Tesla's (TSLA) on-again, off-again relationship with its in-house supercomputer just took another surprising turn. CEO Elon Musk announced over the weekend that the electric vehicle maker will resume development of Dojo3, its third-generation AI chip project, after abruptly shutting it down just five months ago. The decision marks a strategic reversal for the automaker as it seeks to regain control over critical artificial intelligence infrastructure.

The revival comes as Tesla reports progress on its AI5 chip design, which Musk described as being in good shape. This development apparently provided enough confidence to restart the Dojo program despite the company previously concluding it made more sense to consolidate resources around a single chip architecture.

The original Dojo supercomputer was designed to train Tesla's autonomous driving models, including the controversial Full Self-Driving (FSD) technology that remains central to the company's future ambitions.

However, Musk's latest vision for Dojo3 extends far beyond terrestrial applications. The billionaire executive stated the revived project will focus on space-based AI compute. This ambitious pivot aligns with broader industry speculation that future data centers could operate off-planet to avoid straining already maxed-out power grids on Earth.

The announcement raises important questions for investors about Tesla's strategic direction, capital-allocation priorities, and competitive positioning relative to peers in AI infrastructure.

All Eyes on Tesla’s Upcoming Earnings

Valued at a market cap of $1.4 trillion, TSLA stock is down over 15% from all-time highs. While the supercomputer could drive future revenue, Tesla still generates most of its sales from electric vehicles.

In recent years, the EV maker has wrestled with rising interest rates, competition from China, and slowing consumer demand. In fact, after years of stellar revenue growth, Tesla is forecast to end 2025 with sales of $94.6 billion, down from $96.77 billion in 2023.

Since 2022, Tesla has been forced to lower its gross margins to fuel demand. The company’s gross margins are forecast at 17% in 2025, down from 25.3% in 2021. This gross margin compression has meant that Tesla could end 2025 with a free cash flow of $4.87 billion, down from $7.6 billion in 2022.

The key driver for Tesla stock this month will be its upcoming Q4 earnings next week. Analysts tracking TSLA stock forecast revenue of $24.76 billion and adjusted earnings per share of $0.45 for the December quarter. In the year-ago period, it reported revenue of $25.71 billion and EPS of $0.73.

How Did Tesla Perform in Q3?

Tesla delivered a record-breaking third quarter, showcasing the electric vehicle maker's growing momentum across multiple business lines. Meanwhile, CEO Elon Musk outlined an ambitious vision for the company's future in artificial intelligence.

The quarter saw new highs in deliveries, energy storage deployments, and free cash flow generation. Notably, Tesla reported approximately $4 billion in free cash flow and ended with over $41 billion in cash and investments.

Deliveries surged across all regions, with strong performance in Greater China and Asia Pacific, which grew 33% and 29% sequentially, respectively. North America and Europe also posted solid gains of 28% and 25%, respectively.

The strong quarter was driven by continued excitement around the refreshed Model Y lineup, which rolled out progressively throughout 2025, with new variants including Long Wheelbase, Performance, and Standard Range.

Tesla’s energy storage business continued its impressive trajectory, posting record deployments, gross profit, and margins despite over $200 million in tariff headwinds during the quarter. Management emphasized that grid-scale battery storage represents a critical solution for expanding electricity output without building new power plants. By buffering energy with batteries, Tesla believes existing grids could effectively double their output capacity.

Musk expressed growing confidence in achieving full self-driving capability without supervision. The service has already covered over 250,000 miles in Austin without anyone in the driver's seat and surpassed 1 million miles in the Bay Area. Tesla plans to expand Robotaxi operations to eight to ten metro areas, including Nevada, Florida, and Arizona, pending regulatory approvals.

On the technology front, Musk detailed progress on the company's AI5 chip, claiming it will deliver 40 times better performance than the current AI4 chip on certain metrics. Both TSMC (TSM) and Samsung (SMSN.L.EB) will initially manufacture AI5 chips, as Tesla aims to create an oversupply to ensure production flexibility.

Looking ahead, management signaled plans to rapidly expand vehicle production capacity, now that full self-driving capability appears achievable. Capital expenditures are expected to increase substantially in 2026 to support growth across existing businesses and ambitious AI initiatives, including the Optimus humanoid robot program.

What Is the TSLA Stock Price Target?

Analysts tracking TSLA stock forecast revenue to increase from $94.66 billion in 2025 to $210 billion in 2029. In this period, adjusted earnings per share are projected to expand from $1.64 to $8.30.

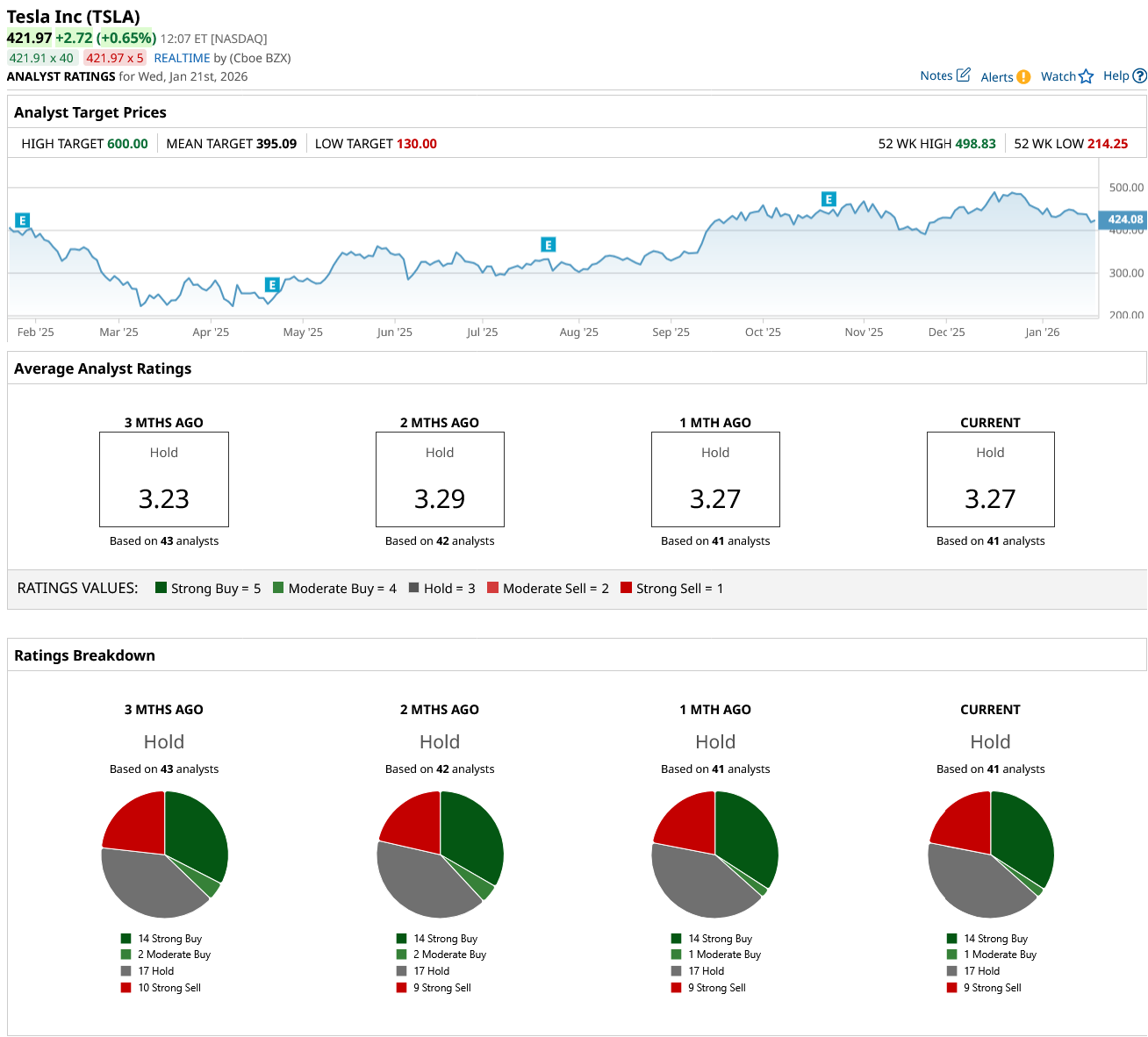

Out of the 41 analysts covering TSLA stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 17 recommend “Hold,” and nine recommend “Strong Sell.” The average TSLA stock price target is $395.09, below the current price of $421.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Netflix Is Below 1-Year Lows With Heavy Call and Put Option Activity - Bullish Signals for NFLX

- Nebius Just Scored a Major Supercomputer Win. Should You Buy NBIS Stock Here?

- This Space Stock Just Won a Key Role in Building Trump’s Golden Dome. Should You Buy Shares Now?

- CEO Sanjay Mehrotra Says Demand for Memory Will Keep Lifting Micron Stock for Years to Come