from $2.63 in fiscal 2024. However, adjusted EPS is anticipated to grow 6.7% year over year to $2.71 in fiscal 2026.

Shares of FirstEnergy have soared 18.5% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 13.3% return and the Utilities Select Sector SPDR Fund's (XLU) 9% gain over the same period.

On Dec. 17, FE shares rose 1.1% after the company declared a quarterly dividend of 44.5 cents per share of outstanding common stock payable March 1, 2026, to shareholders of record at the close of business on February 6, 2026.

Analysts' consensus view on FirstEnergy stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 16 analysts covering the stock, six recommend a "Strong Buy," one "Moderate Buy," and nine "Holds."

The mean price target of $50.08 implies a 6% upswing from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart