Invitation Homes Inc. (INVH) leads the way as a residential real estate investment trust (REIT) focused on single-family rentals. Based in Dallas, Texas, it buys, upgrades, rents out, and oversees homes in popular U.S. cities such as Atlanta, Phoenix, and Tampa. The firm prioritizes tenant satisfaction with expert upkeep, digital rental tools, and homes in thriving areas. The company has a market capitalization of $16.95 billion.

The company is expected to report its fourth-quarter results for fiscal 2025 soon. Ahead of the release, Wall Street analysts are tepid about the company’s bottom-line trajectory.

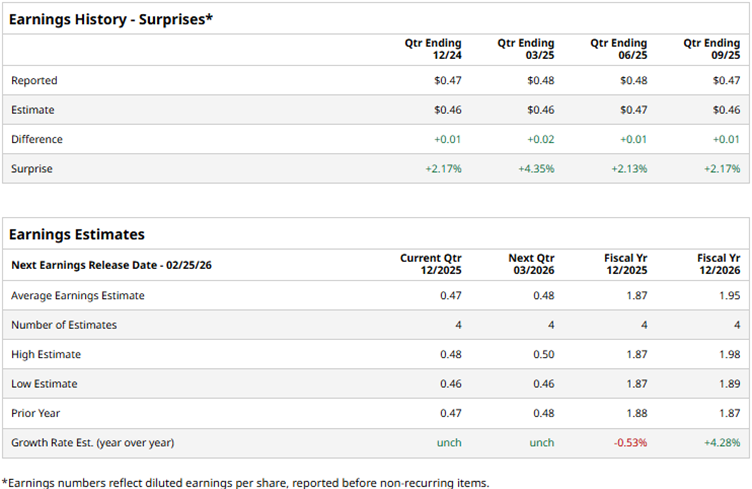

Analysts expect Invitation Homes’ profit to remain unchanged year-over-year (YOY) at $0.47 per share on a diluted basis for Q4. However, the company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect INVH’s diluted EPS to decline marginally YOY to $1.87, followed by a 4.3% improvement to $1.95 in fiscal 2026.

Invitation Homes’ stock has come under pressure amid weakness in the real estate market, including some softness in the Sunbelt cities. Over the past 52 weeks, the stock has declined by 12.9%, while it has been down 15.4% over the past six months. On the other hand, the broader S&P 500 Index ($SPX) has increased by 13.3% and 7.9% over the same periods, respectively. Therefore, the stock has underperformed the broader market.

We now compare Invitation Homes’ performance with that of its sector. The State Street Real Estate Select Sector SPDR ETF (XLRE) has increased marginally over the past 52 weeks but declined 1.1% over the past six months. Therefore, the stock has also underperformed its sector.

This month, the Trump administration announced an immediate action to prohibit major institutional investors from buying additional single-family homes in the U.S., sending shockwaves and leading to a significant drop in INVH’s stock. As this news was released, the company’s shares dropped 6% intraday on Jan. 7.

On Oct. 29, 2025, Invitation Homes announced its third-quarter results, reporting a 4.2% YOY increase in its total revenues to $688.17 million. This was based on the REIT’s rental revenues growing 3.2% annually to $593.61 million. Its average occupancy for the quarter was 96.5%. Its adjusted funds from operations (AFFO) remained unchanged YOY at $0.38 per share.

Wall Street analysts are soundly bullish on INVH’s prospects. Among the 24 analysts covering the stock, the consensus rating is “Moderate Buy.” The ratings configuration is less bullish than it was a month ago, with 10 “Strong Buy” ratings, down from 11. The stock also has one “Moderate Buy” and 13 “Holds.” The mean price target of $33.59 implies a 23.1% upside from current levels, while the Street-high price target of $40 implies 46.6% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart