Advanced Micro Devices (AMD) stock is on a solid run, rewarding investors with gains that have outpaced those of its much larger rival, Nvidia (NVDA). AMD shares have climbed more than 104% over the last 12 months, reflecting enthusiasm around artificial intelligence (AI).

This rally is particularly notable given the persistent skepticism surrounding AMD’s ability to compete head-to-head with Nvidia in the high-end graphics processing unit (GPU) market. Nvidia remains the dominant player in advanced GPUs, yet AMD’s stock performance suggests that investors are increasingly confident in the company’s broader growth strategy, execution, and long-term positioning.

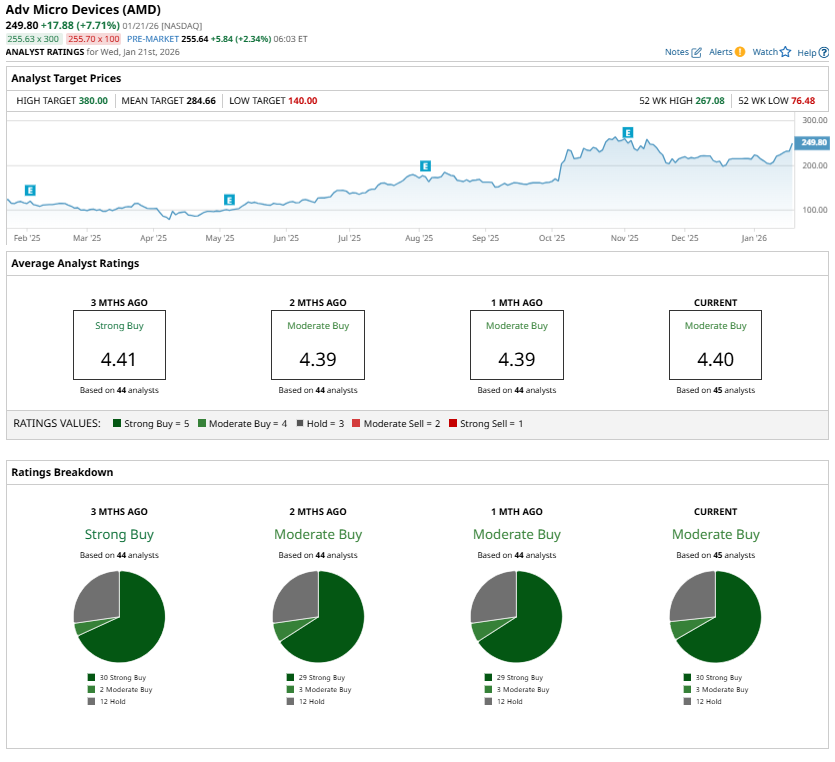

The momentum has carried into 2026. As of Jan. 21, AMD shares were up 16.6% year-to-date (YTD), while NVDA stock was trading lower. The contrast becomes even more pronounced over longer periods. Over the past six months, AMD stock has surged more than 59%, far exceeding Nvidia’s roughly 7% gain over the same timeframe. Looking back over the full year, AMD has more than doubled, while NVDA has risen just over 30%.

What’s Behind the Rally in AMD Stock?

AMD stock has moved sharply higher following the company’s latest Financial Analyst Day, where management provided a solid growth outlook. Accelerating AI demand and product innovation is likely to give a significant boost to AMD’s earnings, supporting its share price.

Management is projecting exceptionally strong growth for the company over the next several years. Total revenue is expected to rise at a compound annual growth rate (CAGR) of more than 35% over the next three to five years, reflecting accelerating AI demand.

Profitability is also set to strengthen meaningfully as the company benefits from operating leverage. AMD’s adjusted operating margin is projected to climb above 35%, a substantial improvement from approximately 24% in the third quarter of 2025.

The rapid top-line growth and rising margins could translate into a sharp increase in earnings. Management believes earnings per share (EPS) could exceed $20 over the same time frame, significantly higher than the $3.13 analysts currently forecast for the ongoing fiscal year.

AMD’s fast-growing data center business will be the main engine behind its future growth. Revenue from this segment is expected to rise at a CAGR of about 60%. At the same time, AMD continues to broaden its multi-generation EPYC server CPU lineup, which will drive its market share.

AMD projects that AI-related data center revenue will increase by more than 80% annually, supported by strong customer adoption and continued deployment of its Instinct accelerator products. The MI350 Series GPUs have already ramped quickly, and AMD plans to introduce Helios systems powered by MI450 GPUs in the third quarter of 2026. Beyond that, the company’s roadmap extends to the MI500 Series, expected in 2027, which should further enhance AMD’s competitiveness in next-generation AI computing.

More recently, investor sentiment also improved following favorable analyst commentary. A couple of analysts have reiterated their bullish views on the stock, citing robust server CPU demand and sustained spending on AI infrastructure as key tailwinds.

Overall, AMD’s strong guidance, expanding product roadmap, solid demand trends, and positive analyst outlook help explain the renewed enthusiasm around the stock.

AMD Stock Still Looks Compelling on Valuation

The recent rally in AMD stock has driven its valuation higher. Even so, the shares remain attractive relative to their future earnings growth potential. AMD trades at a forward earnings multiple of 41.8 times, which appears reasonable considering analysts’ EPS growth forecast of roughly 77% in fiscal 2026.

Is AMD Stock a Buy?

Wall Street assigns AMD stock a “Moderate Buy” consensus rating. However, the company’s aggressive growth outlook, expanding AI-focused product lineup, and reasonable valuation suggest that AMD is a compelling AI stock, even after its impressive run.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How This Options Expert Screens for High-Probability Spread Trades, Step-by-Step

- Calling Back to Jimmy Carter, Citigroup’s CEO Says Credit Card Rate Caps Would ‘Not Be Good’ for the U.S. Economy

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?

- KHC Is Low-Hanging Fruit for Greg Abel: Which Warren Buffett Stock Will He Sell Next?