With a market cap of $120.8 billion, Adobe Inc. (ADBE) is a global technology company that provides innovative solutions enabling individuals, teams, and enterprises to create, manage, and optimize digital content and customer experiences. Through its Digital Media, Digital Experience, and Publishing and Advertising segments, Adobe serves a wide range of users from creatives and students to marketers, developers, and C-suite executives worldwide.

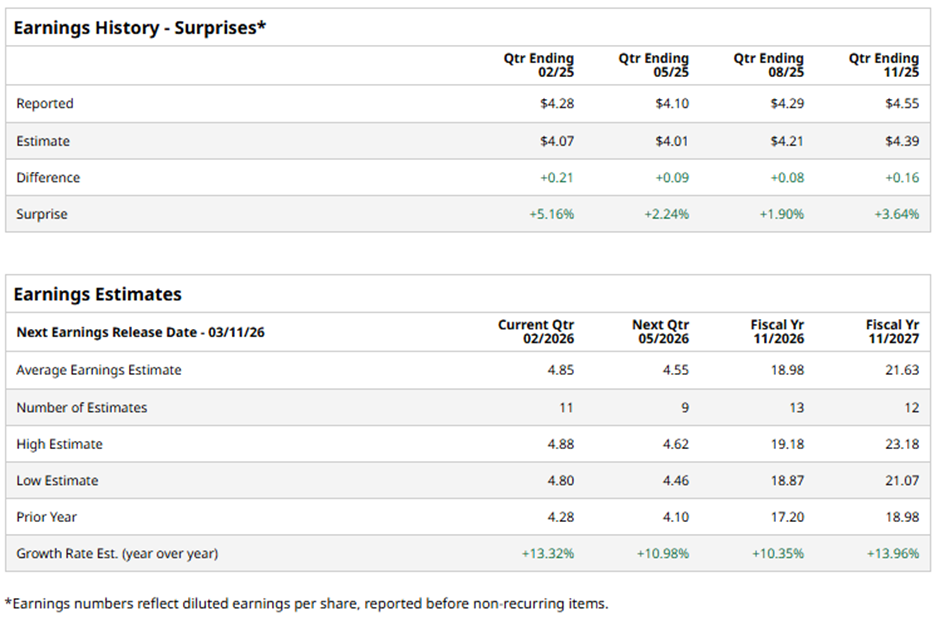

The San Jose, California-based is slated to announce its fiscal Q1 2026 results soon. Ahead of this event, analysts forecast ADBE to post an EPS of $4.85, a 13.3% growth from $4.28 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2026, analysts predict the creative software giant to report EPS of $18.98, a rise of 10.4% from $17.20 in fiscal 2025. Moreover, EPS is projected to increase nearly 14% year-over-year to $21.63 in fiscal 2027.

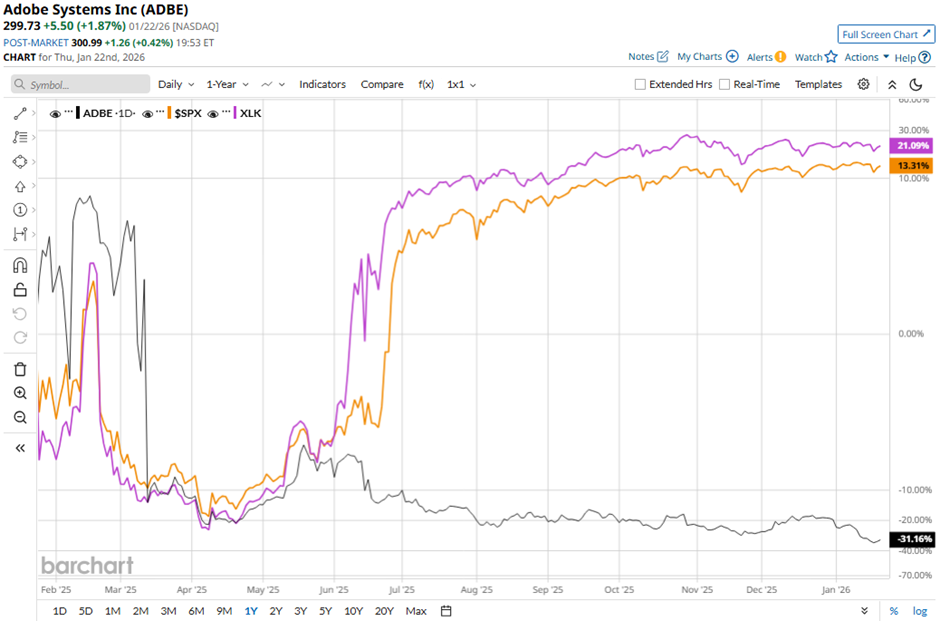

Shares of Adobe have decreased 31.5% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 13.6% rise and the State Street Technology Select Sector SPDR ETF's (XLK) 20% return over the same period.

Shares of Adobe rose 2.1% following its better-than-expected Q4 2025 results on Dec. 10, highlighted by record quarterly revenue of $6.19 billion and adjusted EPS of $5.50. The stock was further supported by robust 2025 results, including $23.77 billion in revenue, $10.03 billion in operating cash flows, and ARR growth of 11.5% to $25.20 billion.

Additionally, Adobe’s confident 2026 outlook targets over 10% ending ARR growth, $25.90 billion - $26.10 billion in revenue, and continued double-digit subscription growth across customer groups.

Analysts' consensus view on ADBE stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 37 analysts covering the stock, 18 recommend a "Strong Buy," two "Moderate Buys," 13 "Holds," and four "Strong Sells." The average analyst price target for Adobe is $436.21, suggesting a potential upside of 45.5% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart