Autodesk, Inc. (ADSK) is a California-based multinational software company and a global leader in 3D design, engineering, construction, manufacturing, and media and entertainment technology solutions. Founded in 1982 and valued at $53.8 billion by market cap, Autodesk is best known for pioneering AutoCAD, one of the most widely used computer-aided design (CAD) applications worldwide.

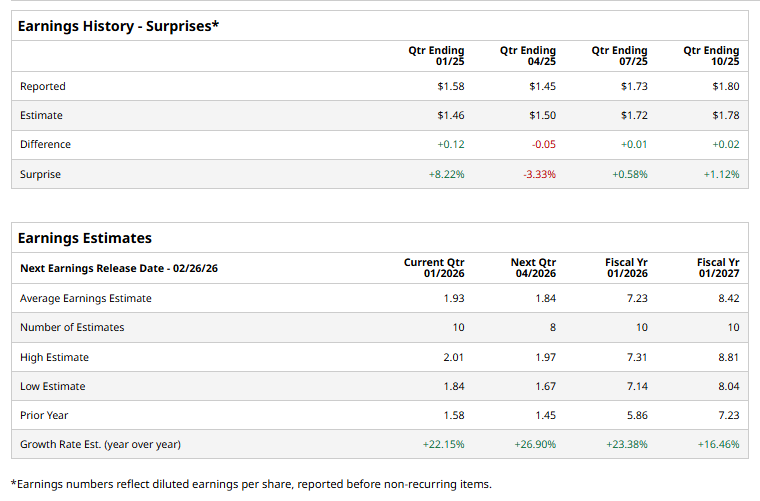

The global leader in software is expected to announce its fiscal fourth-quarter earnings for 2026 in the near term. Ahead of the event, analysts expect ADSK to report a profit of $1.93 per share on a diluted basis, up 22.2% from $1.58 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the current year, analysts expect ADSK to report EPS of $7.23, up 23.4% from $5.86 in fiscal 2025. Its EPS is expected to rise 16.5% year over year to $8.42 in fiscal 2027.

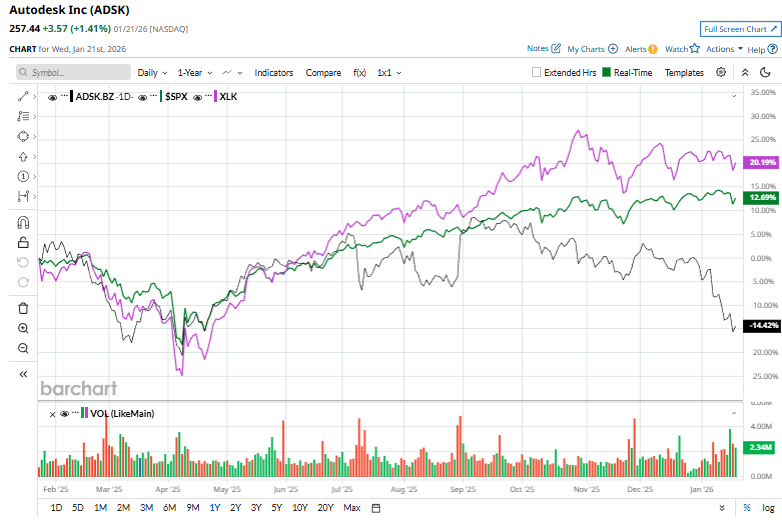

Over the past year, ADSK stock has dipped 13.3%, underperforming the S&P 500 Index’s ($SPX) 13.7% gains and the Technology Select Sector SPDR Fund’s (XLK) 21.8% gains over the same time frame.

Autodesk shares fell 3.5% in afternoon trading as broader technology stocks retreated following reports that Chinese authorities blocked NVIDIA Corporation’s (NVDA) H200 AI chips, heightening concerns over global trade tensions and the sustainability of the AI-driven rally. The weakness reflected broader investor unease over geopolitical tensions and their potential impact on the long-term outlook for technology and software companies, including Autodesk.

Analysts’ consensus opinion on ADSK stock is bullish, with a “Strong Buy” rating overall. Out of 27 analysts covering the stock, 22 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” ADSK’s average analyst price target is $376.77, indicating a potential upside of 46.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart